Criminal Probe into Goldman Sachs

Bloomberg gives a fair and balanced picture of the criminal investigation: “The federal review, which lawyers say is common in such...

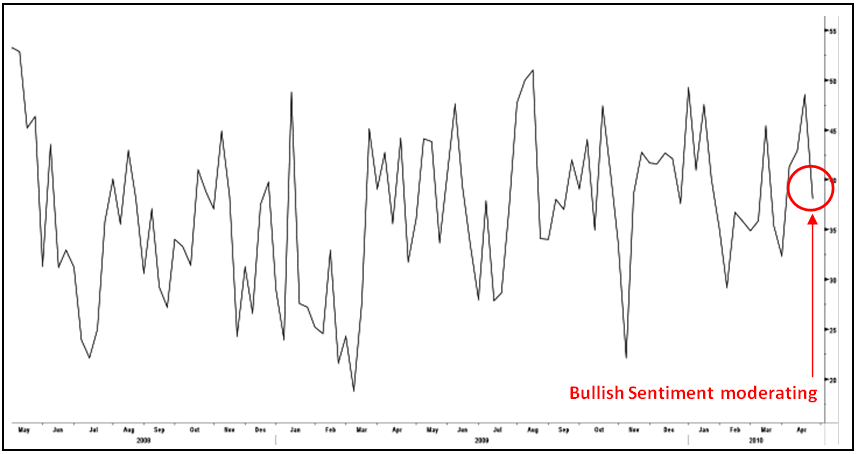

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

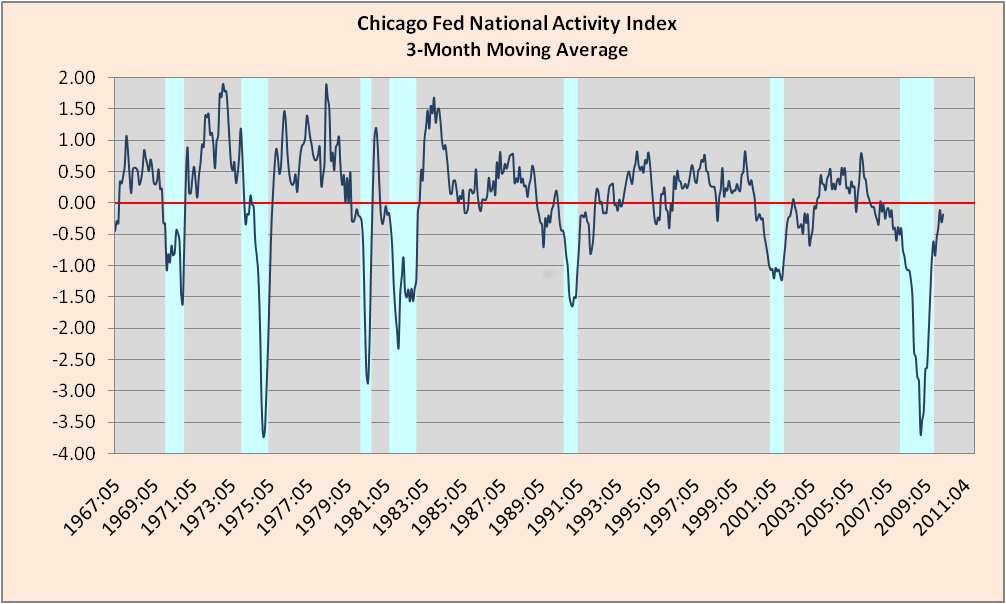

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...

Get subscriber-only insights and news delivered by Barry every two weeks.