Word Origins: “Austerians”

Sometime over the past two weeks, the word “Austerians” burst onto the blogosphere. A play on the fiscal reserve of the...

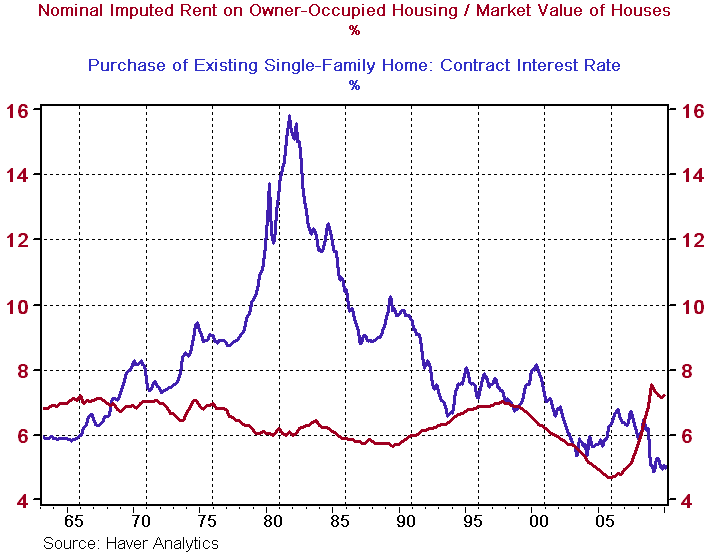

Several readers expressed surprise that I still believed home prices remain too high, as discussed in the A Closer Look at the Second Leg...

Several readers expressed surprise that I still believed home prices remain too high, as discussed in the A Closer Look at the Second Leg...

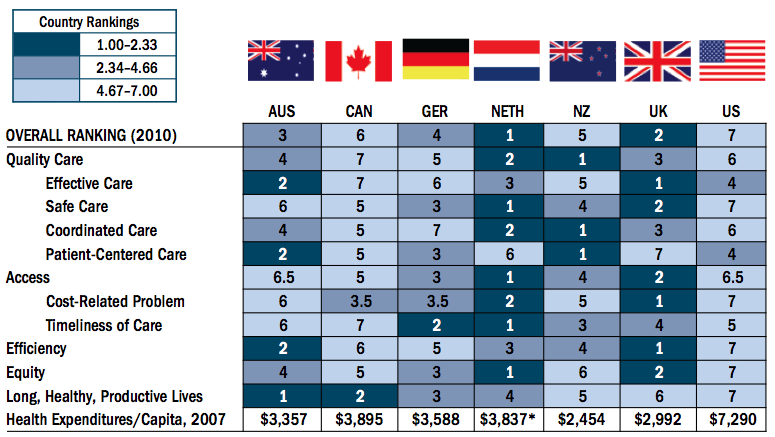

This continues to be fascinating: “The U.S. health system is the most expensive in the world, but comparative analyses consistently...

This continues to be fascinating: “The U.S. health system is the most expensive in the world, but comparative analyses consistently...

New York’s most fascinating park, The High Line, is set for a grand expansion. Fast Company has some drawings, along with a video...

New York’s most fascinating park, The High Line, is set for a grand expansion. Fast Company has some drawings, along with a video...

> Last weekend, we discussed issues of Wall Street compensation and liability in placing a natural limit to excessive risk-taking:...

> Last weekend, we discussed issues of Wall Street compensation and liability in placing a natural limit to excessive risk-taking:...

Get subscriber-only insights and news delivered by Barry every two weeks.