Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >

Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >

Read More

> Scott Patterson asks: Did the automatic shutdowns make the plunge worse? “A number of high-frequency firms stopped trading...

> Scott Patterson asks: Did the automatic shutdowns make the plunge worse? “A number of high-frequency firms stopped trading...

Read More

Chairman Ben S. Bernanke At the University of South Carolina Commencement Ceremony, Columbia, South Carolina May 8, 2010 • 40 KB PDF I...

Read More

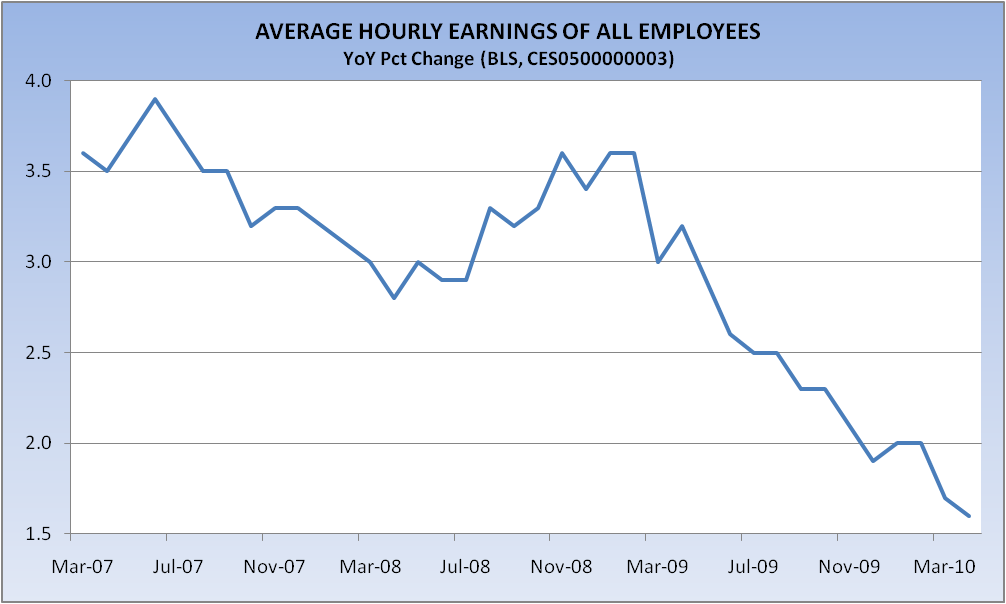

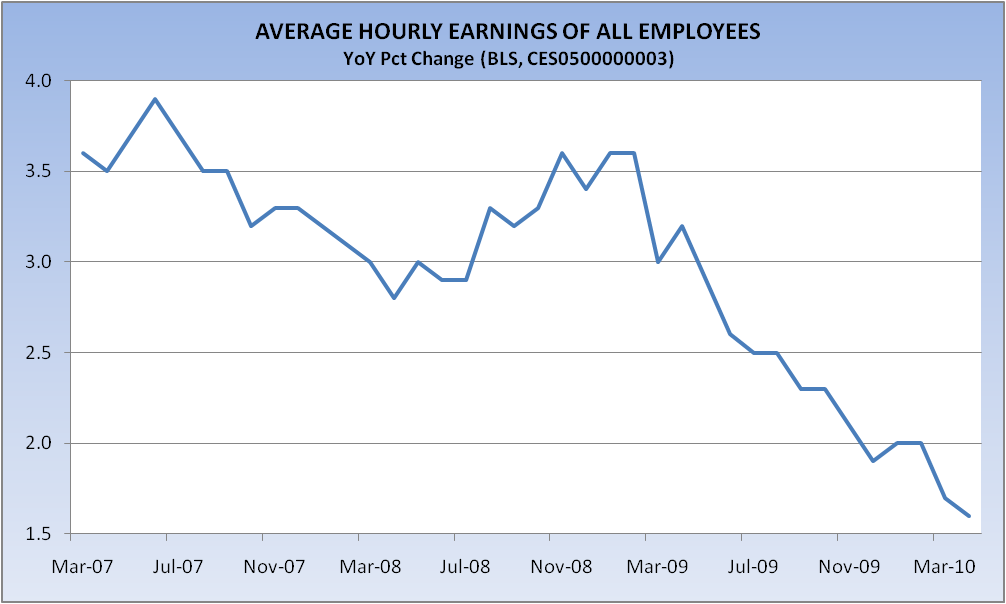

While there can be no doubt that adding jobs is a better outcome than losing them, there remain some trouble spots that bear watching as...

While there can be no doubt that adding jobs is a better outcome than losing them, there remain some trouble spots that bear watching as...

Read More

David R. Kotok, Cumberland Advisors May 8, 2010 America’s stock market turmoil scared the “H” out of everybody this week. Part of...

Read More

The NYSE CEO blamed non NYSE markets — his market competitors. He claims their “thinly traded electronic markets” as...

Read More

President of TradersAudio.com Ben Lichtenstein’s breathless order-taking in the S&P 500 pit in Chicago during Thurday’s...

Read More

May 7, 2010 By John Mauldin The Risks from Fiscal Imbalances The Challenge for Central Banks Bang, Indeed! The Center Cannot Hold A...

May 7, 2010 By John Mauldin The Risks from Fiscal Imbalances The Challenge for Central Banks Bang, Indeed! The Center Cannot Hold A...

Read More

“Not so long ago, if our markets experienced severe stress, and certainly a “fat finger”, human wisdom would intervene. Reasons...

Read More

Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >

Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >

Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >

Forget the Great Depression, the 1987 crash, or the dot com bubble; My pal Howard Lindzon has the right idea with these t-shirts: >