The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

Read More

This week, we speak with Bill Dudley, former president and chief executive officer of the Federal Reserve Bank of...

Read More

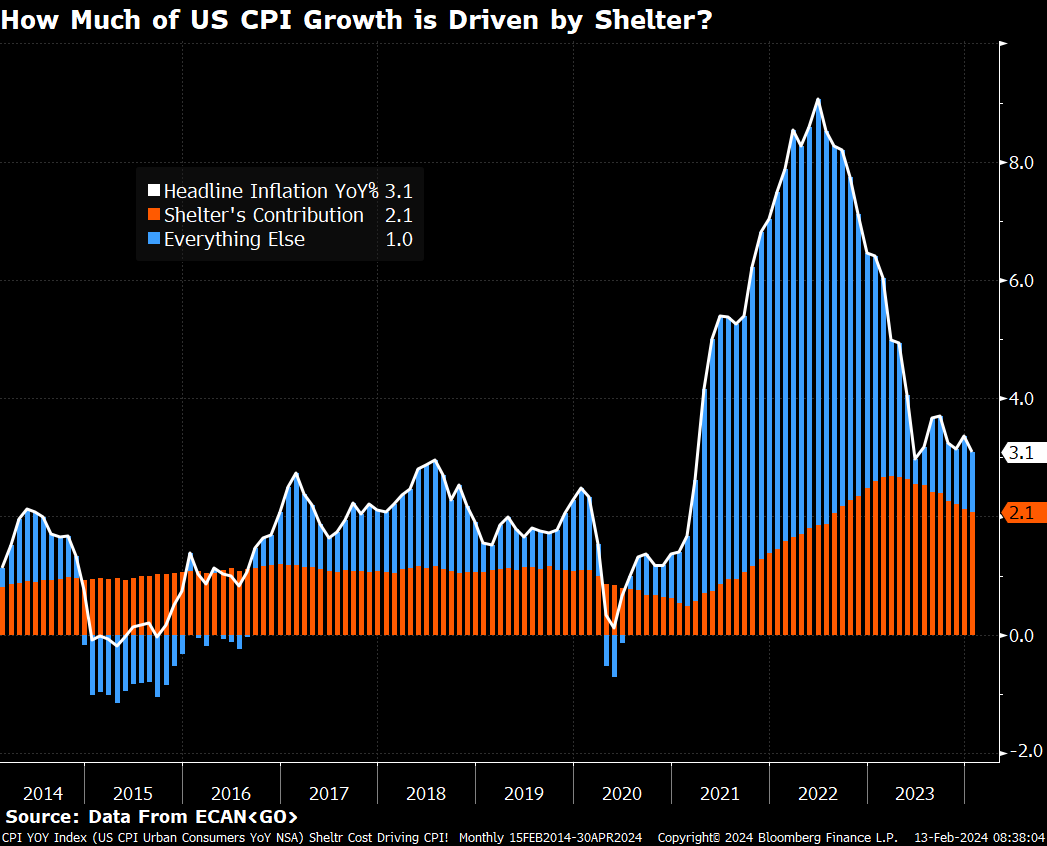

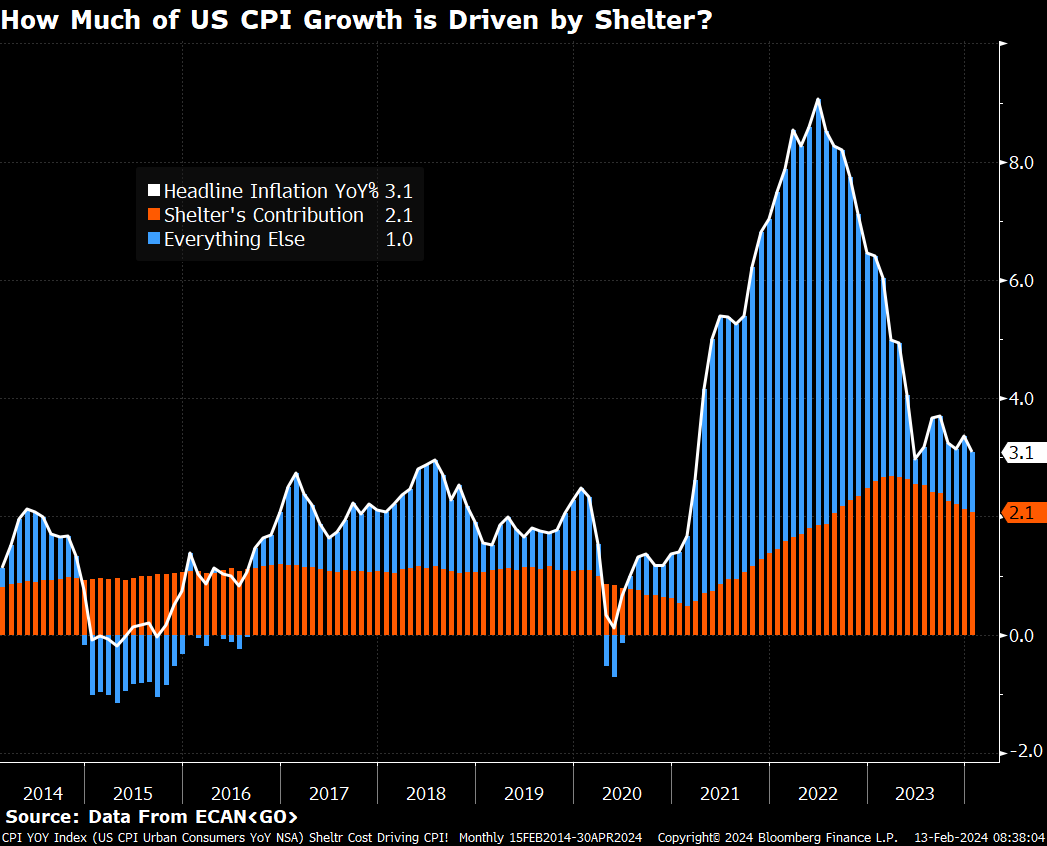

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent...

Read More

At the Money: Is War Good for Markets? (February 14, 2024) What does history tell us about how war impacts the stock...

Read More

The transcript from this week’s, MiB: David Einhorn, Greenlight Capital, is below. You can stream and download our...

Read More

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Over Three Decades, Tech Obliterated Media:...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Over Three Decades, Tech Obliterated Media:...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • A Cycle...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • A Cycle...

Read More

Hey, I am heading up to Boston today for the annual MIT Sloan Investment Conference. Its’ always a fascinating time (I...

Hey, I am heading up to Boston today for the annual MIT Sloan Investment Conference. Its’ always a fascinating time (I...

Read More

This week, we speak with David Einhorn. president of Greenlight Capital. He launched the value-oriented...

Read More

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. (February 7, 2024) How much you pay...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • NFL...