In the past, I have warned against relying on the magazine cover indicator for specific companies. There are some very specific caveats on this here.

The reason for this is that, in my experience, the Cover Indicator is useful for determining when large social phenomena are reaching an emotional crescendo. Oftentimes, emotions take over at the extremes, as things become either giddy or bleak.

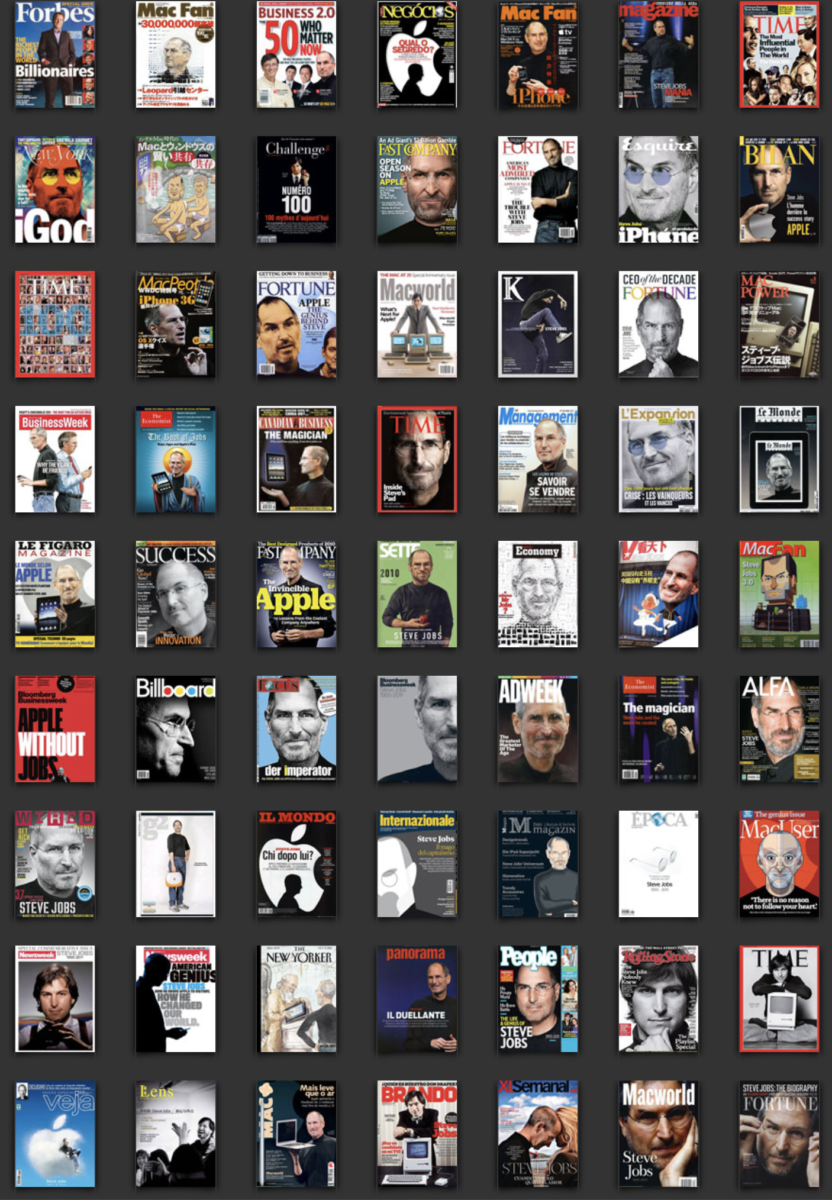

A perfect example of why the Mag cover isn’t appropriate for individual companies is Apple. Check out this collage of 56 covers, as compiled by Kuo Design:

>

What Magazine Cover Indicator?

click for more covers

The CEO of Apple Computer and Pixar Animation Studio on the covers of magazines.

For the entire collection of 56 covers, go here.

So the key question for afficianados of the magazine cover indicator is simply this: Which cover was your sell signal?

The collage above shows why the cover indicator is not really applicable to single companies . . .

