John McCain on Shorting, Default Swaps, TBTF

Wait for it . . . John McCain isn’t selling his soul for political gain — he’s driving down its price so he can make a...

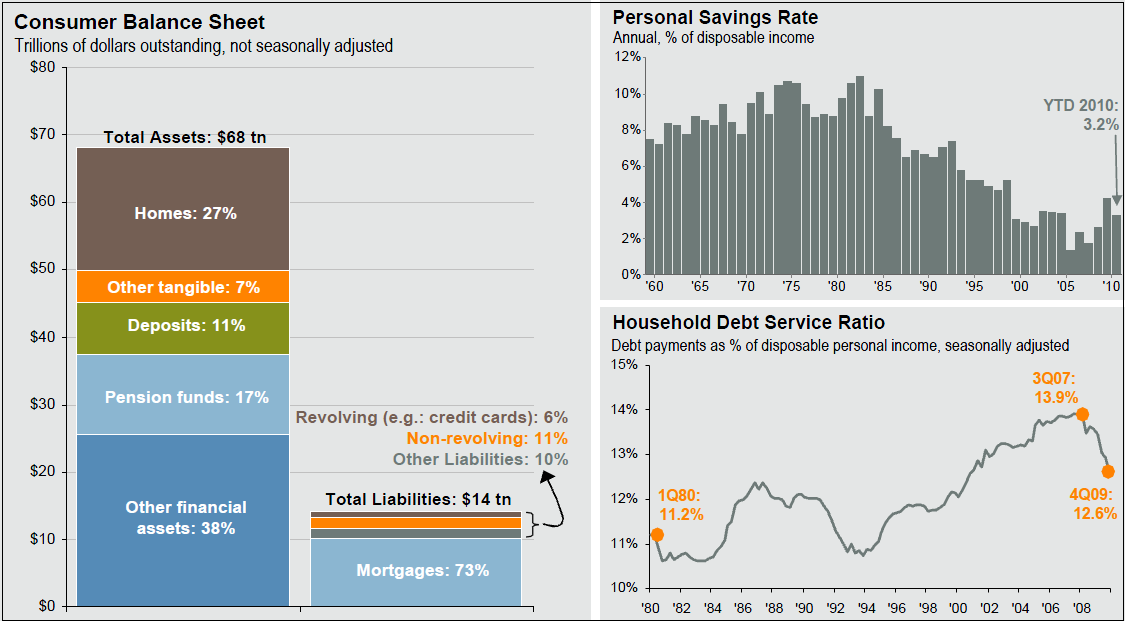

As per our prior discussion, let’s take a look at a nice set of charts showing the present state of Consumer Finances (all data...

As per our prior discussion, let’s take a look at a nice set of charts showing the present state of Consumer Finances (all data...

> Today’s must read(s) comes to us via two separate WSJ articles — one about Goldie, and the other about JPM’s Jamie...

> Today’s must read(s) comes to us via two separate WSJ articles — one about Goldie, and the other about JPM’s Jamie...

Get subscriber-only insights and news delivered by Barry every two weeks.