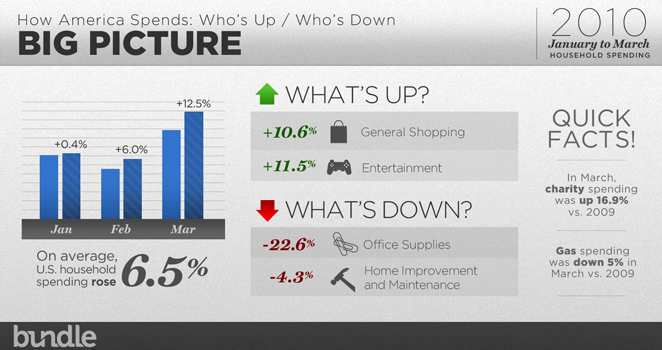

U.S. Consumer Spending ChartFest

I linked to an article about US spending the other day. Since then, I keep seeing a variety of telling charts about the changes in US...

I linked to an article about US spending the other day. Since then, I keep seeing a variety of telling charts about the changes in US...

Time for Legal Liability for Rating Agencies

“Ratings firms fear litigation more than they fear regulation because past regulation efforts haven’t “been that...

If only all Spanish banks were like the big ones

The only guarantee of the day is that we’ll see the biggest trading volume of the week solely due to quadruple witch expiration and...

CHINA THE BLACK BOX

Peter T Treadway, PhD Historical Analytics LLC THE DISMAL OPTIMIST June 18, 2010 > “Because of statistics I can dig out the deepest...

On the Treasury “Bubble”

I (Invictus) posted here about a debate in which David Rosenberg squared off with Jim Grant about whether “bonds are for...

I (Invictus) posted here about a debate in which David Rosenberg squared off with Jim Grant about whether “bonds are for...

You Can Get With This, Or You Can Can Get With That

Why is the Hamster commercial for the Kia Soul so damn addictive? > The original Black Sheep video is here.

Expiry, Rebalancing, Summer Friday

We have lots of things going on in the market today — do not be surprised to see some odd trading: • Its the end of the quarter,...

Is BP the Next Lehman Brothers?

~~~ Source: Is BP the Next Lehman Brothers? Peter Gorenstein Yahoo Tech Ticker Jun 17, 2010 12:18pm EDT...