>

Source:

The Steve Jobs on Magazine Cover Page

Kuo Design, 2/3/04-1/29/06

http://www.kuodesign.com/pineapple/coverme/index.html

Time magazine appears to be whoring their cover out now… I wonder if Apple donated all that “cool” stuff to them.

Oh yea baby. Gonna tank. I remember the bulls posting how Apple was going to take over the world and how they loved it at eighty something right here on this board just a month or two ago. I didn’t like it then and really hate it now. It is one of the very weakest large cap techs. Apple has undergone serious distribution and it’s joy ride is gonna be one hell of a tumble imo. There’s alot of room below when the E in PE evaporates. Oh, I forgot. The pundits told me Intel’s problems were strictly because of AMD not because of a slow down in sales. Scratch that. I’m sure Apple will go through the roof. With this meteoric rise there is no meaningful support below. Zilch. Till it gets to the bull market fib retracement of 61% which is $38ish.

If it holds there, who knows. That’s like a long ways off. At least a few months. lol.

The consulting firm Booz Allen Hamilton just came out with a research paper supported by S&P data that was geared more towards business investment and strategy. The net net was behavioral economics played a huge role in corporate investments and corporate performance that then translated into stock performance as well.

As it pertains to Apple, a key nugget was that successful business segments in the short term tended to underperform in the long term and it occured just about the time the markets and management started to believe they were invincible. Now I like Jobs alot. And he has as good of chance as any to keep and expand the content mantle but the chances of a hardware guy inserting himself in the middle of the digital content revolution is mighty slim. MP3s sure. The convergence of all forms of digital content? Where the content owners will likely wield tremendous power? Hmmm…..The trend is your friend and Apple’s trend is DOWN. That said, it would be a likely probability we’ll see a bounce from the low $60s.

>>>The collage above shows why the cover indicator is not really applicable to single companies . . .<<< I'm still not sure whether you are right or not. I see your point regarding apple. OTOH, Apple's success was IMO extremely fortuitous and rare. For a company to churn out a billion dollar product and turn it into a fad especially when such a product (mp3 player) had already been on the market for many years is incredibly unique. I would think that there have been many a magazine cover of one hit wonder companies that have flopped, not to mention those during the dot com era. Though, I can't give an example as I don't follow print all to much so maybe my own point is a bit weak. So I get your message, but not sure how strong it is with just an example of Apple.

Seems to be working for me… I’ve been on the short side of AAPL since January, and it’s been one of my most successful trades!

Yeah, I don’t remember Seykota ever suggesting that the Cover Indicator applied to specific companies. Instead, he always spoke about it in relation to major asset classes like oil or gold or stocks. Even so, I agree, it certainly isn’t perfect. But, IMO, it does sometimes point to massive societal Ahas. And I guess as soon as everyone finally ‘gets it,’ i.e. Aha!, well, the move has prolly made most of its big move already.

Brad — could place these covers on a timeline, along with significant events in Apple’s history and a stock-price chart? That might make your point a little bit clearer for the Apple Bears.

Brad? Brad? Someone thinks your name is Brad? As in BRAD PITT? Or is it like the Brad from Rocky Horror Picture Show?

They angloed his name up a bit….

Here’s the deal with Apple… The iPod was the “it” gift this Christmas and it would take a miracle for Apple to repeat that next year.

Apple basically created a whole market for its music players and legal music downloads that never existed before. However, now that AAPL showed the world how to do it, competition will come screaming in from every direction. Pricing will have to come down to stay competitive (which is already happening) and those sweet iPod margins will start to decline. Any softening in demand will compound the pressure.

Also, I’m sure that any Apple entry into the home media and cell phone business will be well recieved, but those areas are already VERY competitive. I really doubt MOT and NOK will let Apple steal their lunch.

Finally, the idea that Apple switching to Intel chips would be a reason to upgrade your Mac is ridiculous. Switching to the faster chips might be a long-term strategic move for Apple, but no one is running to the Apple store for an “Intel upgrade.” It’s just not a compelling enough reason to buy a computer.

Anyway, those were my reasons for jumping on the short side early this year. The market seems to agree on some level.

