May Retail Sales suck but building materials main culprit

May Retail Sales on the surface was not good, as the headline figure fell by 1.2%, ex auto’s fell by 1.1% and ex auto’s and...

There is a terrific cover story on the PermaBears in the upcoming BusinessWeek. I spoke with the reporter about some of the bears...

There is a terrific cover story on the PermaBears in the upcoming BusinessWeek. I spoke with the reporter about some of the bears...

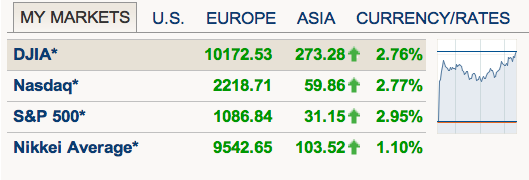

> We saw a near 3% pop in the markets today — but the volume was anemic. Does this amount to anything? Is it nothing more than a...

> We saw a near 3% pop in the markets today — but the volume was anemic. Does this amount to anything? Is it nothing more than a...

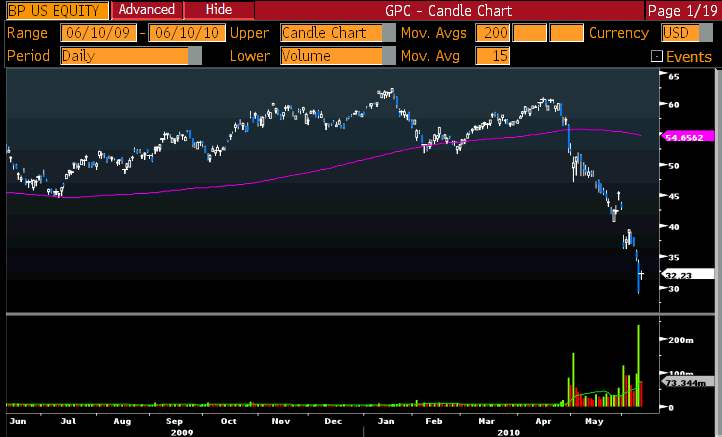

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing with the crew how to trade BP My suggestions on the subject can be found...

> Tonite I will be on Fast Money on CNBC at 5:00pm discussing with the crew how to trade BP My suggestions on the subject can be found...

Interesting chart from Morgan Stanley Europe: > BP has underperformed its European oil peers by 20% since April 20 click for larger...

Interesting chart from Morgan Stanley Europe: > BP has underperformed its European oil peers by 20% since April 20 click for larger...

The single most common emailed question I’ve gotten — from readers, from clients, from the media — is “Do you buy...

The single most common emailed question I’ve gotten — from readers, from clients, from the media — is “Do you buy...

Get subscriber-only insights and news delivered by Barry every two weeks.