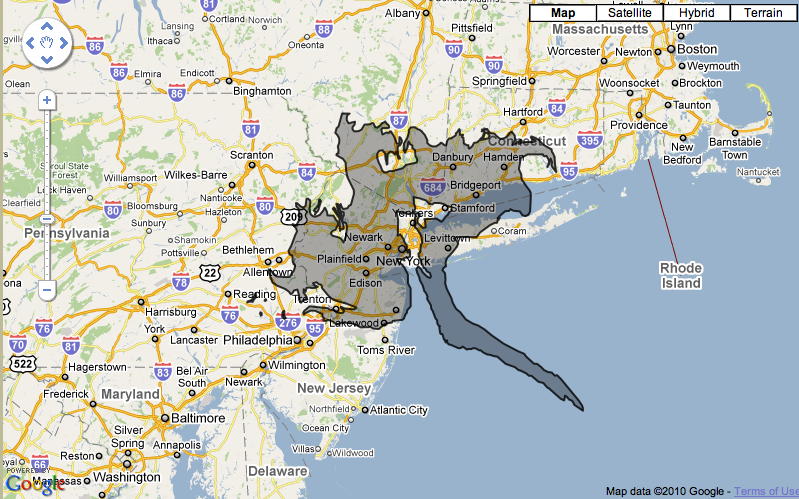

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...

Read More

David R. Kotok Chairman and Chief Investment Officer Memorial Day Weekend, May 31, 2010 > “The fact that neither the government nor...

Read More

~~~ BankruptingAmerica: According to a recent poll, 74 percent of likely voters are extremely or very concerned about the current level...

Read More

Traders are probably relieved that May is over, and June is finally here: > via The Chart Store

