In his Washington Post column last week, Fareed Zakaria laid out the argument that Obama is anti-business (Obama’s CEO problem — and ours):

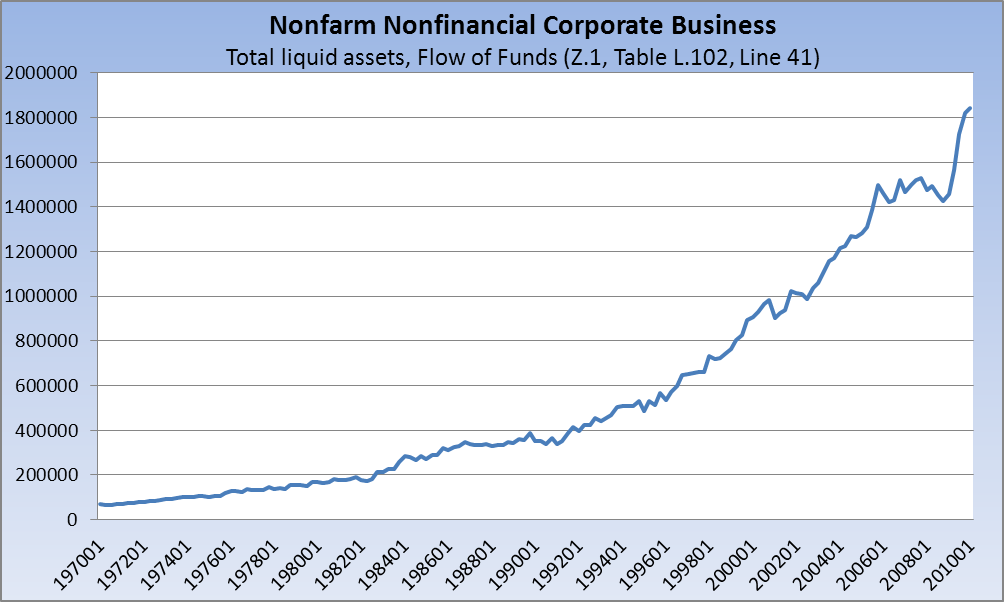

“The Federal Reserve recently reported that America’s 500 largest nonfinancial companies have accumulated an astonishing $1.8 trillion of cash on their balance sheets . . . And yet, most corporations are not spending this money on new plants, equipment, or workers . . . The key to a sustainable recovery and robust economic growth is to get companies to start investing in America. So why are they reluctant, despite having mounds of cash lying around?”

Answers to Zakaria’s questions apparently came from “business leaders” who “wanted to stay off the record, for fear of offending people in Washington.”

“Economic uncertainty was the primary cause of their caution . . . But in addition to economics, they kept talking about politics, about the uncertainty surrounding regulations and taxes . . . But all [the business leaders] think he is, at his core, anti-business.”

First, a look at the series in question:

>

>

For starters, I disagree with Mr. Zakaria’s notion of what the key is to a sustainable recovery. Since we know that Personal Consumption Expenditures comprise 70 percent of GDP, I’m not sure why “getting companies to start investing” would be considered the key. The demand problem we have on our hands is what is keeping companies’ spigots closed.

Further, I would rebut Mr. Zakaria’s findings as follows:

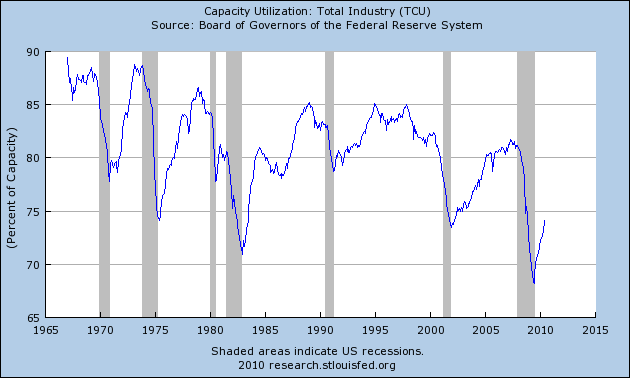

1) Capacity Utilization is still lingering near all-time lows, having just bounced off a record-setting low:

>

>

As Paul Krugman put it in a recent column:

“Ask the Obama-is-scaring-business crowd for some actual evidence supporting their claim, and they’ll tell you that business spending on plant and equipment is at its lowest level, as a share of G.D.P., in 40 years. What they don’t mention is the fact that business investment always falls sharply when the economy is depressed. After all, why should businesses expand their production capacity when they’re not selling enough to use the capacity they already have? And in case you haven’t noticed, we still have a deeply depressed economy.”

Why should businesses invest or expand when 26% of capacity is still sitting idle? What sense would that make?

And what senior management team wouldn’t have thought about improving its company’s liquidity position in late 2008 after reading this little ditty:

“Sept. 22 (Bloomberg) – McDonald’s Corp., the world’s largest restaurant company, told some U.S. franchisees to seek other ways to finance store improvements after Bank of America Corp. declined to increase lending.

Store owners have exhausted financing used to pay for upgrades and equipment to make lattes and espressos, and Bank of America won’t provide more money as it works on the planned purchase of Merrill Lynch & Co., McDonald’s said in a memo that was obtained by Bloomberg News.”

And when was the recent trough in corporations’ total liquid assets? Uh, that would be the fourth quarter of 2008 — just after stories like the one above were peppered throughout the news.

