The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...

Read More

This week, we speak with Sarah Kirshbaum Levy, chief executive officer of Betterment, an independent digital investment...

Read More

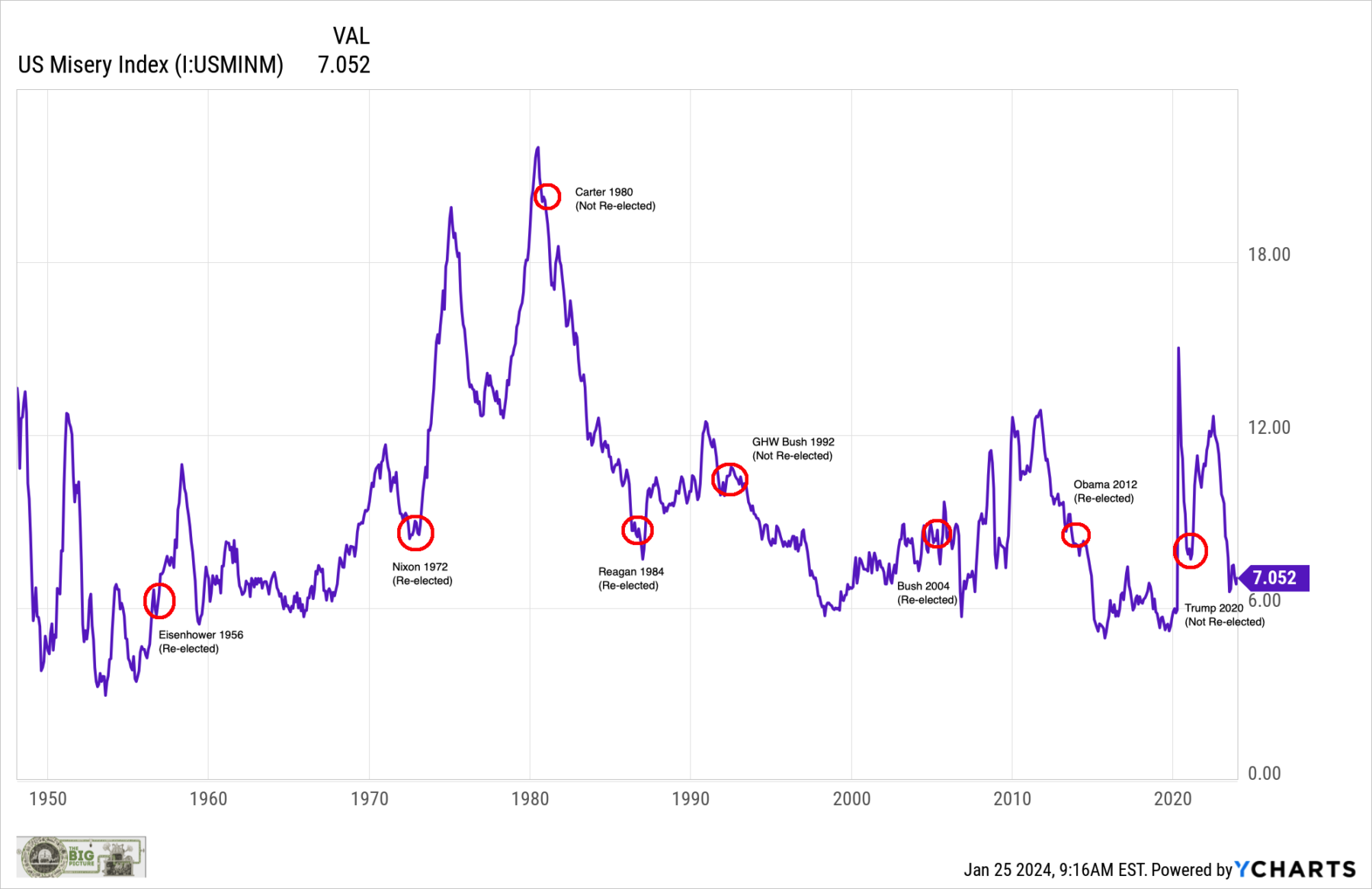

