Contrarian Investing

Fantastic investor letter from the Lex team at the FT on contrarian investing against the expert consensus: “Dear Investor, It has...

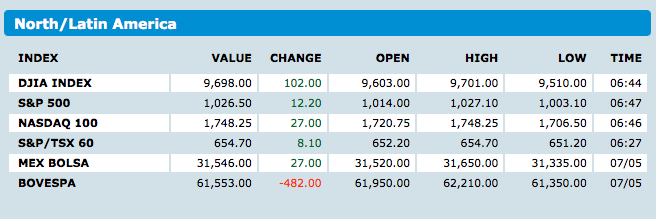

> Good Tuesday morning — Dow futures are indicating an opening of 100+ today, following 7 consecutive sessions of losses....

> Good Tuesday morning — Dow futures are indicating an opening of 100+ today, following 7 consecutive sessions of losses....

Warning: The following post is offered in the spirit of shameless self-promotion. Those who prowl the web and consume all manner of...

Warning: The following post is offered in the spirit of shameless self-promotion. Those who prowl the web and consume all manner of...

This droll, dry wit is precisely what I would have expected: > > Although the title of “best business card ever” may be...

This droll, dry wit is precisely what I would have expected: > > Although the title of “best business card ever” may be...

Get subscriber-only insights and news delivered by Barry every two weeks.