Independence Day

The American Revolution was a beginning, not a consummation. ~Woodrow Wilson Those who expect to reap the blessings of freedom, must,...

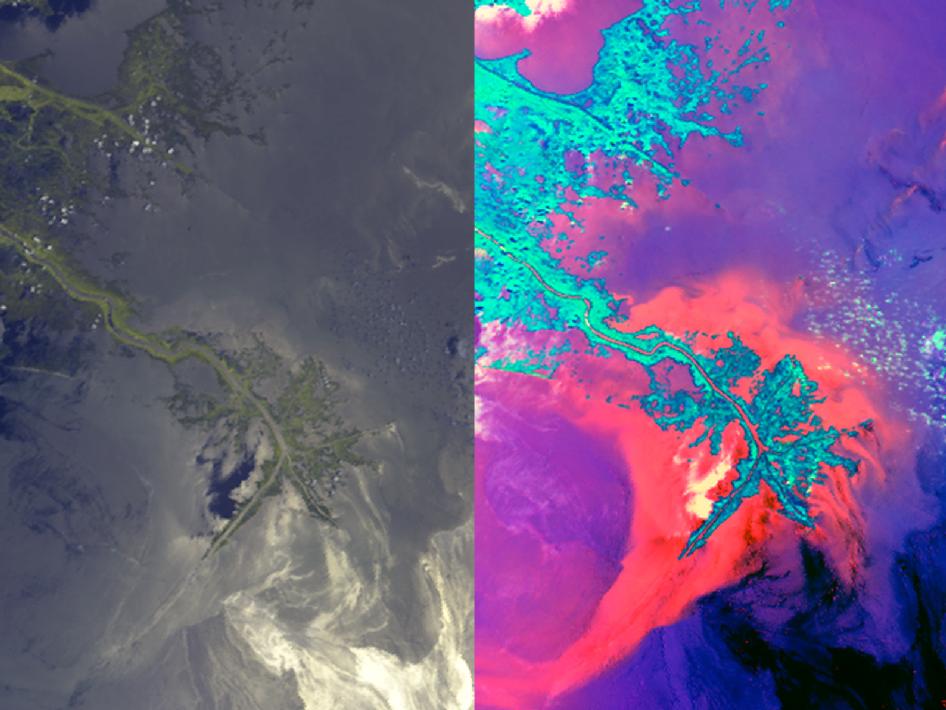

Multiple cameras on JPL’s MISR instrument on NASA’s Terra spacecraft were used to create two unique views of oil moving into...

Multiple cameras on JPL’s MISR instrument on NASA’s Terra spacecraft were used to create two unique views of oil moving into...

The Dismal Science Really Is July 2, 2010 By John Mauldin Some Really Dismal Numbers Unemployment Went Down? Earnings Take a Hit Money...

The Dismal Science Really Is July 2, 2010 By John Mauldin Some Really Dismal Numbers Unemployment Went Down? Earnings Take a Hit Money...

Chris Kimble gives us this terrific look at the H&S formation. Chris is a 30-year market technician, a student of Sir John Templeton...

Chris Kimble gives us this terrific look at the H&S formation. Chris is a 30-year market technician, a student of Sir John Templeton...

Get subscriber-only insights and news delivered by Barry every two weeks.