Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...

Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...

Read More

With 3 hours to go in afternoon trading, consolidated NYSE volume is on track with Wednesday’s volume run rate of 6.7b shares, well...

Read More

David R. Kotok, Cumberland Advisors May 10, 2010 In “Oil Slickonomics”, part 1, we set forth three scenarios for the BP disaster....

Read More

On Friday, the one man contrary indicator announced — AFTER the equity market collapse, AFTER a huge spike in gold — that it...

Read More

> This afternoon, I’m on Bloomberg TV, between 2pm and 2:45pm discussing the market crash, whether HFT was to blame, and the SEC...

> This afternoon, I’m on Bloomberg TV, between 2pm and 2:45pm discussing the market crash, whether HFT was to blame, and the SEC...

Read More

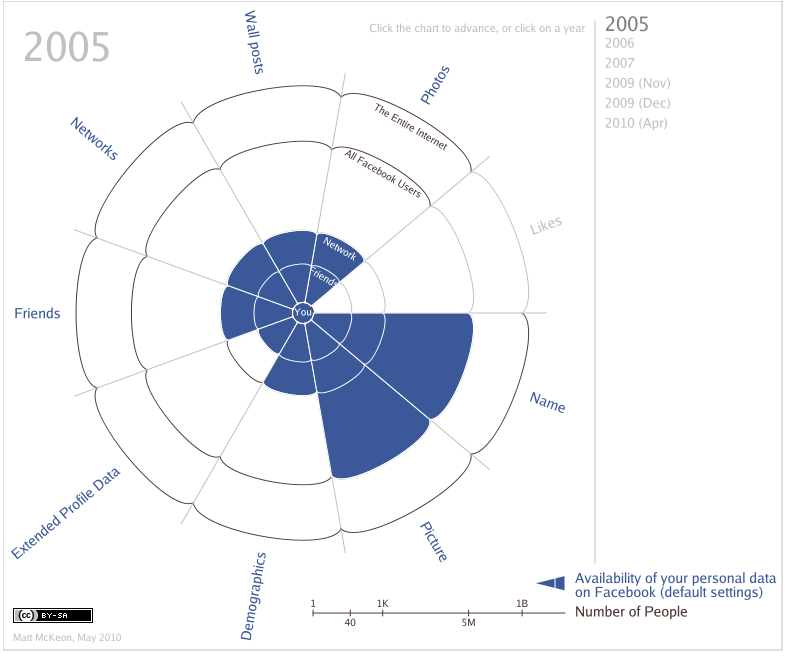

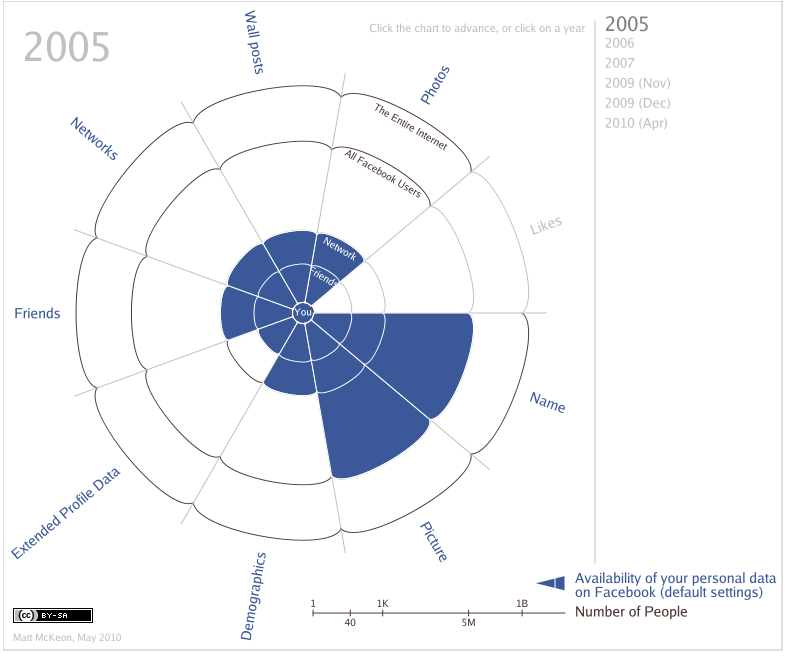

This is pretty amusing, via Matt McKeon: click for animation

This is pretty amusing, via Matt McKeon: click for animation

Read More

The lead in this morning’s paper WSJ provides all necessary guidance for global wealth holders: “The European Union agreed on an...

Read More

It’s estimated that one million Americans walked away from homes “underwater” or worth less than their mortgages even...

Read More

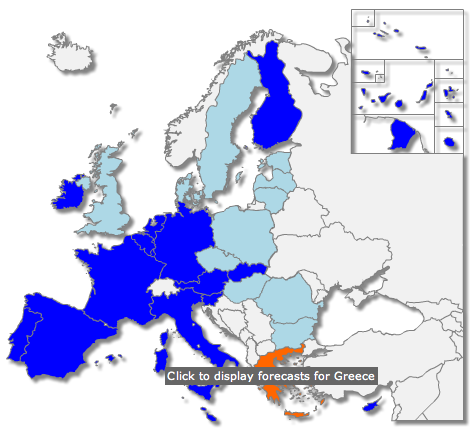

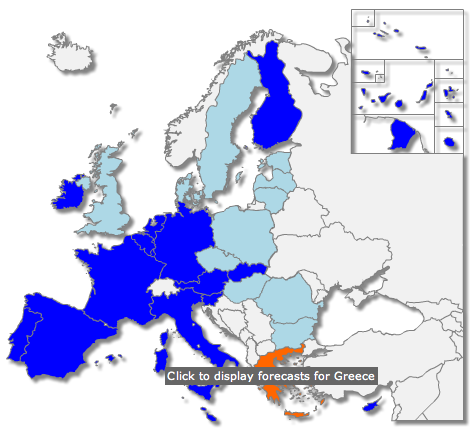

Nice interactive graphic from the European Commission’s Economic and Financial Affairs division, showing a map of the...

Nice interactive graphic from the European Commission’s Economic and Financial Affairs division, showing a map of the...

Read More

Joseph Saluzzi (jsaluzzi@ThemisTrading.com) and Sal L. Arnuk (sarnuk@ThemisTrading.com) are co-heads of the equity trading desk at Themis...

Joseph Saluzzi (jsaluzzi@ThemisTrading.com) and Sal L. Arnuk (sarnuk@ThemisTrading.com) are co-heads of the equity trading desk at Themis...

Read More

Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...

Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...

Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...

Wow, this is a surprise: Net Applications is reporting that Microsoft’s Internet Explorer dropped to a historic market share low in...