Economic data

March PPI rose .7% m/o/m, .2% above expectations but the core rate was in line, up .1%. Food prices rose 2.4% m/o/m while energy prices...

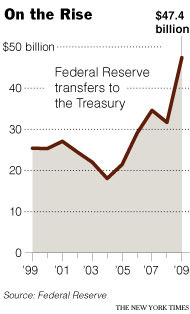

Its good to be the central bank: “The Federal Reserve transferred $47.4 billion, a record sum, to the Treasury Department last...

Its good to be the central bank: “The Federal Reserve transferred $47.4 billion, a record sum, to the Treasury Department last...

Professor Mark Perry, at his Carpe Diem blog, posted an excerpt from a lengthy story by Steven Malanga about how unions have essentially...

Professor Mark Perry, at his Carpe Diem blog, posted an excerpt from a lengthy story by Steven Malanga about how unions have essentially...

Get subscriber-only insights and news delivered by Barry every two weeks.