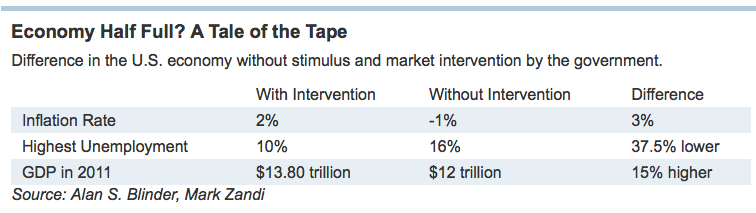

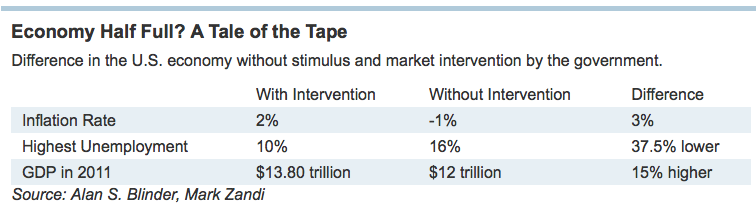

Earlier this month, I discussed a NYT OpEd by Treasury Secretary Tim Geithner (Welcome to My Job Security). Geithner pointed approvingly to the report released by Alan Blinder and Mark Zandi, advisers to President Bill Clinton and Senator John McCain, respectively:

“The combined actions since the fall of 2007 of the Federal Reserve, the White House and Congress helped save 8.5 million jobs and increased gross domestic product by 6.5 percent relative to what would have happened had we done nothing.” (emphasis added).

I did not have cause to disagree with the Blinder/Zandi numbers; they are best guesses using Moody’s econometric modeling. However, I did criticize their overall approach, saying: “That is now our standard — what was done versus doing nothing? That is truly the wrong counter-factual…”

David Weidner took issue with that assessment. In his column A Nation That Won’t Be Fooled Again, he noted:

“The financial crisis and stagnant economy have made us bitter. We’ve become a nation of complainers and critics. Nothing is ever good enough for us. The bailouts are misguided. The stimulus didn’t work or wasn’t enough. Reform is too weak or makes matters worse. It’s one thing to call the glass half empty, but these days we deny the existence of tableware.”

I don’t disagree with Weidner’s perspective. Many people have gone off the deep end, obsessing with “recession porn,” seemingly addicted to negative commentary and wild conspiracy theories.

>

>

My disagreement with the Zandi-Blinder report is not its theoretical underpinnings — it is by definition a hypothetical counter-factual. Rather, it is the counter-factual Blinder/Zandi chose to use: “What would the economy look like now if we had done nothing?”

Instead, I propose a better counter-factual: “What if we had done the right thing, instead of nothing — or the wrong thing?”

A quick definition first: The term “counter-factual” is a term of art often misunderstood. The definition of counter-factual is a “what-if” — counter-factuals explore historical incidents by extrapolating an alternative time line:

-What-if Chrysler was not bailed out in 1980?

-What-if JPM was not guaranteed $29B of Bear’s liabilities?

-What if Citi and BofA were put into reorg/receivership?

-What if AIG’s counter-parties were not made whole 100 cents on the dollar?

We don’t have alternative universe laboratories to run control bailout experiments, but we can imagine the alternative outcomes if different actions were taken.

So let’s do just that. Imagine a nation in the midst of an economic crisis, circa September-December 2008. Only this time, there are key differences: 1) A President who understood Capitalism requires insolvent firms to suffer failure (as opposed to a lame duck running out the clock); 2) A Treasury Secretary who was not a former Goldman Sachs CEO, with a misguided sympathy for Wall Street firms at risk of failure (as opposed to overseeing the greatest wealth transfer in human history); 3) A Federal Reserve Chairman who understood the limits of the Federal Reserve (versus a massive expansion of its power and balance sheet).

In my counter factual, the bailouts did not occur. Instead of the Japanese model, the US government went the Swedish route of banking crises: They stepped in with temporary nationalizations, prepackaged bankruptcies, and financial reorganizations; banks write down all of their bad debt, they sell off the paper. Int he end, the goal is to spin out clean, well financed, toxic-asset-free banks into the public markets.

Thus, Bear Stearns is not bailed out by the Fed. Instead, the FOMC chair tells JP Morgan’s CEO “You have 9 trillion dollars in exposure to Bear derivatives. Instead of guaranteeing you $29 billion for a risk free takeover, we will start preparing a liquidation plan for Bear. And given your exposure to them, we best plan one for JPM too. (and if you don’t like that, you can kiss our ass).”

