What’s the point of macro?

I am back in Tuscany and will head to Milan tomorrow early, give a speech at the Bloomberg offices and then back home. But it is Monday...

~~~ June 21st: Today’s $10 Ticket Friday, June 25 PNC Bank Arts Center Saturday, June 26 Nikon at Jones Beach Theater I am not...

~~~ June 21st: Today’s $10 Ticket Friday, June 25 PNC Bank Arts Center Saturday, June 26 Nikon at Jones Beach Theater I am not...

Markets have given up nearly all of their gains today, as the excitement over the weekend’s PBOC announcement has been replaced...

Markets have given up nearly all of their gains today, as the excitement over the weekend’s PBOC announcement has been replaced...

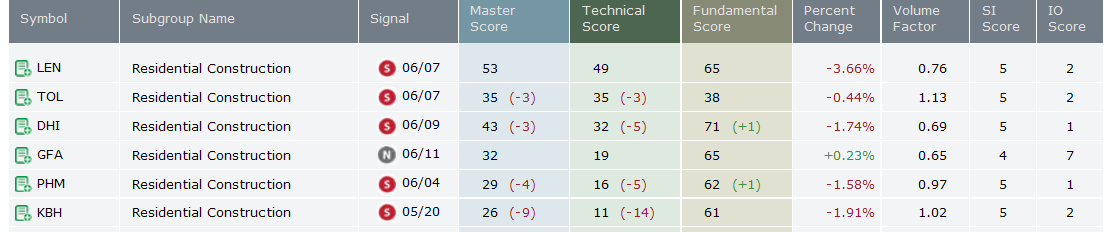

I was just discussing how ugly the Home builders look with AJ, one of our institutional sales traders. Nearly every builder has been on a...

I was just discussing how ugly the Home builders look with AJ, one of our institutional sales traders. Nearly every builder has been on a...

Kudos to BR for a nice tout in this week’s Up and Down Wall Street column in Barron’s, penned this week by Randall Forsyth: A...

Kudos to BR for a nice tout in this week’s Up and Down Wall Street column in Barron’s, penned this week by Randall Forsyth: A...

Get subscriber-only insights and news delivered by Barry every two weeks.