Traders are probably relieved that May is over, and June is finally here: > via The Chart Store

Read More

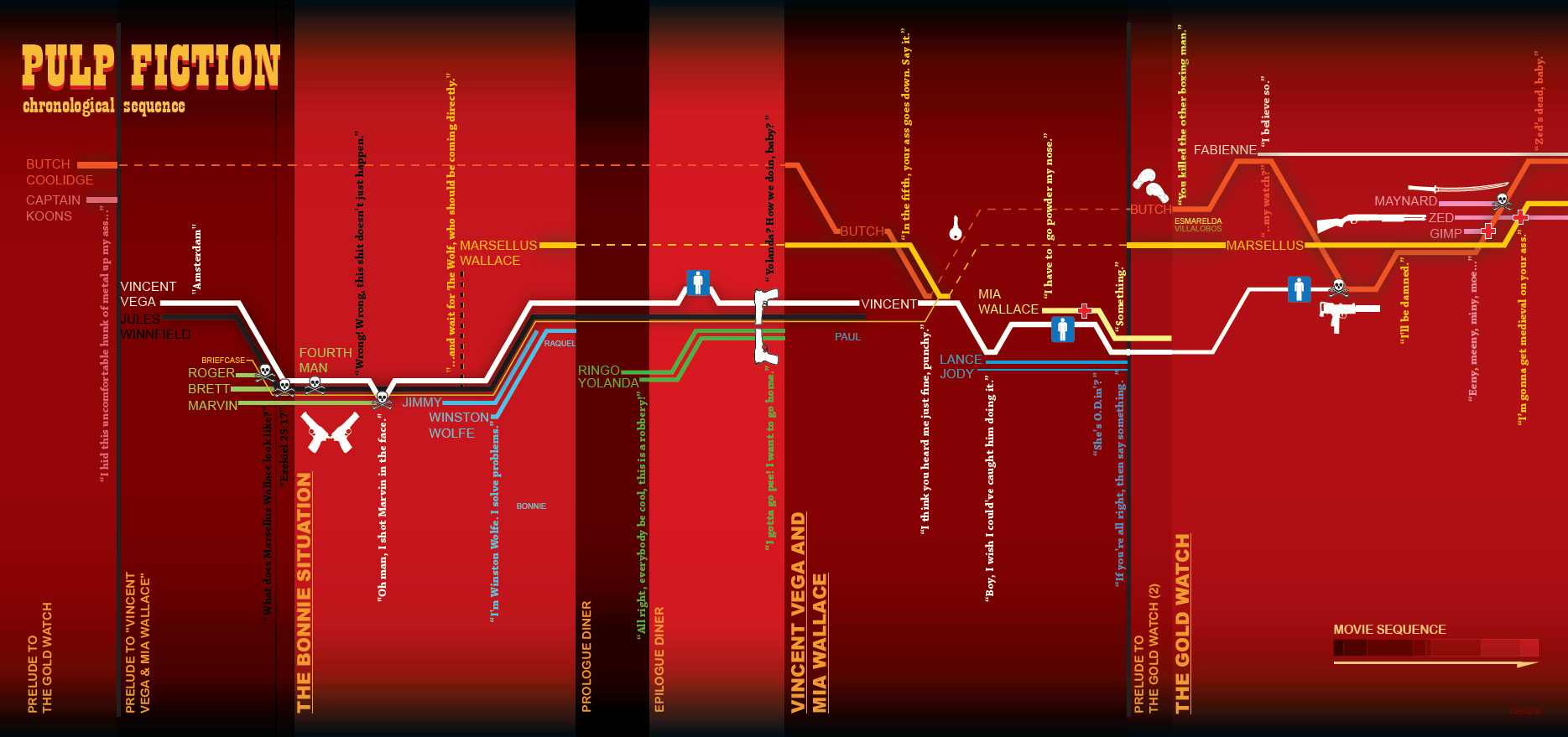

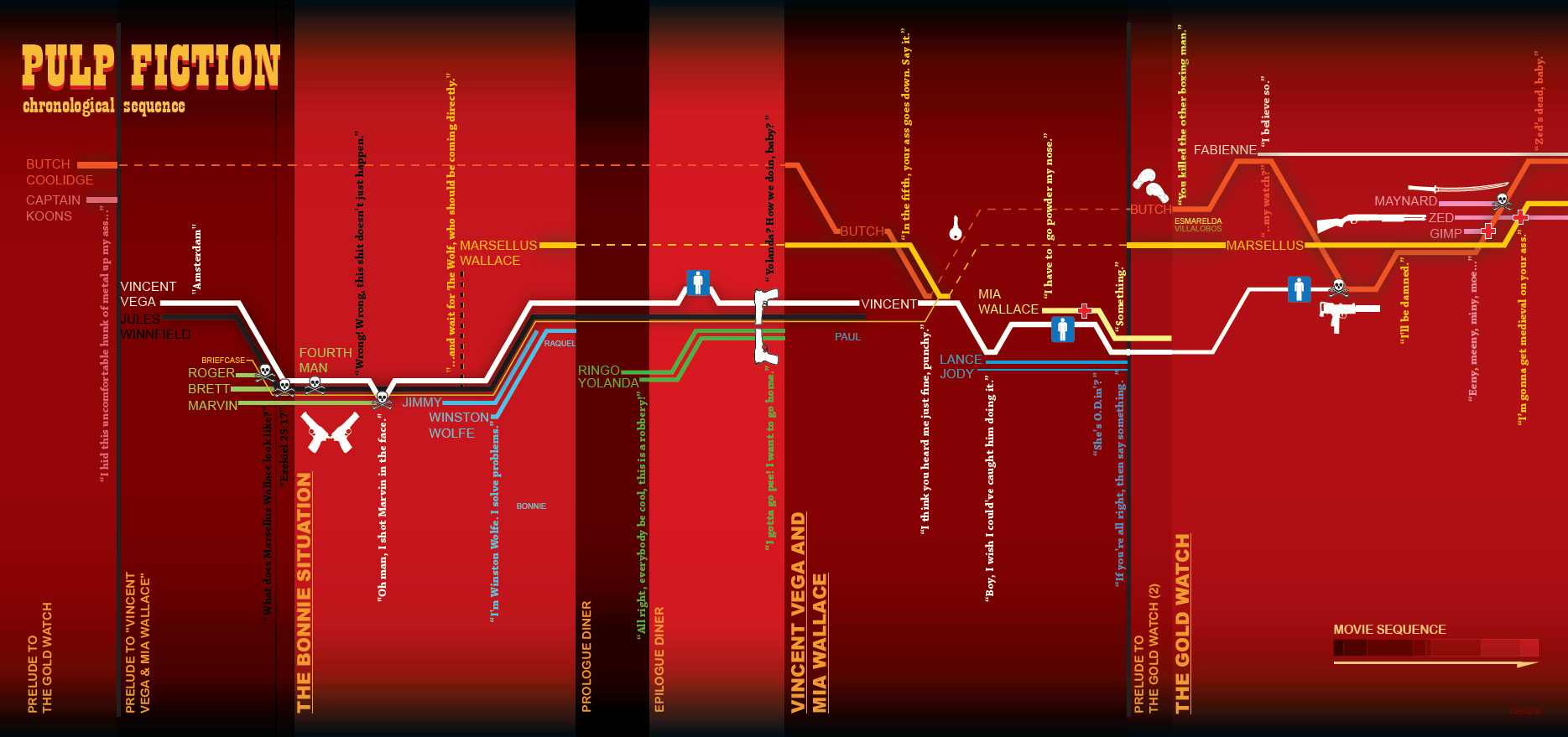

Pretty awesome: Deviant Art has plotted the timeline and character interaction of the film, Pulp Fiction: > Hat tip Flowing Data

Pretty awesome: Deviant Art has plotted the timeline and character interaction of the film, Pulp Fiction: > Hat tip Flowing Data

Read More

Alan Abelson notes this in this week’s Barrons that the top 8 stocks in the POWERSHARES QQQ exchange-traded fund for the Nasdaq 100...

