Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian

Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian

Read More

This morning, we learned of a huge compromise in regulatory reform. The expectation was that no one was happy with the bill, but the...

Read More

5.0 out of 5 stars Great history lesson on government bailouts Great book on helping me understand how we got to the bailout mess we are...

5.0 out of 5 stars Great history lesson on government bailouts Great book on helping me understand how we got to the bailout mess we are...

Read More

I listened to Senator Bob Corker — and others — discuss the new financial regulations this morning. I was astonished to hear...

Read More

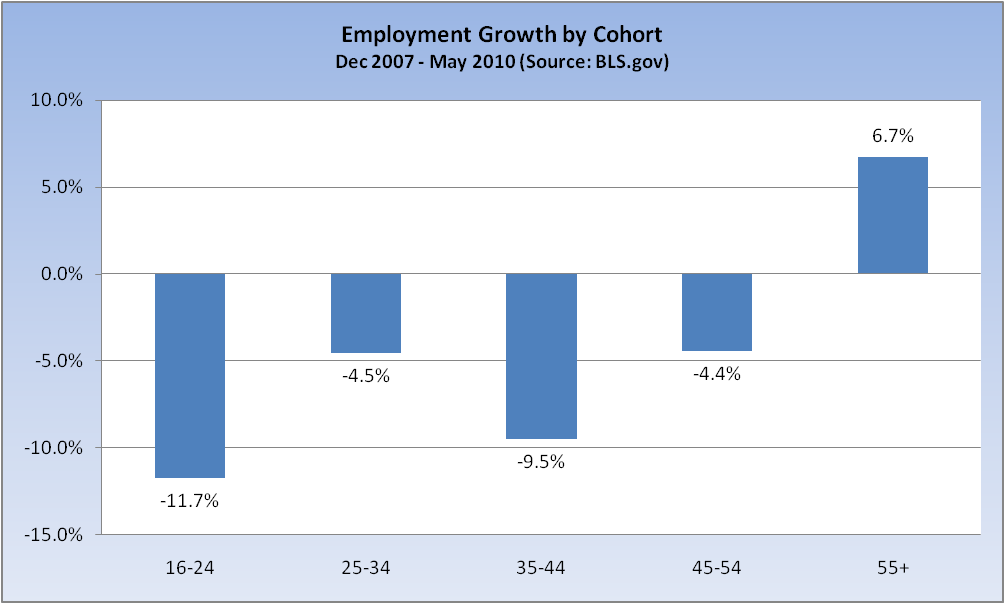

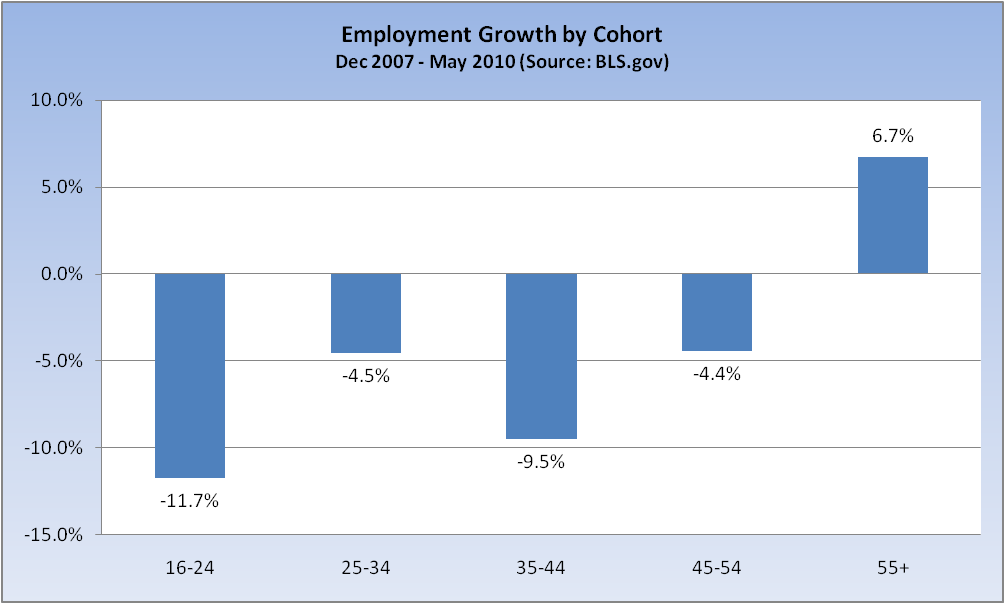

On a somewhat related note to my recent Kudlow post (that means it’s Invictus here, not BR, boys and girls), I see that in some...

On a somewhat related note to my recent Kudlow post (that means it’s Invictus here, not BR, boys and girls), I see that in some...

Read More

Of all days, TODAY ! Working on this . . . I listened to Senator Bob Corker — and others — discuss the new financial...

Read More

> Tonite I will be on Fast Money on CNBC for the full hour, discussing with the crew: – RIMM, Apple and iPhone 4.0 – BP...

> Tonite I will be on Fast Money on CNBC for the full hour, discussing with the crew: – RIMM, Apple and iPhone 4.0 – BP...

Read More

Dan Gross looks at why Fed Chair Ben Bernanke doesn’t seem too concerned about job losses.He disposes of the usual explanations,...

Read More

Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian

Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian

Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian

Information is Beautiful has this tasty chartporn depicting the UK emergency budget: > click for larger graphic via The Guardian