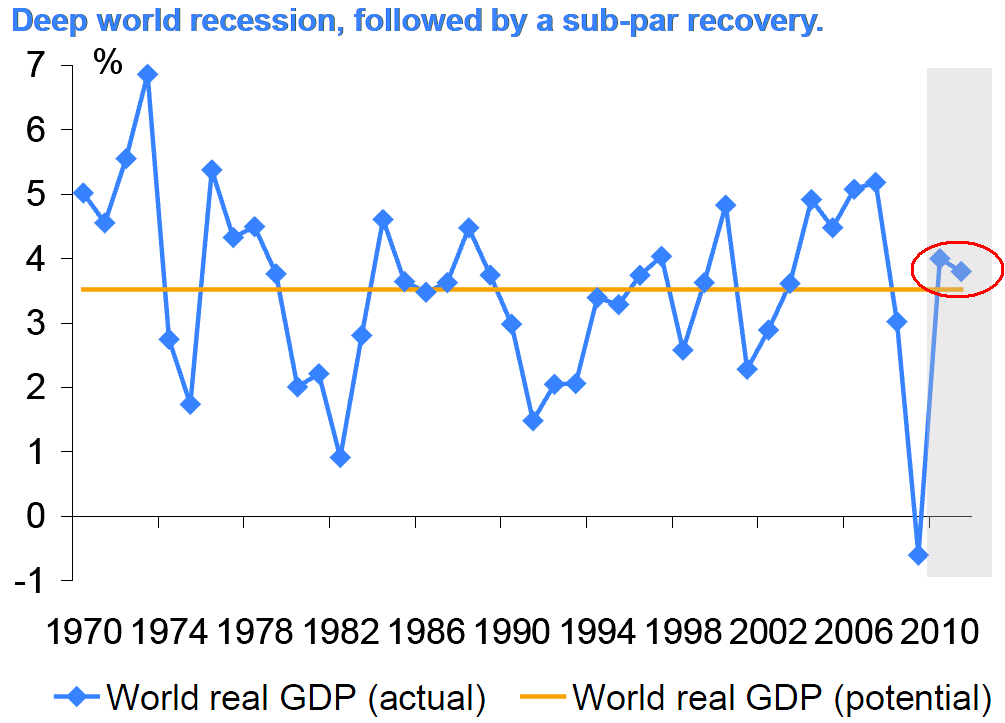

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...

Read More

~~~ Suddenly, Gary Shilling’s Bearishness Doesn’t Seem So Nutty Aaron Task Yahoo Tech Ticker, Jun 16, 2010 02:14pm EDT by...

Read More

Initial Jobless Claims remain disappointingly elevated, totaling 472k on the week, 22k above expectations, up from 460k last week and at...

Read More

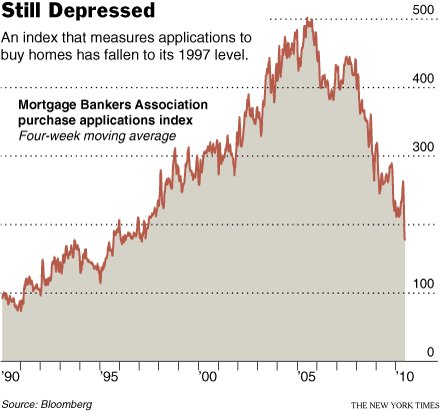

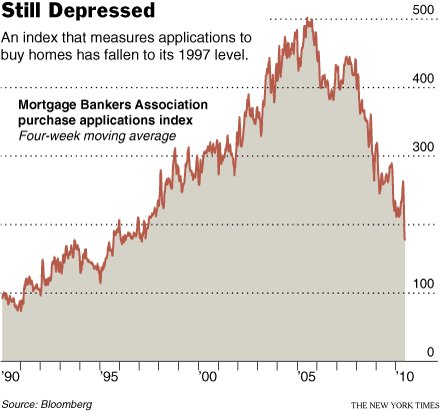

Plenty of inventory. Distressed sellers. Tight credit. File this under DUH: If you are in the market for a house, the current real estate...

Plenty of inventory. Distressed sellers. Tight credit. File this under DUH: If you are in the market for a house, the current real estate...

Read More

The Financial Times – Good as GLD: While it has now become possible to buy and sell gold with a few mouse clicks through funds like the...

The Financial Times – Good as GLD: While it has now become possible to buy and sell gold with a few mouse clicks through funds like the...

Read More

Helped out by the highest yields since July ’08 and a 40 bps jump just this week, Spain successfully sold 10 yr and 30 yr bonds....

Read More

“There is no trick. We can’t promise to work less, raise pensions and erase deficits.” -French Labor Minister Eric Woerth > The...

Read More

Chairman Ben S. Bernanke At the Squam Lake Conference, New York, New York June 16, 2010 The Squam Lake Report –the centerpiece of...

Chairman Ben S. Bernanke At the Squam Lake Conference, New York, New York June 16, 2010 The Squam Lake Report –the centerpiece of...