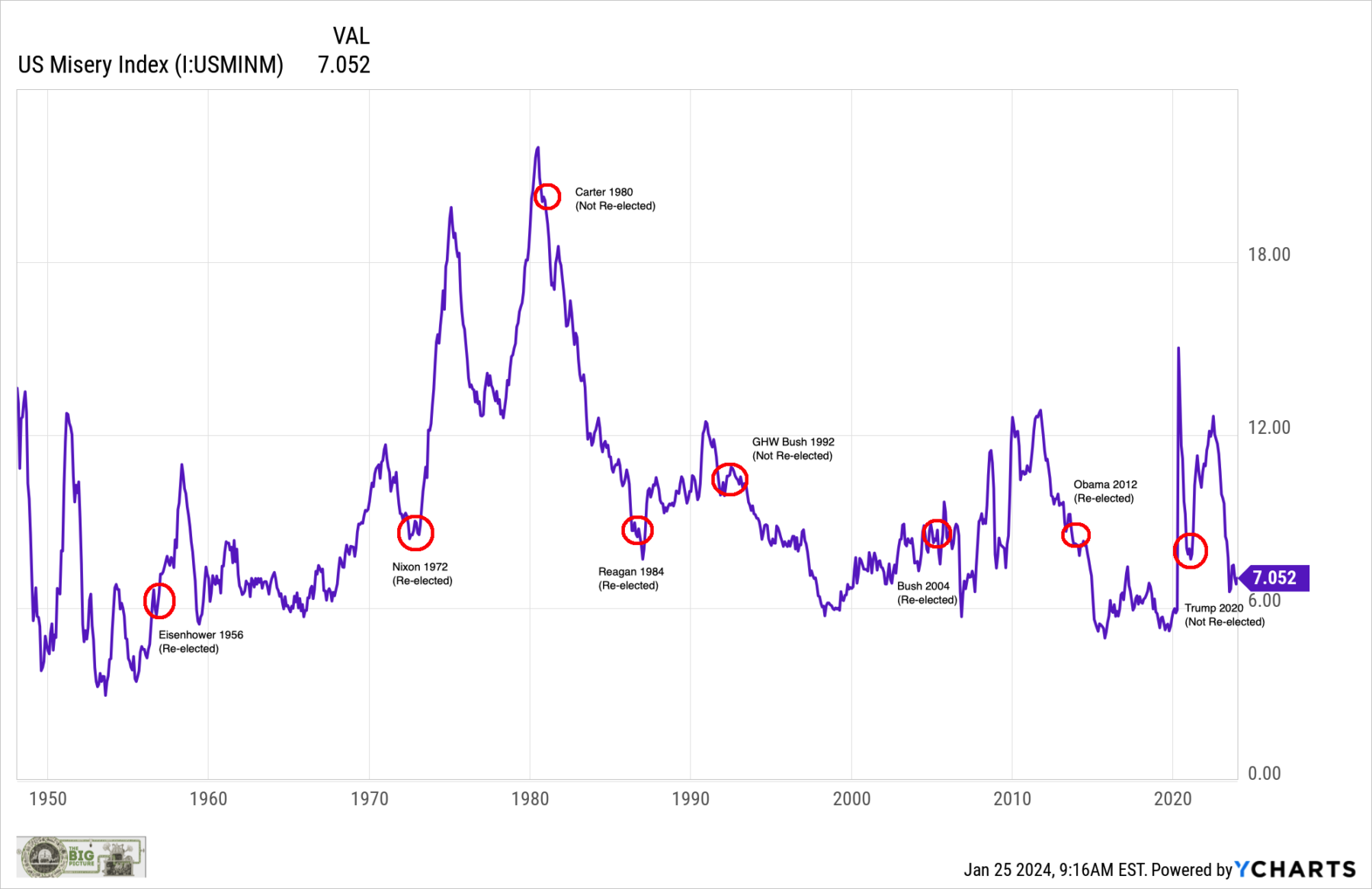

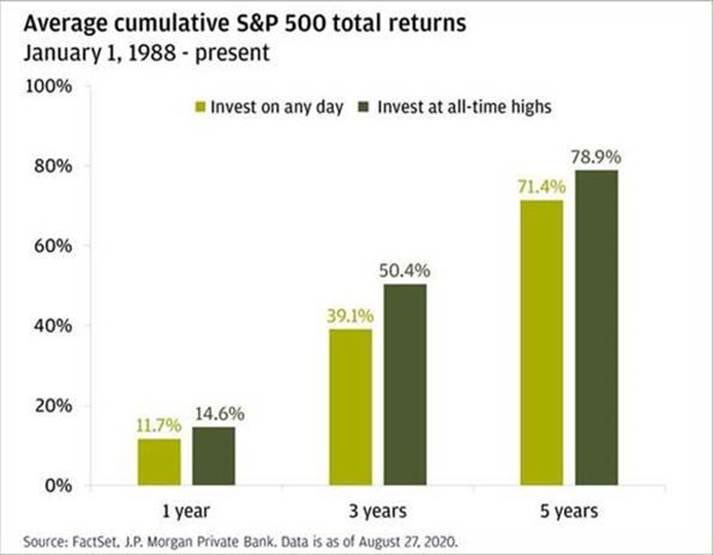

The endless media Sturm und drang over the 2024 election silly season has led me to share a few thoughts and a chart. I...

