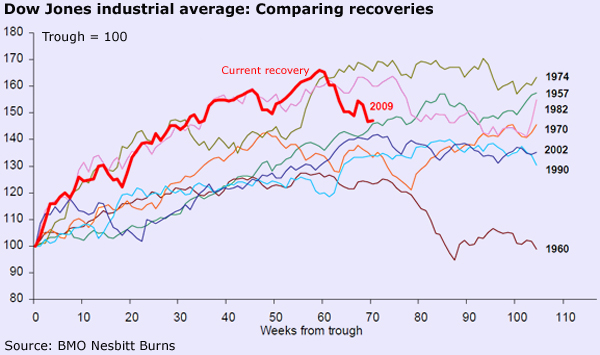

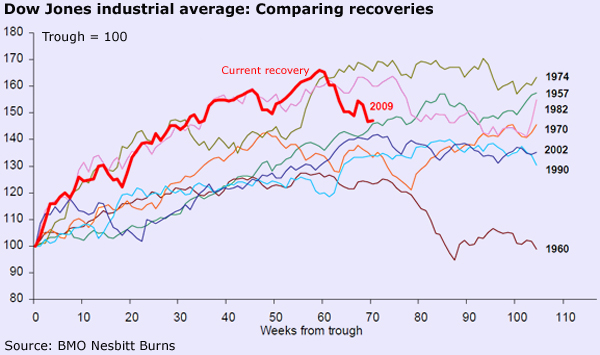

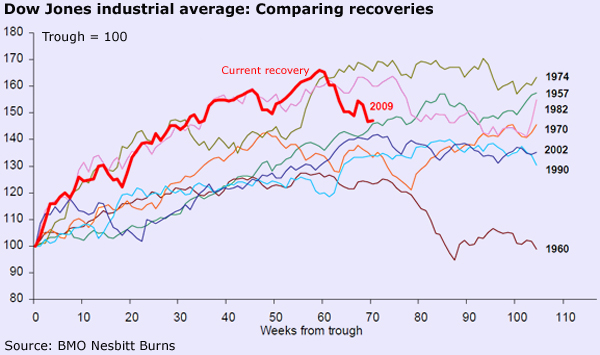

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...

Read More

Penn Jillette on how reading the great religious texts will make you into an atheist, the future of magic, and how he and Teller work...

Read More

No surprise here: “The well-off are losing their master suites and saying goodbye to their wine cellars. The housing bust that...

No surprise here: “The well-off are losing their master suites and saying goodbye to their wine cellars. The housing bust that...

Read More

Congratulations to Pat Riley and the Miami Heat. You have put together a very competitive team that should be fun to watch in the coming...

Read More

Decoupling? That failed thesis of late ’08, early ’09 where problems in the US brought the rest of the world down is now...

Read More

It has been an interesting vacation week in the Hamptons (and 10 degrees cooler than NYC). My wife’s family have owned a beach...

Read More

The US consumer continues to shed and incrementally use less debt. May Consumer Credit outstanding fell by $9.1b, almost $7b more than...

Read More

The problem with vacations is that I don’t get to read everything I want to. The following is what i would be pouring over if I...

Read More

Rich Karlgaard gets all up in the grills of the “über bears” in this post. This alone would not be particularly noteworthy,...

Read More

Taking the inflation/deflation debate to a whole new level, the National Inflation Association (I’ve never heard of them) that...

Read More

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...

Very interesting chart from BMO Nesbitt via the Toronto Globe and Mail: The recovery in stock prices from the lows of the recession now...