A big step in China’s global economic maturation

China’s decision to gradually abandon their hard peg to the US$ takes us back to pre July ’08 when it more freely floated....

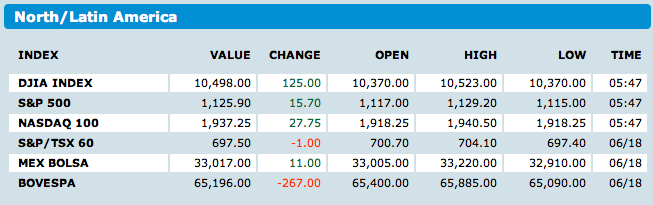

Global equity futures are up strongly on the weekend announcement by the People’s Bank of China regarding the depeg of the Yuan to...

Global equity futures are up strongly on the weekend announcement by the People’s Bank of China regarding the depeg of the Yuan to...

As these charts show, Bank failures in 2010 are running double the pace of 2009 . . . > Charts courtesy of Ron Griess, The Chart Store

As these charts show, Bank failures in 2010 are running double the pace of 2009 . . . > Charts courtesy of Ron Griess, The Chart Store

In Why plans for early fiscal tightening carry global risks, Martin Wolf of the Financial Times demonstrates yet again why he is the most...

In Why plans for early fiscal tightening carry global risks, Martin Wolf of the Financial Times demonstrates yet again why he is the most...

Lovely comments on our humble blog in this week’s Up and Down Wall Street column in Barron’s: “THE CERTAIN IMPACT ON...

Lovely comments on our humble blog in this week’s Up and Down Wall Street column in Barron’s: “THE CERTAIN IMPACT ON...

Get subscriber-only insights and news delivered by Barry every two weeks.