IL, CA, NY, NJ cds continue to rise

Forget again for a moment the European sovereign credit issues, the cost of credit protection for US municipalities Illinois, California,...

The Chicago Fed’s National Activity Index — one of my favorite measures — printed this morning. The monthly number...

The Chicago Fed’s National Activity Index — one of my favorite measures — printed this morning. The monthly number...

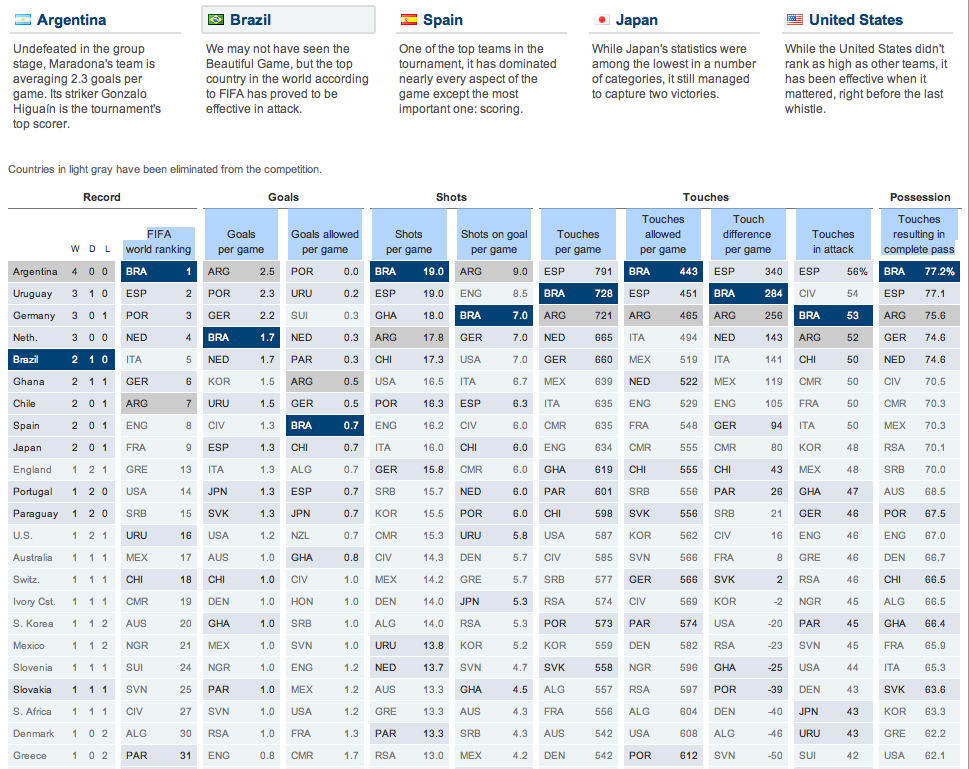

Terrific interactive data dump in the Sunday NYT, ranking various FIFA world cup teams by 10 separate metrics: FIFA world ranking Goals...

Terrific interactive data dump in the Sunday NYT, ranking various FIFA world cup teams by 10 separate metrics: FIFA world ranking Goals...

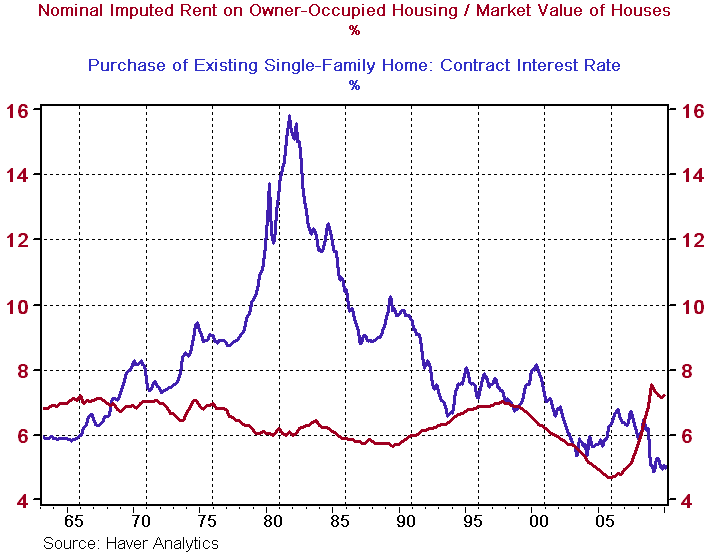

Several readers expressed surprise that I still believed home prices remain too high, as discussed in the A Closer Look at the Second Leg...

Several readers expressed surprise that I still believed home prices remain too high, as discussed in the A Closer Look at the Second Leg...

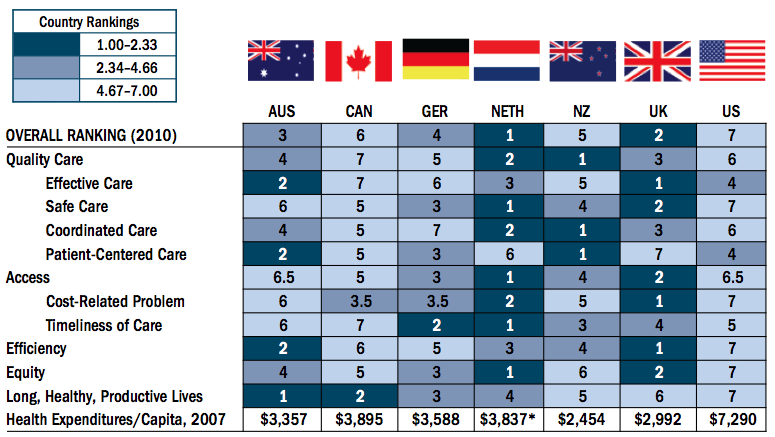

This continues to be fascinating: “The U.S. health system is the most expensive in the world, but comparative analyses consistently...

This continues to be fascinating: “The U.S. health system is the most expensive in the world, but comparative analyses consistently...

Get subscriber-only insights and news delivered by Barry every two weeks.