Tough talk, but the outcome would have been much better: JPM would likely have bought Bear anyway, if for no other reason than to prevent someone else from buying them, and forcing JPM into bankruptcy, to pick up their assets for pennies on the dollar. That would have set a much better tone for future bailout expectations, versus the massive moral hazard the Fed created with the Bear bailout.

Lehman? Prepackaged bankruptcy, less disruptive.

AIG ? There never was an implicit government guarantee that all counter-parties dealing with AIG-Financial Products — a giant leveraged structured finance hedge fund hiding under the skirt of the regulated insurer — would be made whole. But the Bush/Paulson/Bernanke bailout created one. Instead, AIG-FP should have been carved out for dissolution/wind down, while the insurer could have continued to exist on its own. AIG would have had the liability for the government’s costs, but the counter parties? They would have gotten zero. If you go to Vegas and shoot craps in the alley way behind the casino, don’t expect the gaming commission to collect your winnings. But that is what we did with AIG.

Fannie & Freddie: Two more crappy banks that should have been wound down. These were publicly traded companies that were guaranteed lower interest rates — not an infinite backing from taxpayers. They should have been wound down like all any insolvent bank. Today, they serve as the mechanism for backdoor bailouts of the rest of the wounded banking sector.

The same approach should have occurred with the rest of the crowd of irresponsible banks, investment houses, monoline insurers, etc. One by one, we should have put each insolvent bank into receivership, cleaned up the balance sheer, sold off the bad debts for 15-50 cents on the dollar, fired the management, wiped out the shareholders, and spun out the proceeds, with the bondholders taking the haircut, and the taxpayers on the hook for precisely zero dollars. Citi, Bank of America, Wamu, Wachovia, Countrywide, Lehman, Merrill, Morgan, etc. all of them should have been handled this way.

The net result of this would have been more turmoil, lower stock prices, and a sharper, but much shorter economic contraction. It would have been painful and disruptive — like emergency surgery is — but its better than an exploded appendix.

And today, we would have a much healthier economy:

• Functioning Banking System: Clean banks not laden with bad paper would be actually making loans to qualified borrowers;

• Healthier Housing Sector: An unsubsidized real estate sector — no tax credits to first time buyers, no ultra low interest rates — would have had much lower prices, with far less bad mortgages floating around. We would be much further along in the foreclosure process. More of the folks who bought more house than they could afford would have moved into homes they can afford;

• Much Smaller Federal Deficits: The trillions of dollars of bailout costs on the books of Uncle Sam would not exist. Not he Tarp, not the government guarantees, not the GSEs, none of it.

• Right-sized Finance Sector: Instead of an outsized banking sector, finance in the US would be more proportional relative to the overall economy. Resources and assets (including programmers, quants, and engineers) would go to more appropriate firms.

• Bond holders Lose: Here is an insane idea: If you lend money to a firm that goes out of business, you lose most of that money (You do get a high priority in the liquidation). The US Taxpayer does not step in to guarantee the loss. Crazy, I know, but it is crazy enough that it just might work!

• Counter-parties Lose: See above

• Managements Lose: It seems that for the most part, most of the upper level bankers who helped bring about the crisis are still working for the same banks. A study found that “92% of the management and directors of the top 17 recipients of TARP funds” are still working for the same banks. Reorg would have caused these people to be fired; perhaps the bankruptcy judges would have clawed back some of the execs ill gotten gains.

• Moral Hazard: Bankers expectations that they can behave recklessly because Uncle Sam will bail them out, is dramatically reduced.

While we certainly can compare what was done with doing nothing, the proper counter-factual is to compare what was done with what should have been done.

Throwing trillions of dollars at the crisis, and hoping for the best will provide a short term improvement over doing nothing; trillions of dollars have that sort of power.

The proper comparison, however, should be versus what should have been done. Performing that analysis leads one to a very different set of conclusions . . .

>

>

Sources:

Perhaps, It’s Time to Play Offense

DAVID LEONHARDT

NYT: September 16, 2008

http://www.nytimes.com/2008/09/17/business/17leonhardt.html

A Nation That Won’t Be Fooled Again

David Weidner

WSJ, AUGUST 12, 2010

http://online.wsj.com/article/SB10001424052748704901104575424332141218568.html

Previously:

Banking Sector Remains (literally) Unchanged (January 4th, 2010, 10)

Welcome to My Job Security (August 3rd, 2010)

Krugman’s Crisis Responsibility: Reagan or Bush ? (June 12th, 2009)

Grading Financial Regulatory Reform (June 25th, 2010)

Bear Stearns, Lehman Execs Kept Billions . . . (November 23rd, 2009)

What's been said:

Discussions found on the web: