Transcript: Andrew Slimmon, Morgan Stanley Investment Management

Transcript: The transcript from this week’s MiB: Andrew Slimmon, Morgan Stanley Investment Management, is below....

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Google reneged on the monopolistic bargain:...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Google reneged on the monopolistic bargain:...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • How...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • How...

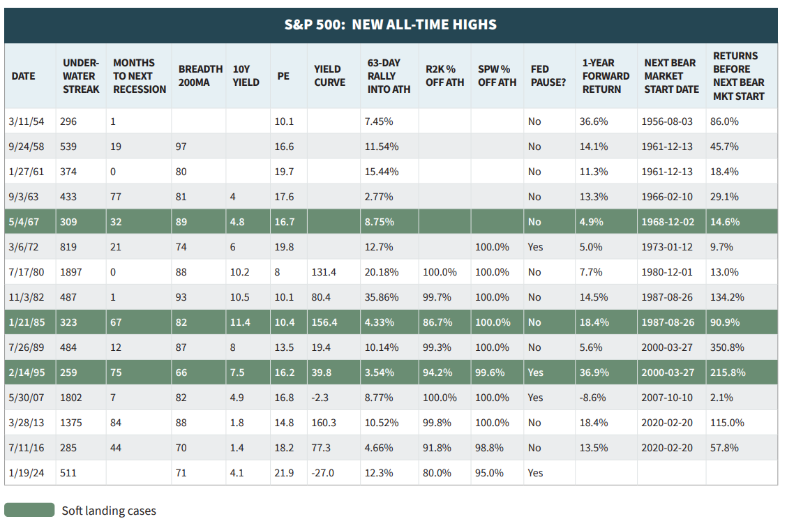

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Palm Beach Is Having a Category 5 Identity...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Palm Beach Is Having a Category 5 Identity...

Over the past few years, my automotive focus has been drawn from achingly beautiful classic cars, toward something newer:...

Over the past few years, my automotive focus has been drawn from achingly beautiful classic cars, toward something newer:...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

Get subscriber-only insights and news delivered by Barry every two weeks.