PIIS country (ex G) yields lower thx to Portugal

Successful bond auctions in Portugal at around 5:50am, both a 3 yr and 10 yr, sent European stock markets higher on the day after being...

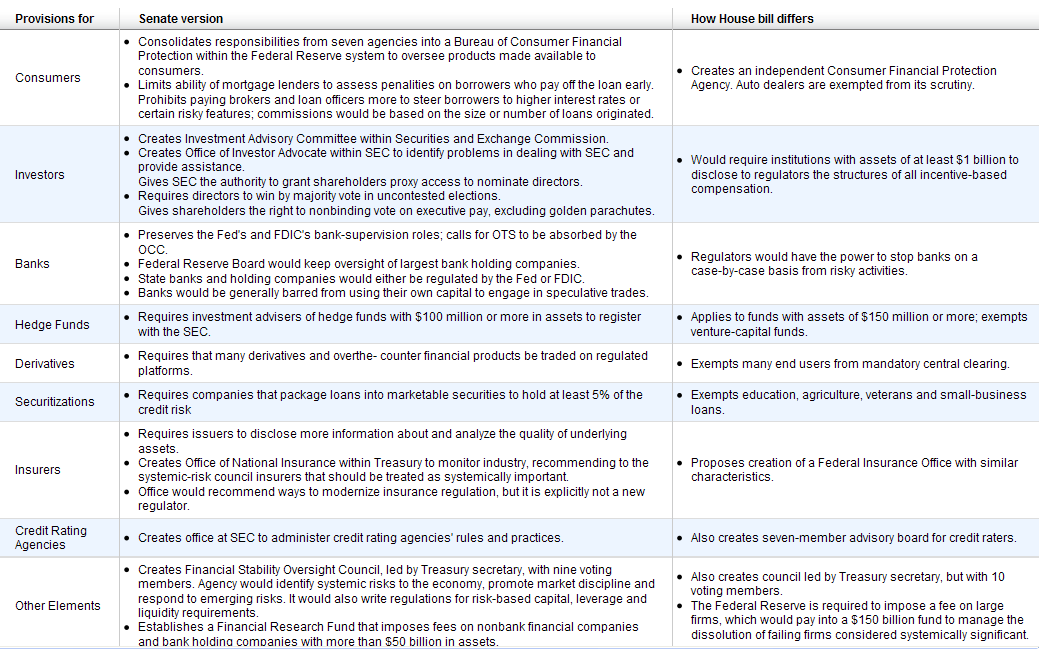

The WSJ has a terrific table comparing the House & Senate versions of the Financial Regulatory Reform bills: > click for table

The WSJ has a terrific table comparing the House & Senate versions of the Financial Regulatory Reform bills: > click for table

You may recall I mentioned a recent trade in Citigroup, and Bank of America, posted under the headline “Buy What You Hate.”...

You may recall I mentioned a recent trade in Citigroup, and Bank of America, posted under the headline “Buy What You Hate.”...

Street Insider – Diamond Offshore (DO) Falls On Leak SpeculationShares of Diamond Offshore Drilling Inc. (NYSE: DO) are under...

Street Insider – Diamond Offshore (DO) Falls On Leak SpeculationShares of Diamond Offshore Drilling Inc. (NYSE: DO) are under...

Get subscriber-only insights and news delivered by Barry every two weeks.