Media Appearance: CNBC’s Fast Money (6/29/10)

> Tonite I will be on Fast Money on CNBC for the full hour, discussing with the crew: -Risk Trade is coming off ? – Double Dip...

> Tonite I will be on Fast Money on CNBC for the full hour, discussing with the crew: -Risk Trade is coming off ? – Double Dip...

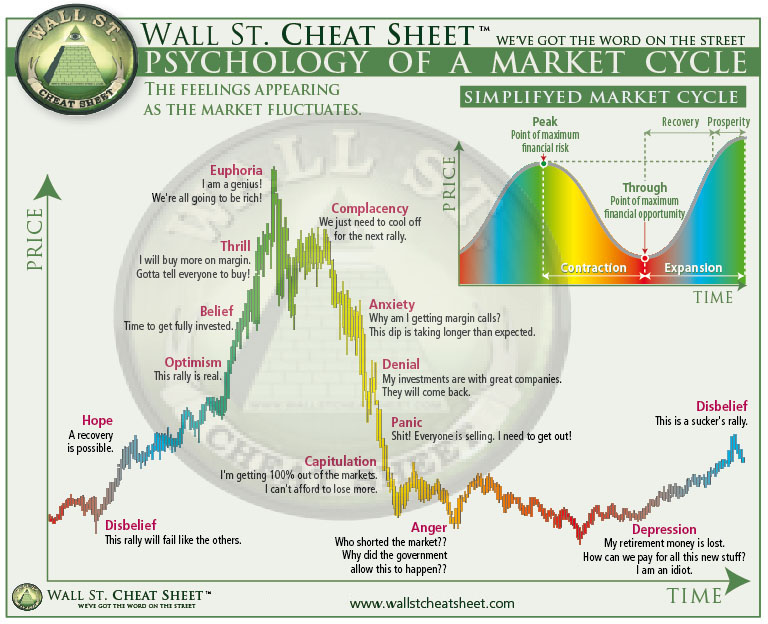

Psychology Cheat Sheet

Today’s infoporn comes to use via the Hoffman Brothers at Wall Street Cheat Sheet: Its a pretty variant on the psychological...

Today’s infoporn comes to use via the Hoffman Brothers at Wall Street Cheat Sheet: Its a pretty variant on the psychological...

Inflation/Deflation/Disinflation

Coincident with the drop in China, commodity prices, Baltic Dry Index and the rally in US Treasuries, the implied inflation rate in the...

Major Indices: “Looking UGLY, Billy Ray!”

Ron Griess of The Chart Store recently mentioned to me that “one of the most bullish patterns around was a failed Head &...

Ron Griess of The Chart Store recently mentioned to me that “one of the most bullish patterns around was a failed Head &...

June Consumer Confidence falls sharply

In contrast to the bounce seen in both the ABC and UoM polls, the Conference Board Confidence # for June was a big miss as it fell about...

Home Price Index a touch better than expected

The April S&P/Case Shiller Home Price Index of 20 cities rose 3.8%, a touch above expectations of a gain of 3.4%. The gain in the non...

Golden Cross Goes “Dark”

Top flight technician Mary Ann Bartels (BofA/ML) comments on the one-year anniversary of the Golden Cross, and the “Dark...

Top flight technician Mary Ann Bartels (BofA/ML) comments on the one-year anniversary of the Golden Cross, and the “Dark...

Conference Board says oops on China data

Pre opening to the Shanghai index opening overnight, China’s April Leading Economic Index was revised to a lower than expected 145...

First-Time Homebuyer Traffic Nose-Dive

First-time buyers purchased 46% of existing home sales in May, down from 49% in April. We all knew that first-time home buyers activity...

First-time buyers purchased 46% of existing home sales in May, down from 49% in April. We all knew that first-time home buyers activity...