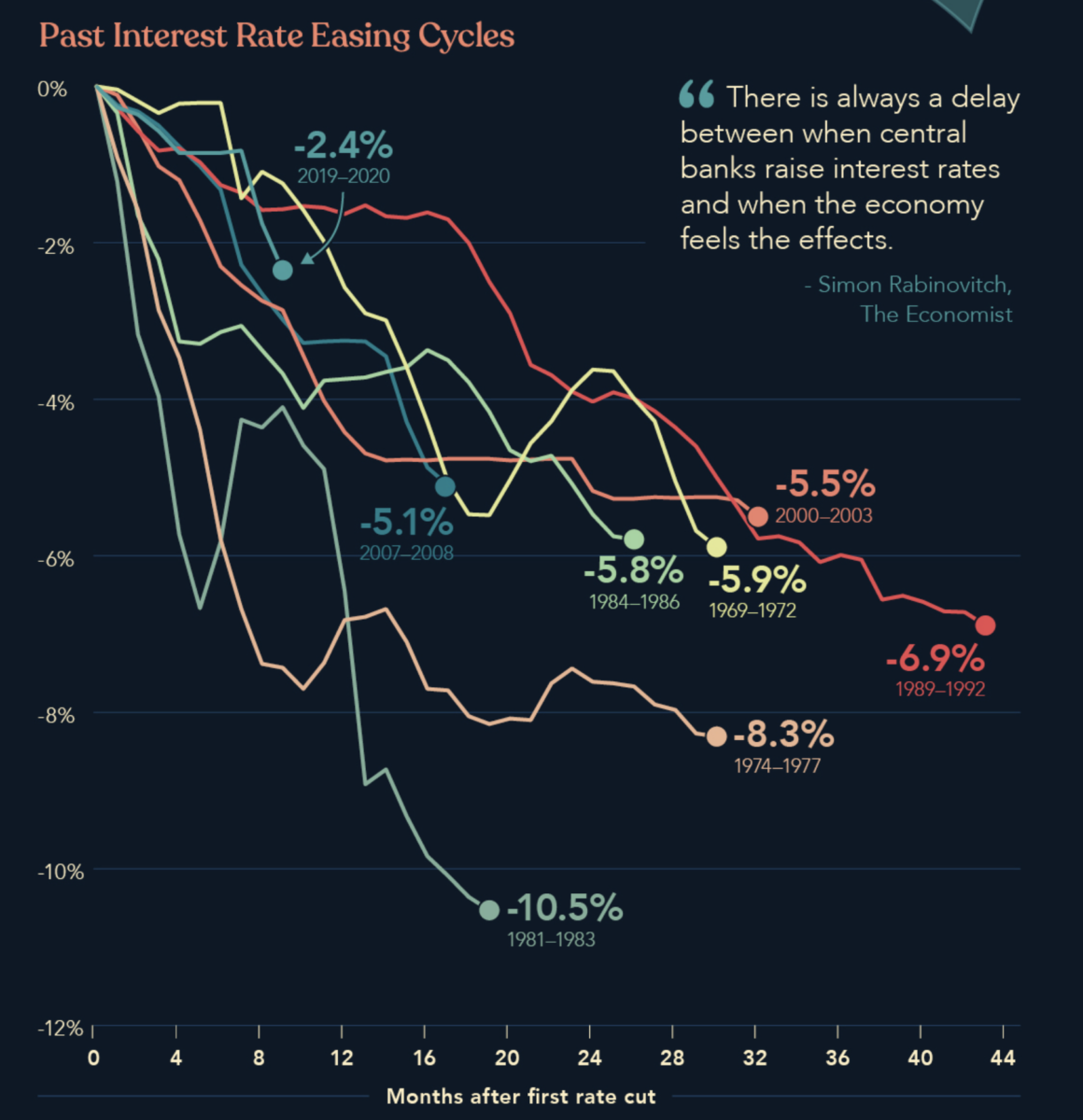

At the Money: How To Know When The Fed Will Cut

At the Money: How To Know When The Fed Will Cut with Jim Bianco (March 13, 2024) Markets have been waiting for the Federal...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Behind the doors of a Chinese hacking...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Behind the doors of a Chinese hacking...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • The Errors Tour: How the Pros Bungled the...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • The Errors Tour: How the Pros Bungled the...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

Get subscriber-only insights and news delivered by Barry every two weeks.