Read More

Chairman Ben S. Bernanke At the Institute for Monetary and Economic Studies International Conference, Bank of Japan, Tokyo, Japan May 25,...

Read More

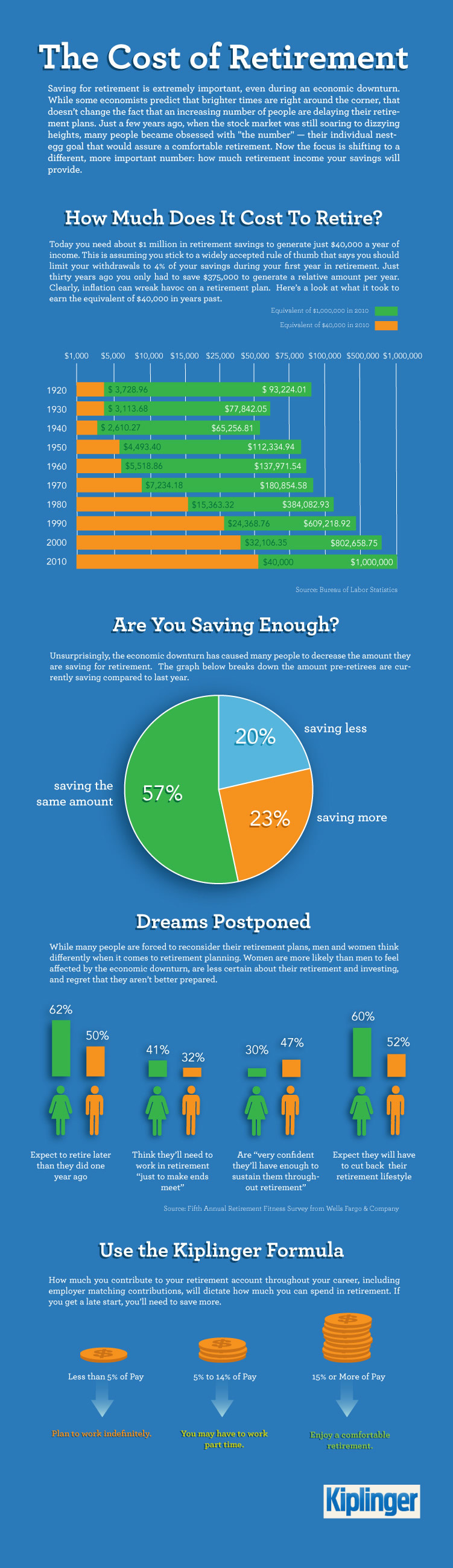

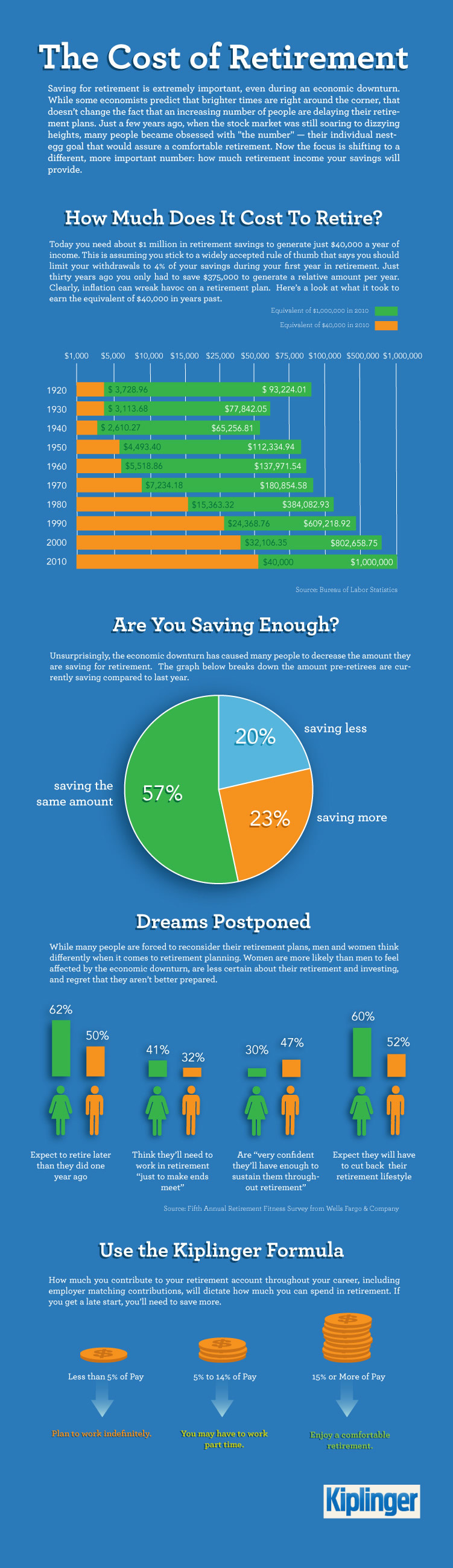

Nice chartporn from Kiplingers as to why most Americans will be eating Purina Cat Chow int heir golden years: >...

Nice chartporn from Kiplingers as to why most Americans will be eating Purina Cat Chow int heir golden years: >...

Read More

James Montier’s latest paper on the insanity of the policy benchmarks, the failures of Yale model, the dangers of risk parity, and...

Read More

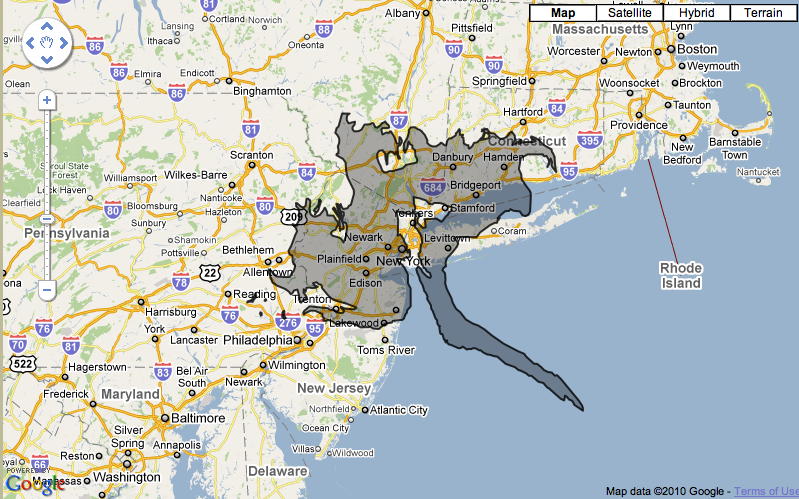

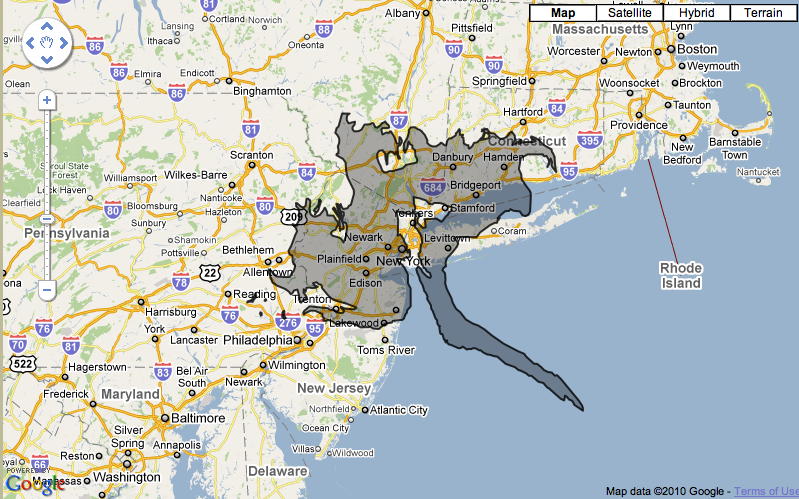

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...

Fascinating little Google Maps mash up allows you to place the BP Oil spill over any city. I tried a few, but San Francisco and NYC drove...