Initial Jobless Claims remain elevated

Initial Jobless Claims totaled 456k, 6k above expectations and last week was revised up by 6k to 459k. This level remains very elevated...

Go figure: Bush Treasury Secretary Hank Paulson and then NY Fed President Tim Geithner misled the public as to how bad AIG’s...

Go figure: Bush Treasury Secretary Hank Paulson and then NY Fed President Tim Geithner misled the public as to how bad AIG’s...

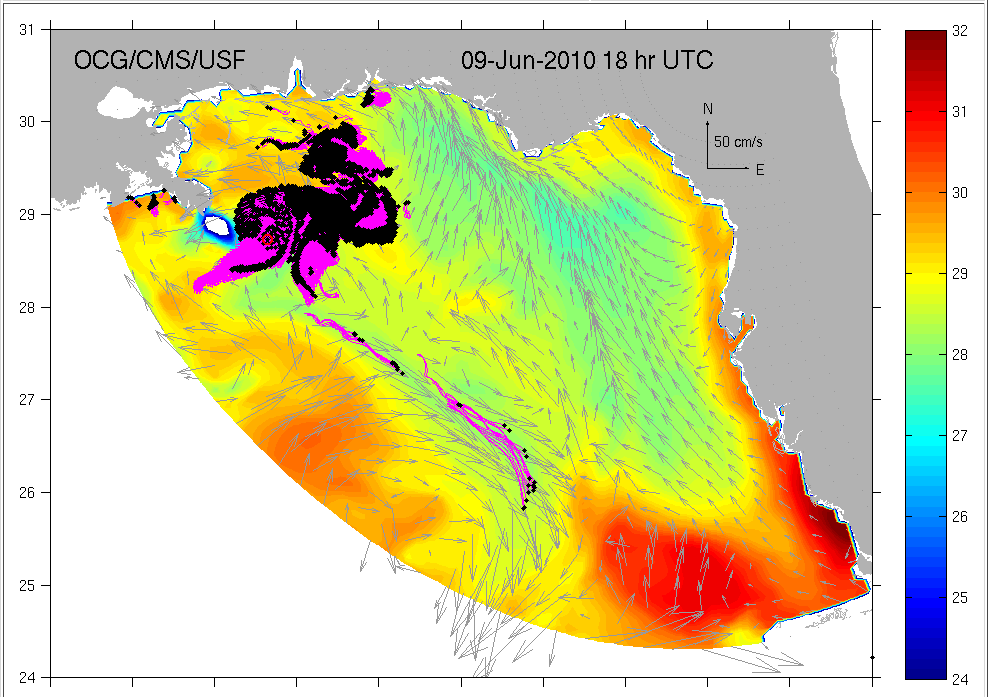

Fascinating animation via the College of Marine Science at the University of South Florida based on West Florida Shelf ROMS: > click...

Fascinating animation via the College of Marine Science at the University of South Florida based on West Florida Shelf ROMS: > click...

Get subscriber-only insights and news delivered by Barry every two weeks.