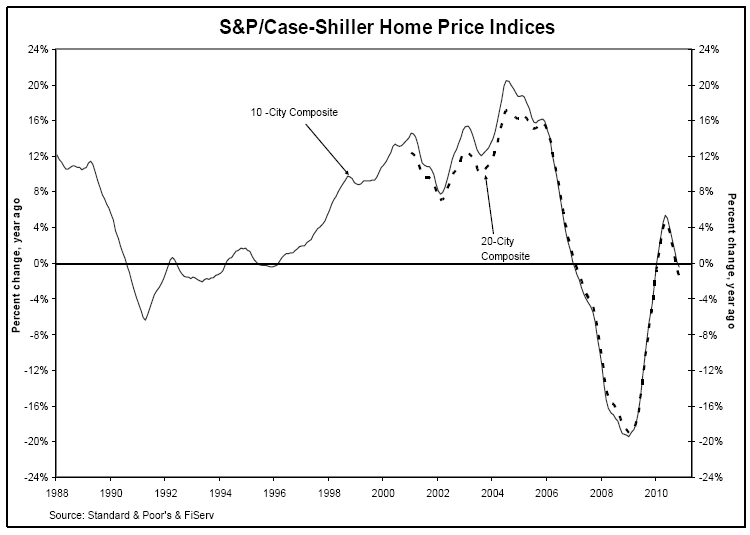

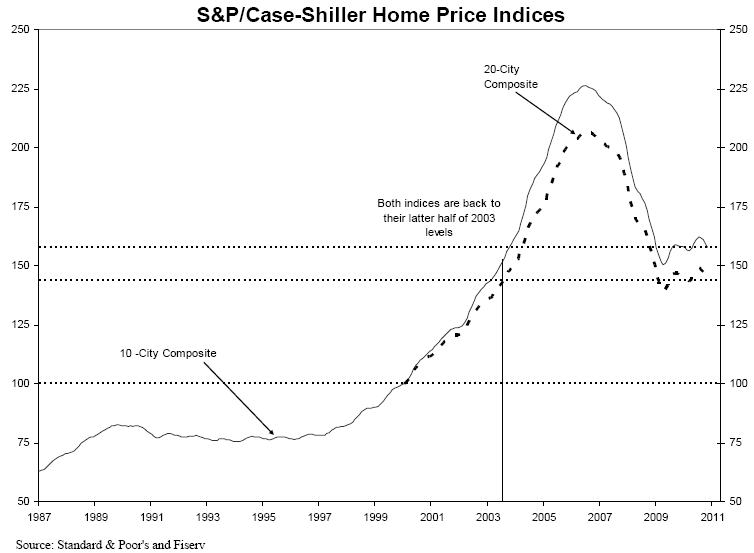

Data through November 2010 shows negative annual growth rates in 17 of the 20 MSAs and the 10- and 20-City Composites compared to what was reported for October 2010.

