What impact Europe?

Adding more anecdotal info to the focus on Europe’s woes and its impact on global growth, MMM at an investor conference is saying...

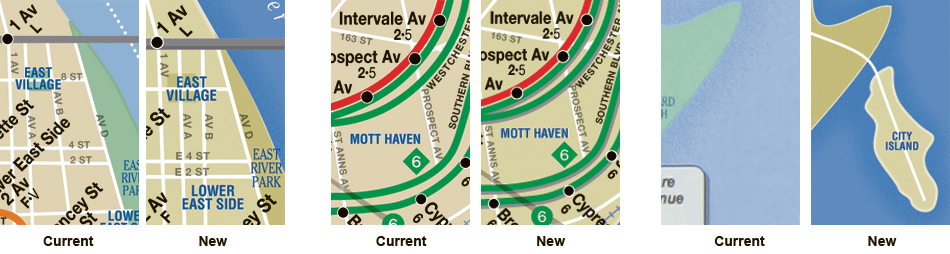

Hey, the new subway map is coming. In June, the Metropolitan Transportation Authority will unveil a resized, recolored and simplified...

Hey, the new subway map is coming. In June, the Metropolitan Transportation Authority will unveil a resized, recolored and simplified...

> I am filling in for Tom Keene today, hosting his show, Bloomberg on the Economy from 11:00am, to 12 noon. We will be having Dana...

> I am filling in for Tom Keene today, hosting his show, Bloomberg on the Economy from 11:00am, to 12 noon. We will be having Dana...

> Be sure to check out the Goldman research piece on World Cup Soccer World Cup and Economics 2010 It is a surprisingly fun approach...

> Be sure to check out the Goldman research piece on World Cup Soccer World Cup and Economics 2010 It is a surprisingly fun approach...

To a man whose only tool is a hammer, pretty soon everything begins to look like a nail. I couldn’t help but be reminded of that...

To a man whose only tool is a hammer, pretty soon everything begins to look like a nail. I couldn’t help but be reminded of that...

Get subscriber-only insights and news delivered by Barry every two weeks.