Sonar by Renaud Hallée: What Music Should Look Like

Fascinating musical info-driven animation called Sonar from Renaud Hallée. I found it both mesmerizing and relaxing . . . You can see a...

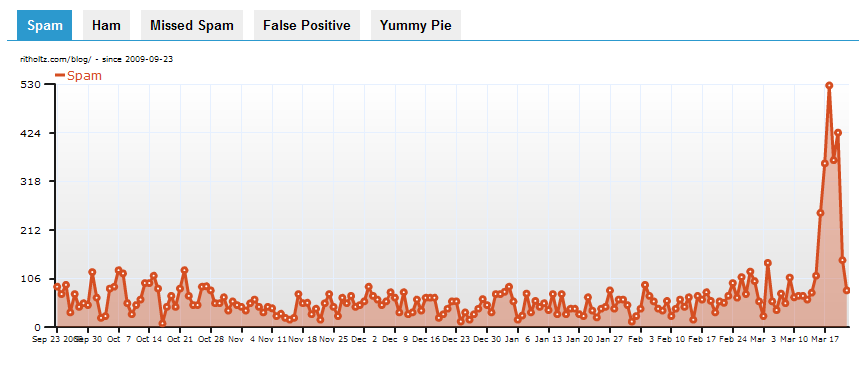

Last week, I noted the mass of trackback spam. The cause seems to be an auto generated “Related Content from the Web” add on...

Last week, I noted the mass of trackback spam. The cause seems to be an auto generated “Related Content from the Web” add on...

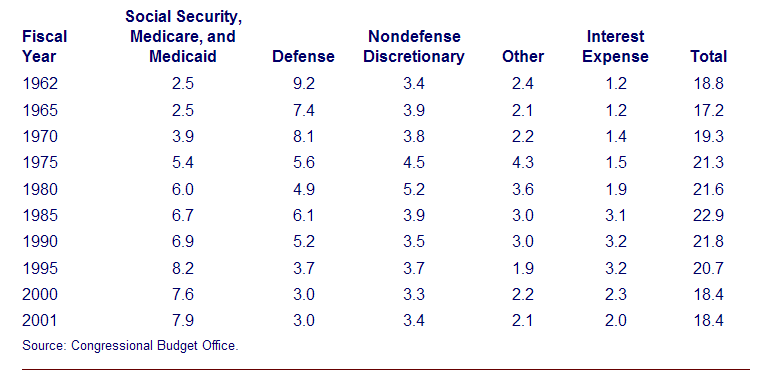

Peter Boockvar dug up these fascinating charts from this CBO report from 2002. What really surprised me is how consistent the US economy...

Peter Boockvar dug up these fascinating charts from this CBO report from 2002. What really surprised me is how consistent the US economy...

Get subscriber-only insights and news delivered by Barry every two weeks.