Economic data

Initial Jobless Claims remain disappointingly elevated, totaling 472k on the week, 22k above expectations, up from 460k last week and at...

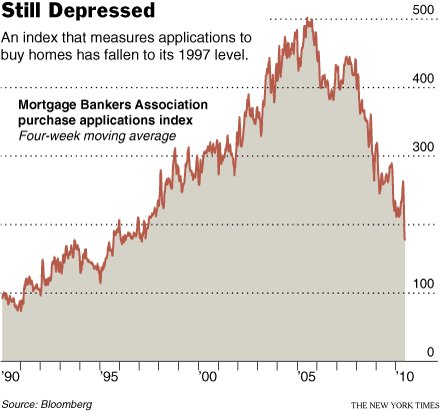

Plenty of inventory. Distressed sellers. Tight credit. File this under DUH: If you are in the market for a house, the current real estate...

Plenty of inventory. Distressed sellers. Tight credit. File this under DUH: If you are in the market for a house, the current real estate...

The Financial Times – Good as GLD: While it has now become possible to buy and sell gold with a few mouse clicks through funds like the...

The Financial Times – Good as GLD: While it has now become possible to buy and sell gold with a few mouse clicks through funds like the...

Get subscriber-only insights and news delivered by Barry every two weeks.