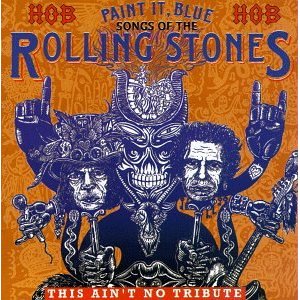

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...

Read More

Visit msnbc.com for breaking news, world news, and news about the economy

Read More

Some items of interest: • 4.6% Increase in Private Hours Worked Are Positive for the Economy (Economix) • The Growing Push to Impose...

Read More

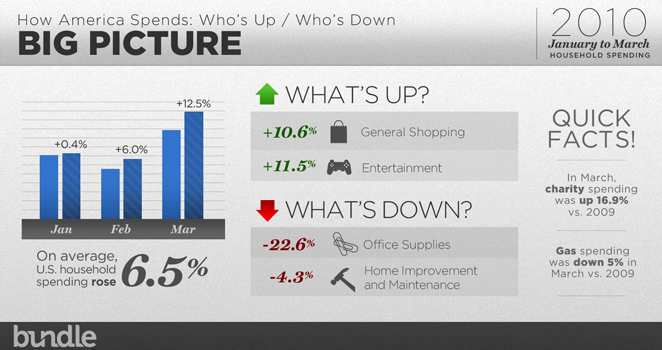

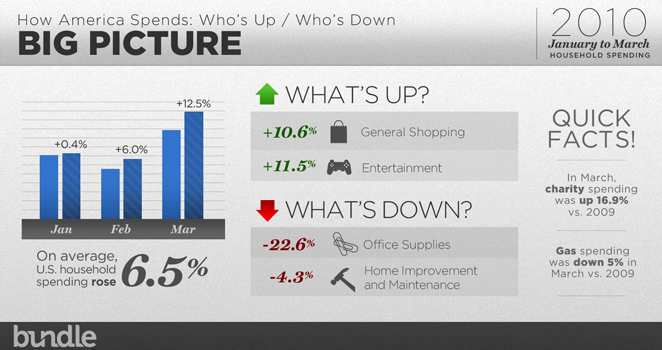

I linked to an article about US spending the other day. Since then, I keep seeing a variety of telling charts about the changes in US...

I linked to an article about US spending the other day. Since then, I keep seeing a variety of telling charts about the changes in US...

Read More

“Ratings firms fear litigation more than they fear regulation because past regulation efforts haven’t “been that...

Read More

The only guarantee of the day is that we’ll see the biggest trading volume of the week solely due to quadruple witch expiration and...

Read More

Peter T Treadway, PhD Historical Analytics LLC THE DISMAL OPTIMIST June 18, 2010 > “Because of statistics I can dig out the deepest...

Read More

I (Invictus) posted here about a debate in which David Rosenberg squared off with Jim Grant about whether “bonds are for...

I (Invictus) posted here about a debate in which David Rosenberg squared off with Jim Grant about whether “bonds are for...

Read More

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...

I mentioned the 40th anniversary of the remastered version of Exile on Main Street a few weeks ago. Lately, I have been listening to an...