Interesting housing update:

Minehan: Fed ‘could be wrong’ about housing

If prices fall, impact on economy could be greater than expected

WASHINGTON (MarketWatch) — One of the greatest risks to the U.S. economy is a possible sharp slowdown in the housing market, said Boston Federal Reserve President Cathy Minehan.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7BC3A6E113%2D5C56%2D4FB3%2D84DE%2D7F1B075D48C5%7D&dist=newsfinder&siteid=google&keyword=

Another useful indicator is to monitor the local Goodwill and Salvation Army thrift stores. Look at the donated books. Market highs, I’ve found correspond with bear market books. In 2000, you could find books like Prechter’s At the Crest of the Tidal Wave. Now, just as the Dow approaches a double top, two copies of Prechter’s Conquer the Crash appear on the shelves of my local Goodwill store.

Many of these cover are very, very old. The oldest go back to the early days of apple. They don’t represent a sudden mania.

Just sayin’…

How about

this magazine cover indicator

See the latest BW Cover? OIL on the cover. For those who don’t get BW, which will soon include me, they talk about how the Middle East OPEC nations were smarter this time by investing at home. Uh, no. They simply fueled a speculative fervor. Saudi markets down 25% last week. Whoa!

While I think there is likely money to be made long term in commodities given the nature of the equity markets, the 70s was a yo-yo for commodities and the drops were fast and hard. And just like today’s equity markets being propped up by real estate and commodites, so was the 70s and the whole market cratered when they cratered. Wild moves to and fro. I simply cannot believe the CRB. I have never, ever seen such a bubble in 100 years of charts. That includes three equity bubbles. The CRB is rolling over for the first time since last May which just so happens to be the start of this market run. Copper is off the freaking charts and people are going to get totally crushed because it’s going to collapse. And while I hope not, it very will likely take the economy with it. (Btw, Cramer said on his TV show just a few weeks ago that these stocks had alot further to go.) Bernanke will kill the CRB and that will be how he knows excess liquidity and speculative inflationary pressures have abated.

Individual investors are plowing into energy and commodities with wreckless abandon. We listen to the bullshit artists tell us how it takes ten years for a new copper mine to be built. I guess they haven’t watched copper historically. The biggest copper bubble in over 100 years and every one came down hard and fast regardless of how long it took to dig a new hole in the ground. Oil has appeared to lose its mojo. Crude inventories higher than when oil was $20. Mexico just found the second largest oil field in the world by some estimates. No lack of crude and never was. Just too much liquidity looking for a home when equities weren’t delivering. Will it ultimately be a tanking CRB that craters the market? Those stocks are propping up the market. I still think long term rates are going to motor here. Simply retesting the top of that multi-year down trend line we broke on the ten year bond. Still bearish for bonds. Energy investments and commodity investments say bye bye.

Posted by: B at Mar 20, 2006 6:55:05 PM

is it me, or does steve only own one black turtleneck?

B- You and I must have been separated at birth. My feelings exactly. I have been calling for that CRB rollover for 2 months. Every time it rallies $4, the commodities bulls come charging out saying “It’s back!”. Looks like a classic A B C correction unfolding to me. Same with gold. Oil may be a range trade though as the geopolitical premium button always seems to get pushed every time oil dips to $60bbl. Are the Nigerian rebels on retainer?

My mom told me I had a twin but he was given away at birth. Rumor is he has collected quite a fortune. I think it’s time we re-unite in the spirit of love and giving.

I too expect oil to hang around at higher levels than the cratering days of yore. Maybe $35-40-45. That’s pure guessing. How did all of this oil end up in parts of the world run by hooligans? There is likely some rationale for that. I suppose such piglets sucking on the tit of that oil pig has kept enough money in their coffers to keep many of these countries from transformations into market driven economies.

We have plenty of nukes to eradicate the “hooligans” along with their crummy religion from Hell. Why we don’t do so is beyond me. The day is coming when we’ll wish we had. They’re not interested in market economies – they just want to live back in the seventh century with their mullahs and omars and slit throats every day.

You’ve got to be kidding?! You criticize the “hooligans” with the statement, “they just want to live back in the seventh century with their mullahs and omars and slit throats every day.” But only two sentences earlier you stated that you wanted to nuke and eradicate them from the planet. Isn’t that worse than slitting throats every day? You’re worse than they are…

We have met the enemy and he is us.