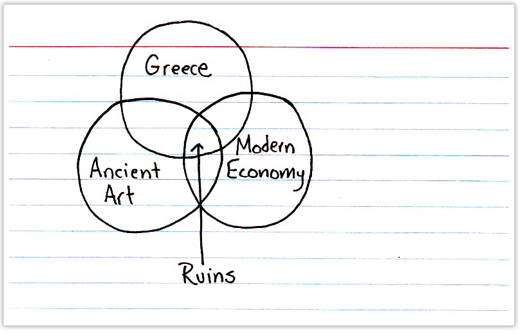

I love this card from Indexed:

I love this card from Indexed:

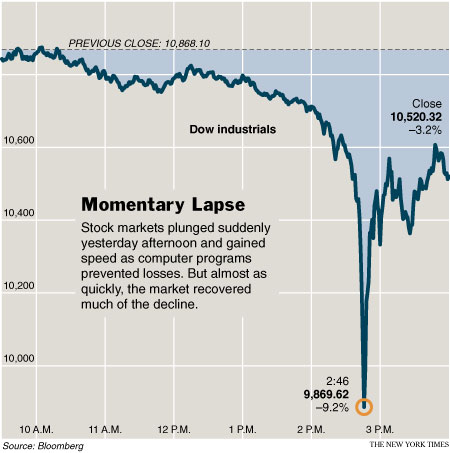

High-Speed Trading Glitch ?

NYT: One official said they identified “a huge, anomalous, unexplained surge in selling, it looks like in Chicago,” about 2:45 p.m....

NYT: One official said they identified “a huge, anomalous, unexplained surge in selling, it looks like in Chicago,” about 2:45 p.m....

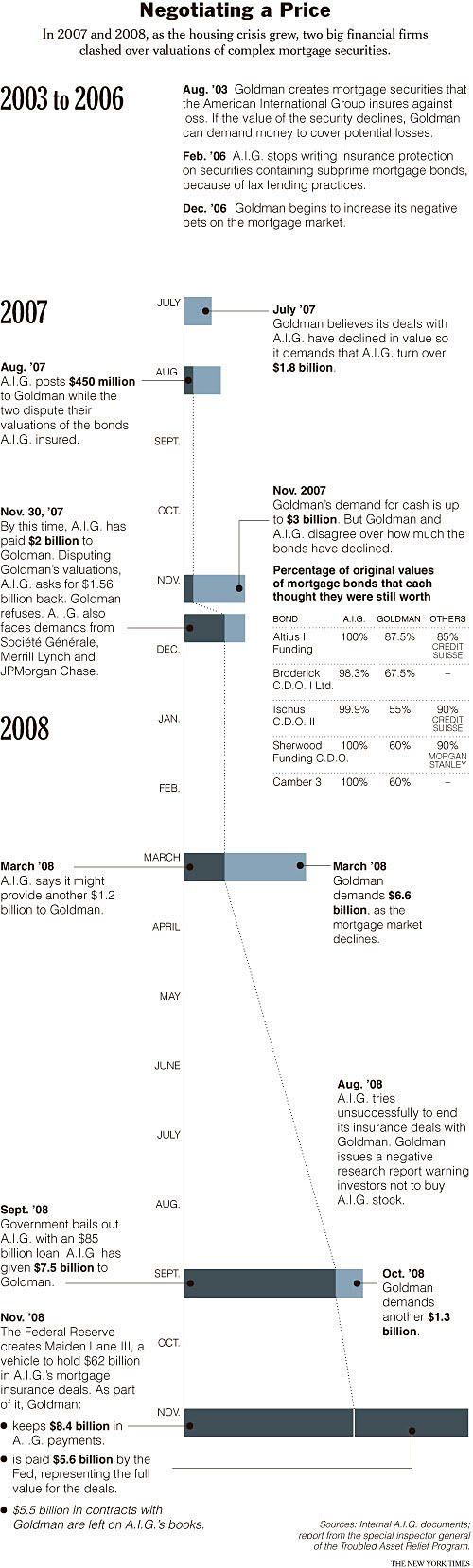

AIG Fires Goldman Sachs (Payback is a Bitch)

The NYT is reporting that A.I.G. has dismissed Goldman Sachs as an advisor: “A.I.G., the insurance giant that planned to retain...

The NYT is reporting that A.I.G. has dismissed Goldman Sachs as an advisor: “A.I.G., the insurance giant that planned to retain...

Art Cashin on NYSE, Cancelled Orders

Art Cashin is head of floor operations at UBS. He has been reporting from the trenches for decades, and puts out daily color on the...

“Bonds are for Losers” Revisited

When Dave Rosenberg and Jim Grant squared off for a debate — dubbed “Bonds are for Losers” — in late March, the...

April Payrolls solid but old news?

Payrolls were strong, rising 290k, 100k above estimates and the private sector saw a gain of 231k, 131k higher than expected. The 2 prior...

NFP = +290,000

BLS: Nonfarm payroll employment rose by 290,000 in April, the unemployment rate edged up to 9.9 percent, and the labor force increased...

European parliaments move to pass Greek bailout

While expected, the 6am release that the German lower house of parliament (upper votes later) voted overwhelmingly for the Greek aid...

Big NFP Data Coming ?

While we await a better understanding if exactly what happened yesterday, let’s remember that today is a NFP day. March...

Do Not Press THIS Button

Prior to yesterday’s 15 minute 700 point whoosh, US markets were downover 3%. The losses — briefly — tripled. This is...

Prior to yesterday’s 15 minute 700 point whoosh, US markets were downover 3%. The losses — briefly — tripled. This is...