Gaming Q2 Performance

Between now and the end of June, traders, wise guys and PMs will try to manipulate stocks higher to game Q2 performance – especially...

June Home Builder survey going thru withdrawal

In a continuation of the hangover from the end of the home buying tax credit, the June NAHB home builder survey was a weaker than...

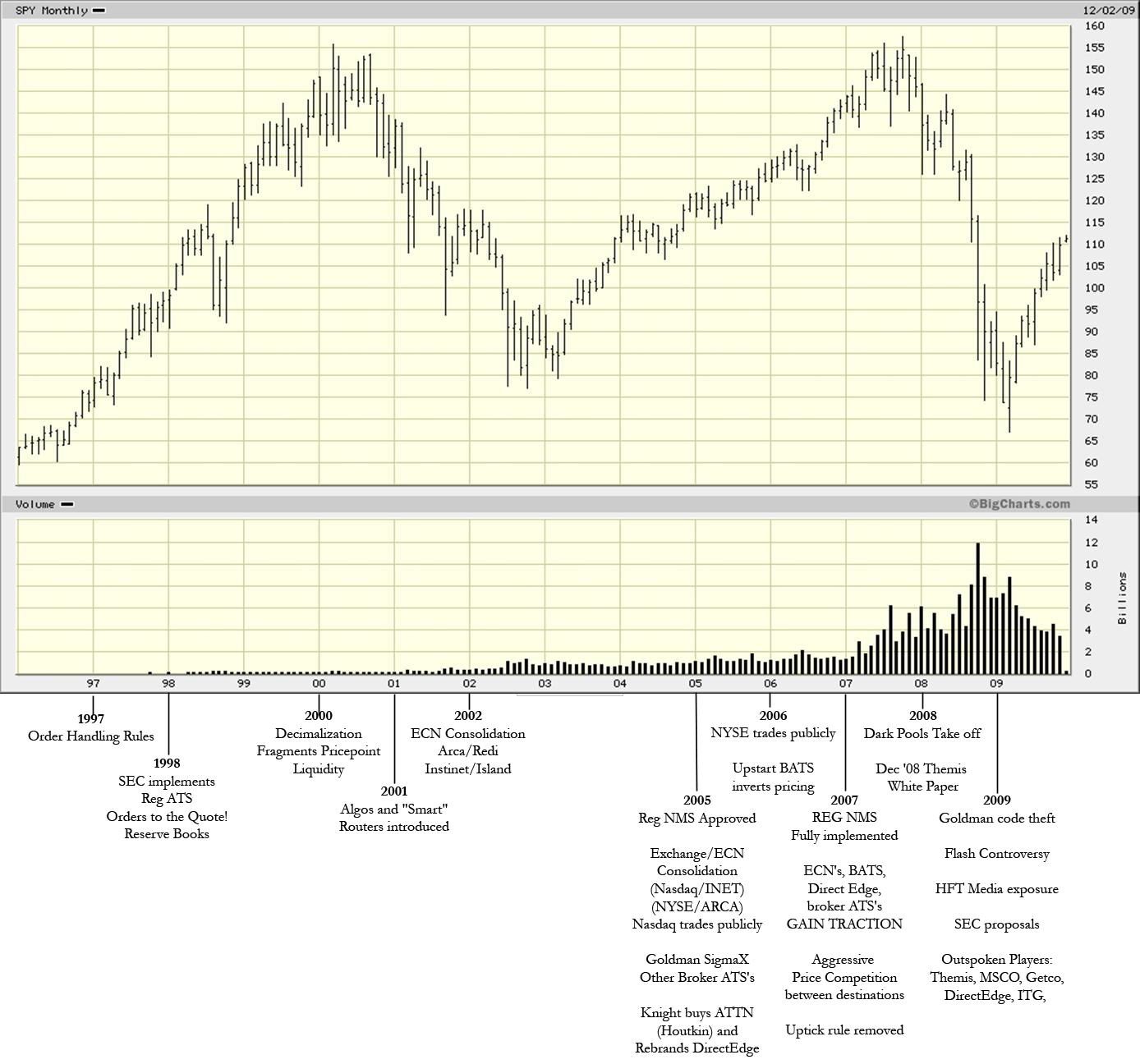

HFT Timeline

From Sal & Joe at Themis Trading comes this terrific timeline regarding the events surrounding high Frequency Trading. > click for...

From Sal & Joe at Themis Trading comes this terrific timeline regarding the events surrounding high Frequency Trading. > click for...

Interactive World Cup Schedule

Way cool! > click for interactive graphic http://www.marca.com/deporte/futbol/mundial/sudafrica-2010/calendario-english.html

Way cool! > click for interactive graphic http://www.marca.com/deporte/futbol/mundial/sudafrica-2010/calendario-english.html

Economic data

The June NY manufacturing survey at 19.6 was about in line with expectations and little changed from May’s # of 19.1 but remaining...

Top 25 Most-Favored Stocks In High Frequency Trading

From Institutional Investor, comes this list of favored HFT names: > Favorites High Frequency US Trading Stocks, 2008-10 Company Name...

Muni Stress

•New York Times – Obama Presses for Aid to Cities and States President Obama on Saturday implored Congress to provide more aid to...

•New York Times – Obama Presses for Aid to Cities and States President Obama on Saturday implored Congress to provide more aid to...

Forced selling puts European debt under pressure

Due to forced selling by investment grade managers, Greek bonds are down sharply following the belated downgrade of their credit rating...

Moody’s Downgrades Greece (Also, Kennedy was shot)

On Monday, Moody’s downgraded Greece’s government bond ratings to junk status of Ba1 from A3. As legislators debate new...