Read More

Visit msnbc.com for breaking news, world news, and news about the economy

Read More

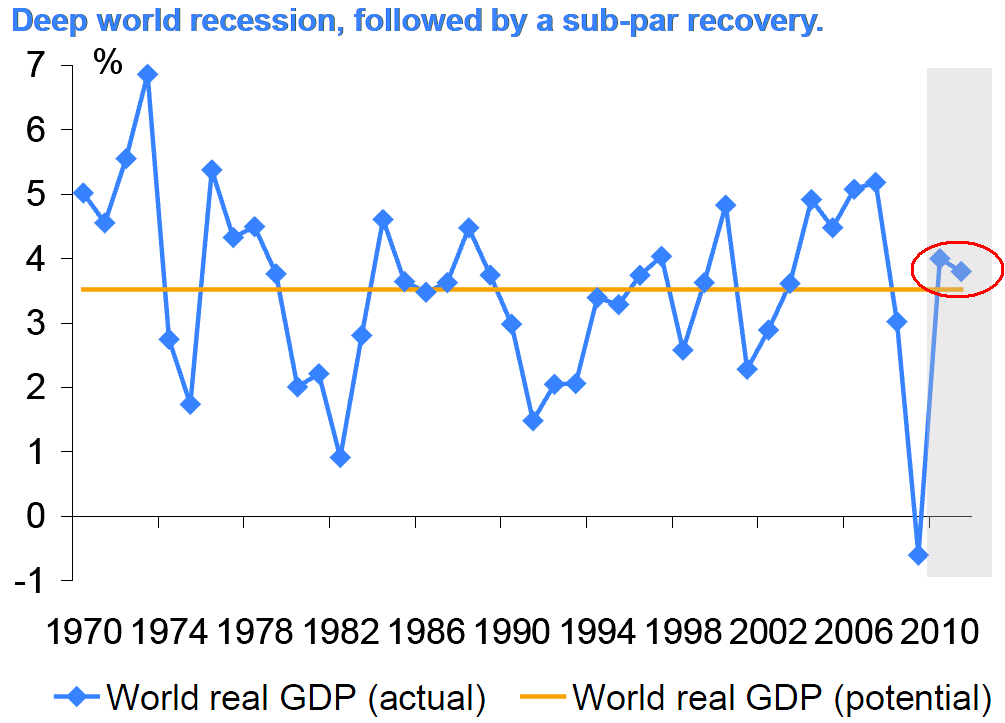

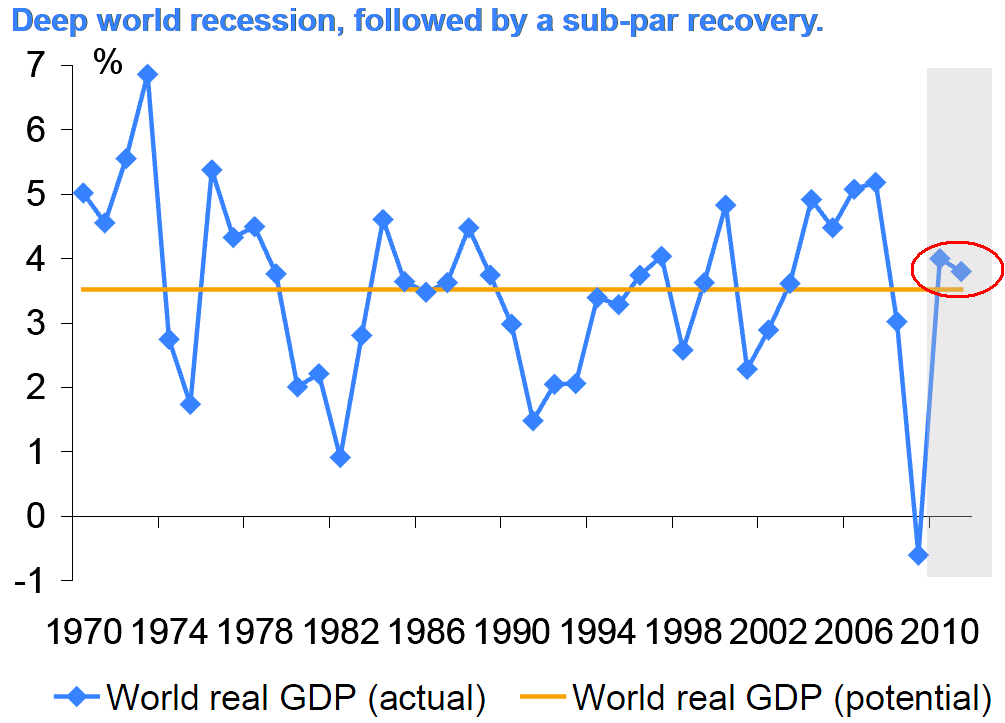

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...

I presented this week at the Ryan’s Metal conference, discussing the state of the US economy. Also presenting was Thomas Berner,...