The endless media Sturm und drang over the 2024 election silly season has led me to share a few thoughts and a chart. I...

Read More

At the Money: How to Pay Less Capital Gains Taxes (January 24, 2024) We’re coming up on tax season, after a banner...

Read More

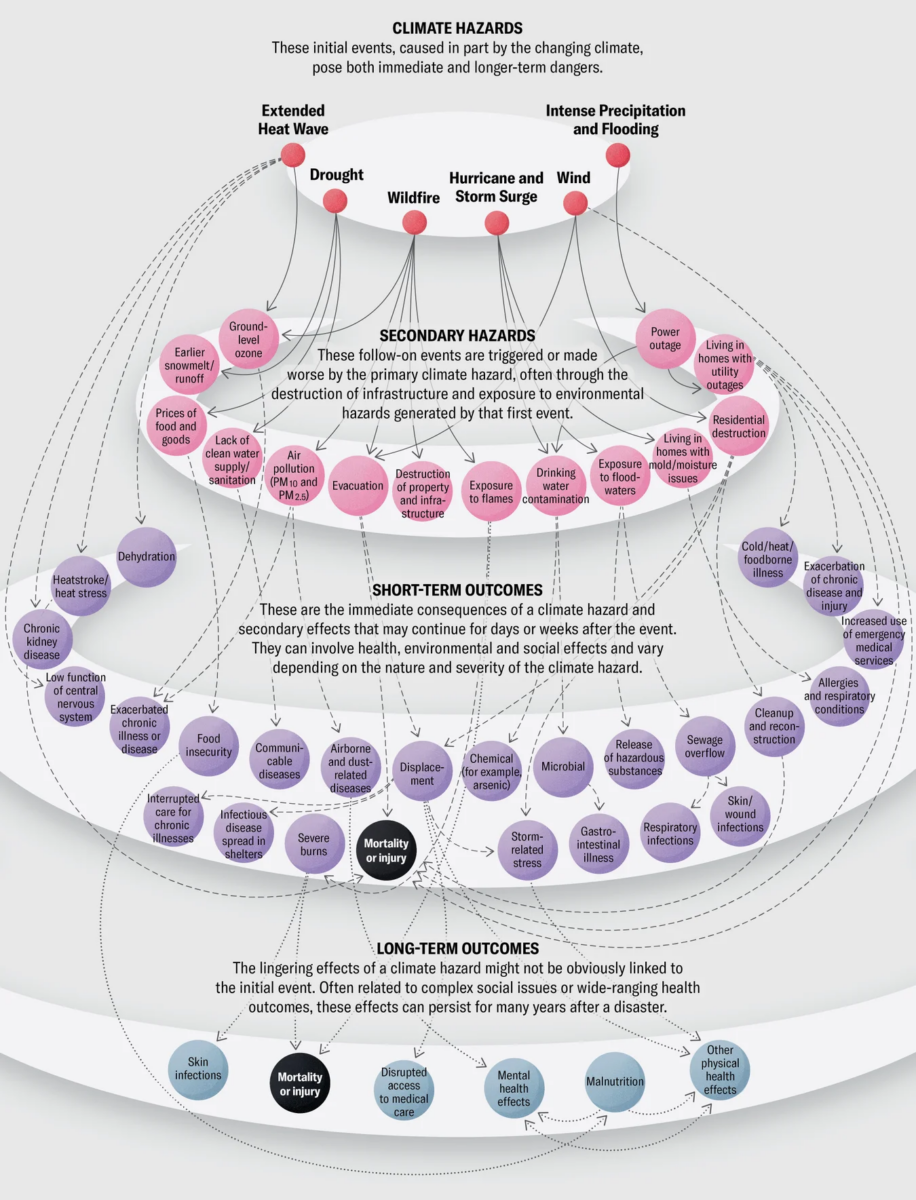

The transcript from this week’s, MiB: Shomik Dutta, Overture Ventures, is below. You can stream and download our...

Read More

Remember Squid Game? Written and directed by Hwang Dong-hyuk, “Squid Game” made its debut on Netflix on September 17, 2001. It...

Remember Squid Game? Written and directed by Hwang Dong-hyuk, “Squid Game” made its debut on Netflix on September 17, 2001. It...

Read More

In May of 2022, I put a deposit down with Moment Motors to convert an ICE car into an EV. The down payment put me into a queue...

In May of 2022, I put a deposit down with Moment Motors to convert an ICE car into an EV. The down payment put me into a queue...

Read More

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Inside the Crime Rings Trafficking Sand:...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Inside the Crime Rings Trafficking Sand:...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

Read More

This week, we speak with Shomik Dutta, founder and managing partner at Overture, a venture capital firm...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • Why...