Perhaps most significant, in my opinion, is that the reason we’ve still got so much idle capacity is that there is no demand in the system to begin to seriously ratchet it down. This is easily the weakest recovery on record in terms of Final Sales of Domestic Product — and this chart is probably the crux of this post and, frankly, goes a long way toward explaining why this recovery isn’t feeling like a recovery:

>

Source data: BEA.gov, Table 1.2.1, Line 2

>

Any CEO who looked at the chart above and decided to forge on with a bold capex plan would probably be replaced in short order. Worse still, we’re apparently still in job-shedding mode, as Wells Fargo recently announced it was laying off 3,800 employees and Merck announced it will trim its workforce by 15 percent. This hardly speaks to an environment in which companies would be “spending…money on new plants, equipment, or workers.” Exactly the opposite, apparently. As Richard Eskow puts it at the Huffington Post: “Their problem isn’t politics — it’s customers. As in, they don’t have any.”

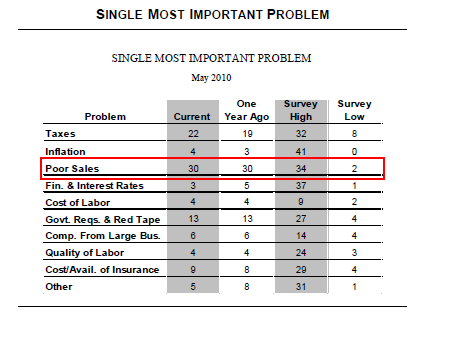

Finally, despite what Mr. Zakaria is hearing from large company brass, we know from National Federation of Independent Business — The Voice of Small Business — that “Poor Sales” is their number one problem, by a long shot, easily eclipsing government regulations. Here is how the NFIB’s “Single Biggest Problem” table looked through May:

>

You’ll note that Poor Sales were at 30 one year ago, and remain there now. “Govt Regulations and Red Tape” were at 13 one year ago and remain there now. Taxes were at 19 one year ago and have ticked up to 22. So there have been no changes in the rank of these three problems from the year ago snapshot; they rank today as they ranked then.

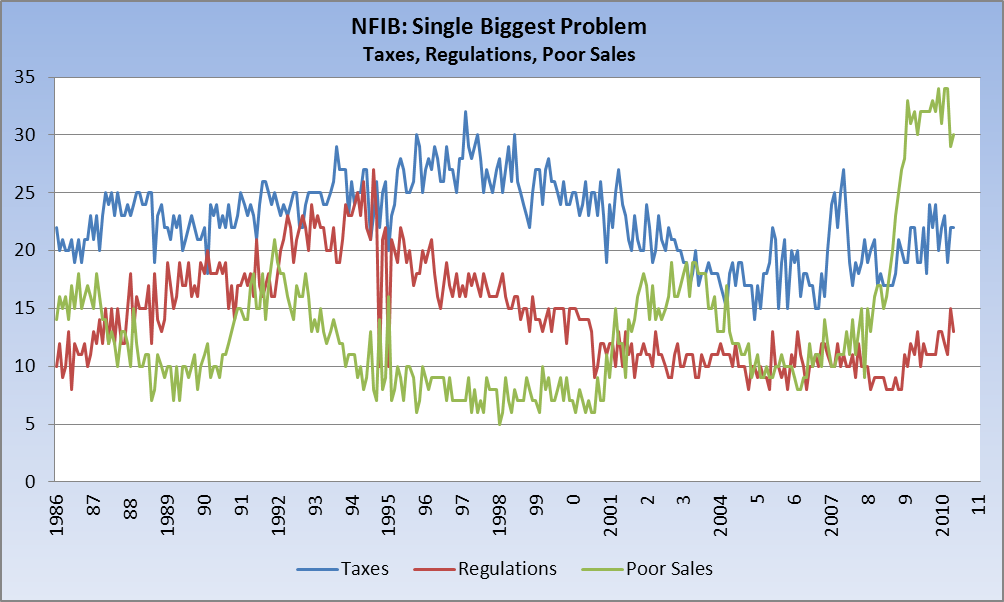

And here is how the problems cited by Mr. Zakaria — taxes and regulations — look over time compared to poor sales:

>

>

I’ll readily stipulate that large businesses and small businesses have both their similarities and their differences. But I have a hard time believing that those differences are so great that larger companies’ biggest concerns are taxes and regulations while small companies are worried about poor sales.

As earnings season gets revved up, we’ll begin to see what’s what, and comps are going to start getting harder in the quarters to come. And the NFIB’s most recent report is due out this week, though the tease for it was somewhat ominous:

“Overall, the job creation picture is still bleak.”

But let’s hear what an expert — Federal Reserve Governor Kevin Warsh — has to say about the buildup in corporate cash:

“A striking feature of this economic expansion has been a dramatic expansion in cash accumulation by corporations. Profit margins have jumped dramatically to the highest levels in decades, largely as a result of efficiency and productivity gains that have strongly outpaced compensation growth. Accordingly, ratios of cash to assets have risen sharply, and ratios of cash to investment have risen from around 60 percent in the past to 150 percent…”

Oh, wait. What’s that you say? That quote is from 2006, when anti-business Bush was in office? Oops. My bad. I guess taxes and regulations were on the minds of CEOs during that buildup, too.

And I’ll leave alone for now the ongoing contraction in consumer credit — along with the ongoing reluctance of financial institutions to lend — that contributes to our inability to gain real traction.

So, we can blame the president for the $1.8 trillion pile of cash that corporate America is sitting on, or we can look at the facts, do a little research and take with a grain of salt what anonymous CEOs whisper into the ear of one of their stenographers.

>

Source:

Obama’s CEO problem — and ours

Fareed Zakaria

Washington Post, July 5, 2010 http://www.washingtonpost.com/wp-dyn/content/article/2010/07/04/AR2010070403856.html

What's been said:

Discussions found on the web: