If you can’t grow, you can’t pay back what you owe

The CEO of Deutshe Bank echoed today what many of us know but European officials and the ECB don’t want to admit as evidenced by...

I have been a long standing critic of the Ratings Agencies. Recall this got me into a little hot water with my publisher — the...

I have been a long standing critic of the Ratings Agencies. Recall this got me into a little hot water with my publisher — the...

Quick question: I want to be able to record an interview, either in person or over the phone, then somehow have that recording converted...

Quick question: I want to be able to record an interview, either in person or over the phone, then somehow have that recording converted...

On this auspicious occasion, the one week anniversary of the great collapse of 2:45pm EST, it is worthwhile to step back and remember...

On this auspicious occasion, the one week anniversary of the great collapse of 2:45pm EST, it is worthwhile to step back and remember...

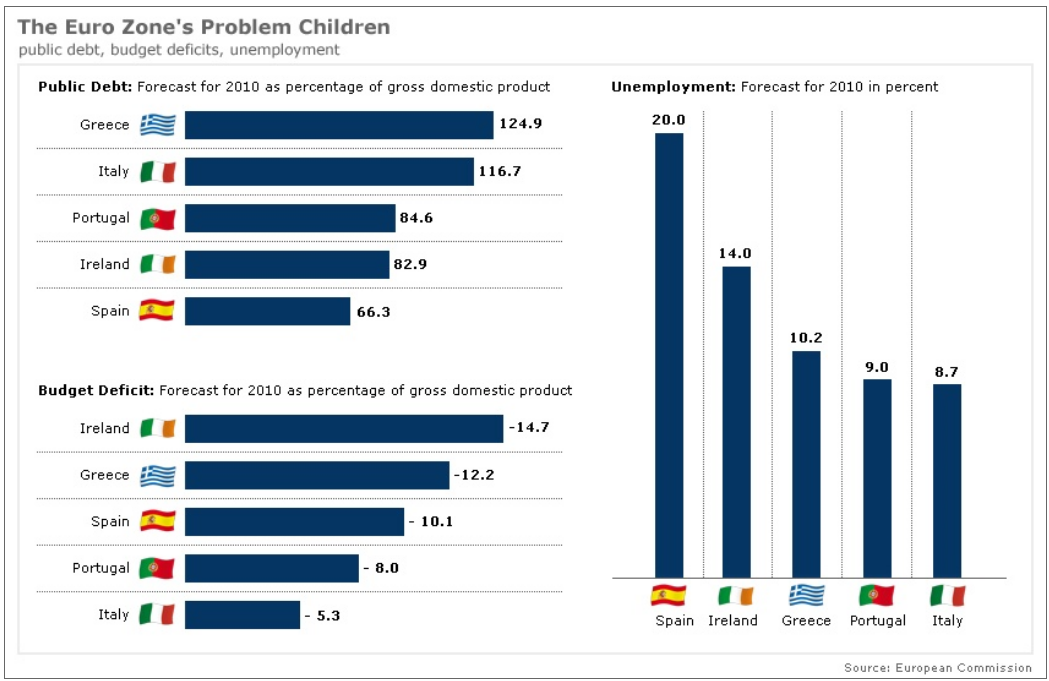

Der Spiegel has this terrific set of graphics looking at the Euro Zone’s problem children: > When Bonds Come Due Budget Deficits...

Der Spiegel has this terrific set of graphics looking at the Euro Zone’s problem children: > When Bonds Come Due Budget Deficits...

Late last month we noted that stock volume was soaring. We said: Since April 7 the S&P 500 is nearly unchanged. An uptick in...

Late last month we noted that stock volume was soaring. We said: Since April 7 the S&P 500 is nearly unchanged. An uptick in...

Get subscriber-only insights and news delivered by Barry every two weeks.