With the end of the week fast approaching, these are the items I am reading: • John Gapper: Time to rein in the rating agencies (FT)...

Read More

The attachment is a detailed description along with some incredible photographs of the Deepwater Horizon oil drilling platform that...

Read More

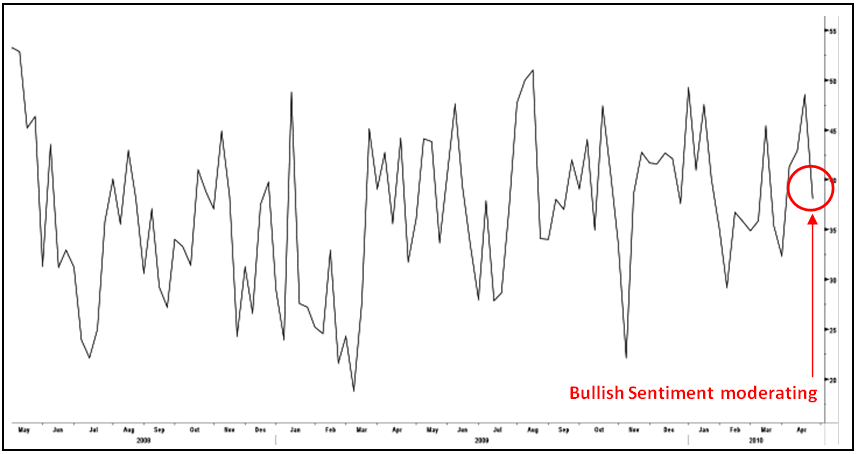

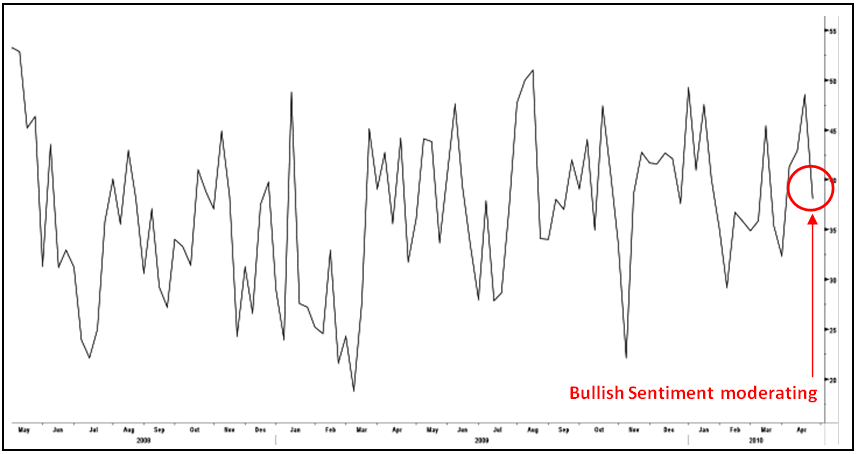

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

Read More

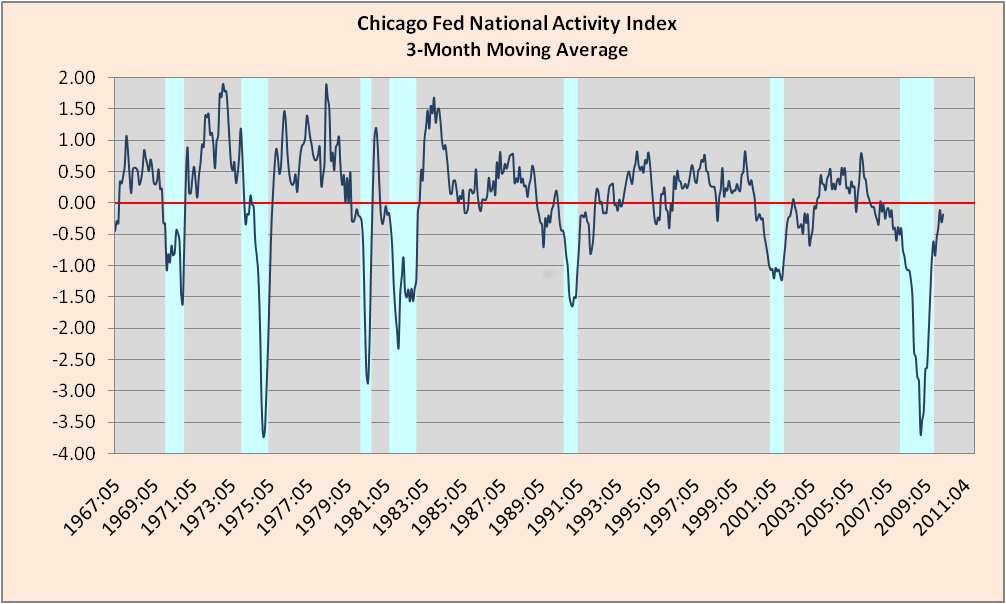

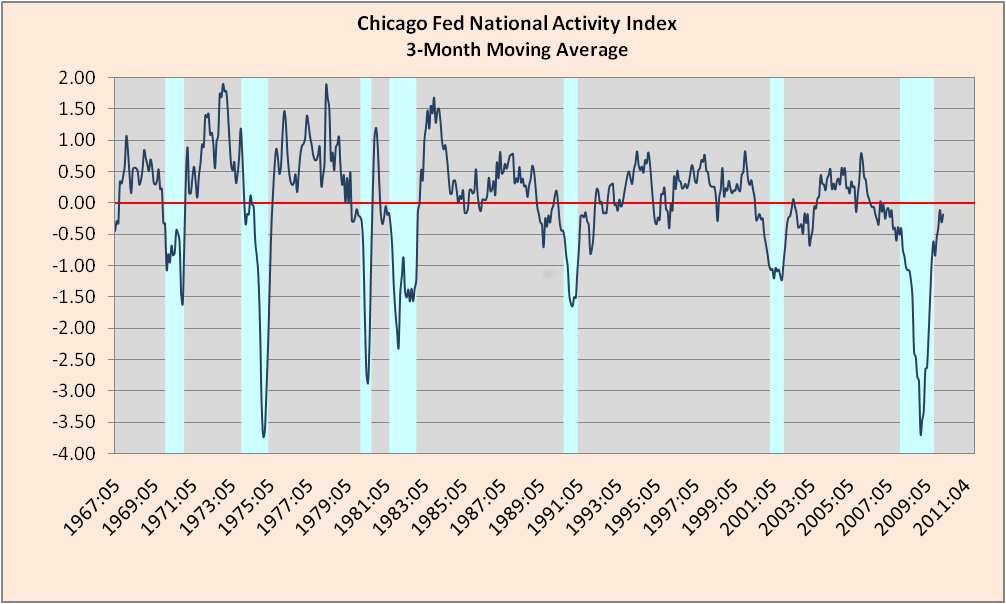

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...

Read More

The winning trade for the past 6 months has been short the Euro/long the Dollar. Very few traders and strategists seemed to have gotten...

Read More

Bond Markets, Greece, The Fed & The ECB April 28, 2010 David R. Kotok, Cumberland Advisors The shock from Greek debt pricing and...

Read More

An expected EC/IMF deal for Greece by the weekend has Greek bonds rallying and is giving a lift to all the European markets. As with any...

Read More

It is time to take a big picture look at everything: This is a summation of everything we have discussed over the past month and quarter....

Read More

Good Evening: After being thoroughly drubbed on Tuesday, U.S. stocks managed a bit of a comeback on Wednesday. Today’s rally was...

Read More

Wow, great new review of Bailout Nation in GQ: “If you read nothing else about money, read [this}: There has been no shortage of...

Read More

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

Last week we showed the AAII allocation survey. Several readers pointed out that the Bullish Sentiment Survey was “heating...

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...

The Chicago Fed’s National Activity Index (CFNAI) — the best economic indicator you’ve never heard of — printed...