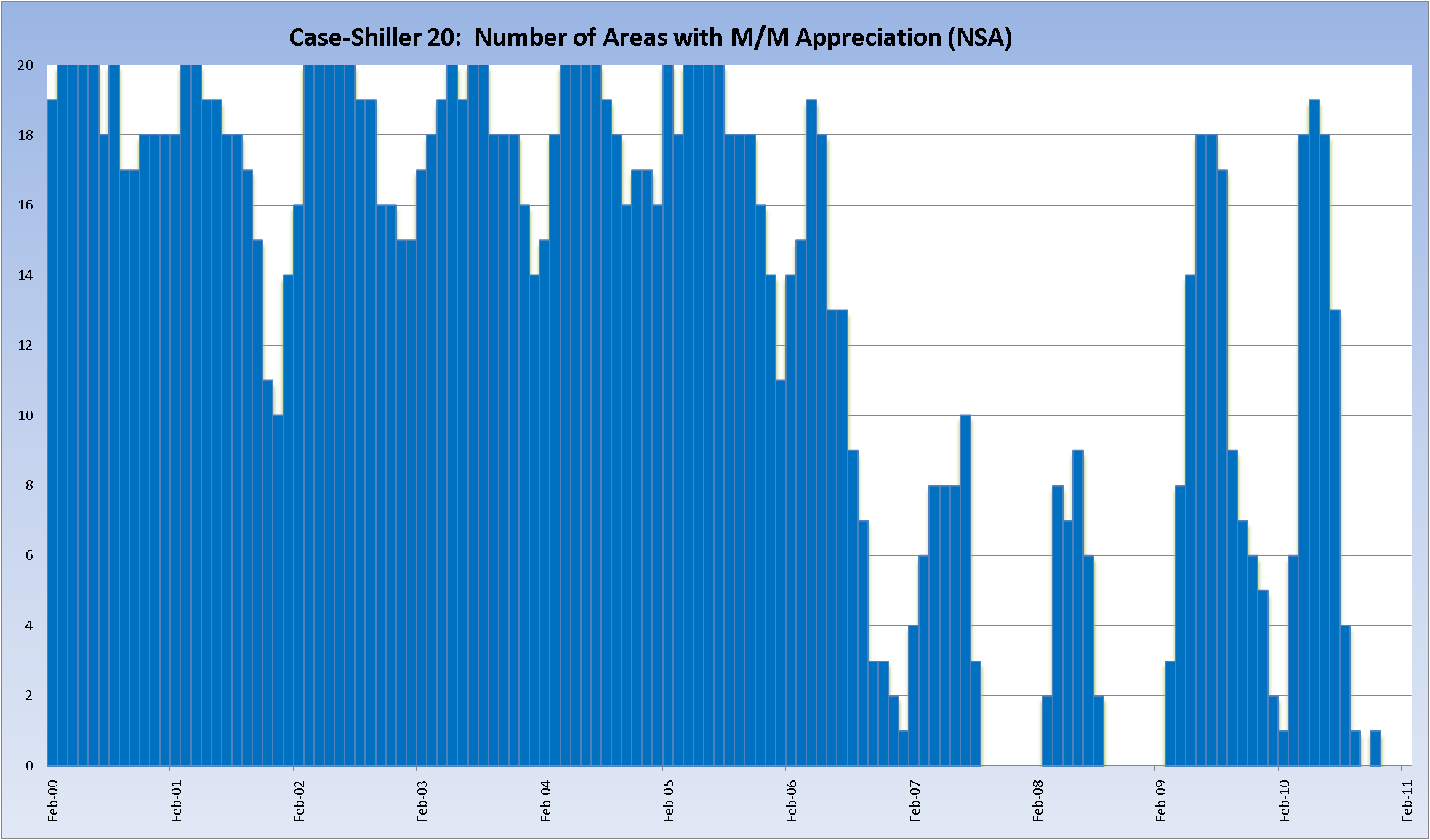

The 10-City Composite was down 0.4% and the 20-City Composite fell 1.6% from their November 2009 levels. Home prices fell in 19 of 20 MSAs and both Composites in November from their October levels.

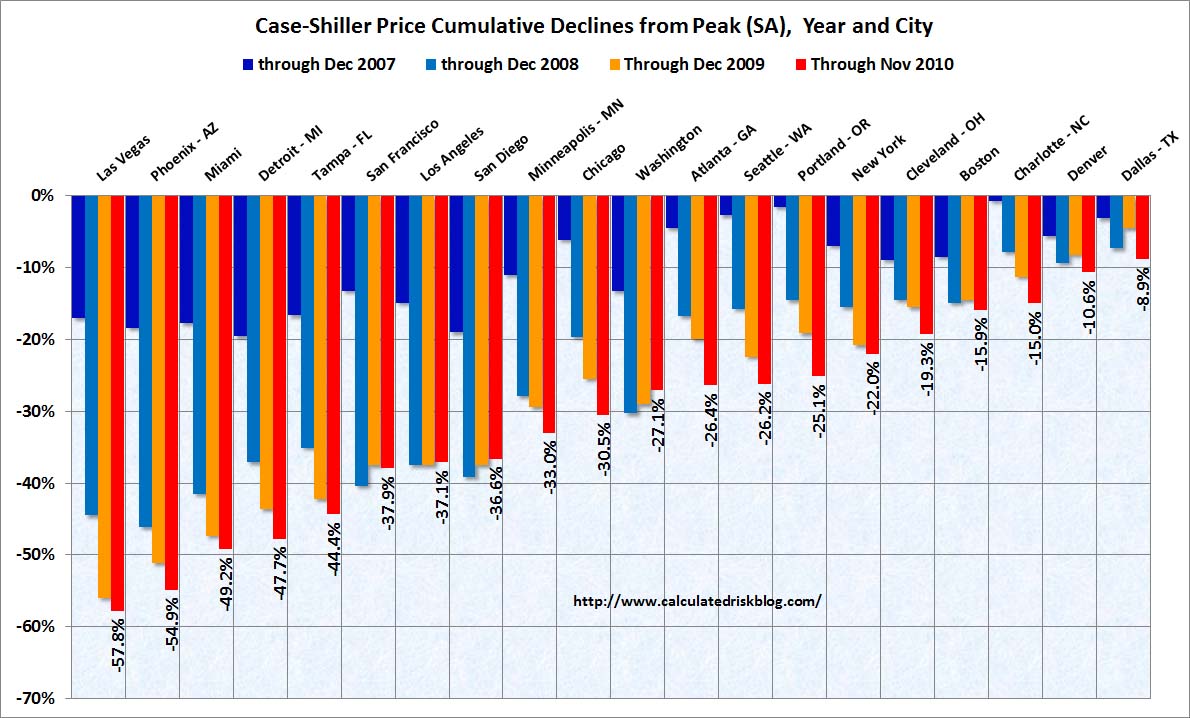

Only four regions – Los Angeles, San Diego, San Francisco and Washington DC – showed year-over-year gains. Eight markets – Atlanta, Charlotte, Detroit, Las Vegas, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices peaked in 2006 and 2007, meaning that average home prices in those markets have fallen even further than the lows set in the spring of 2009.

Your CS Housing chart round up:

>

Chart courtesy of Calculated Risk

>

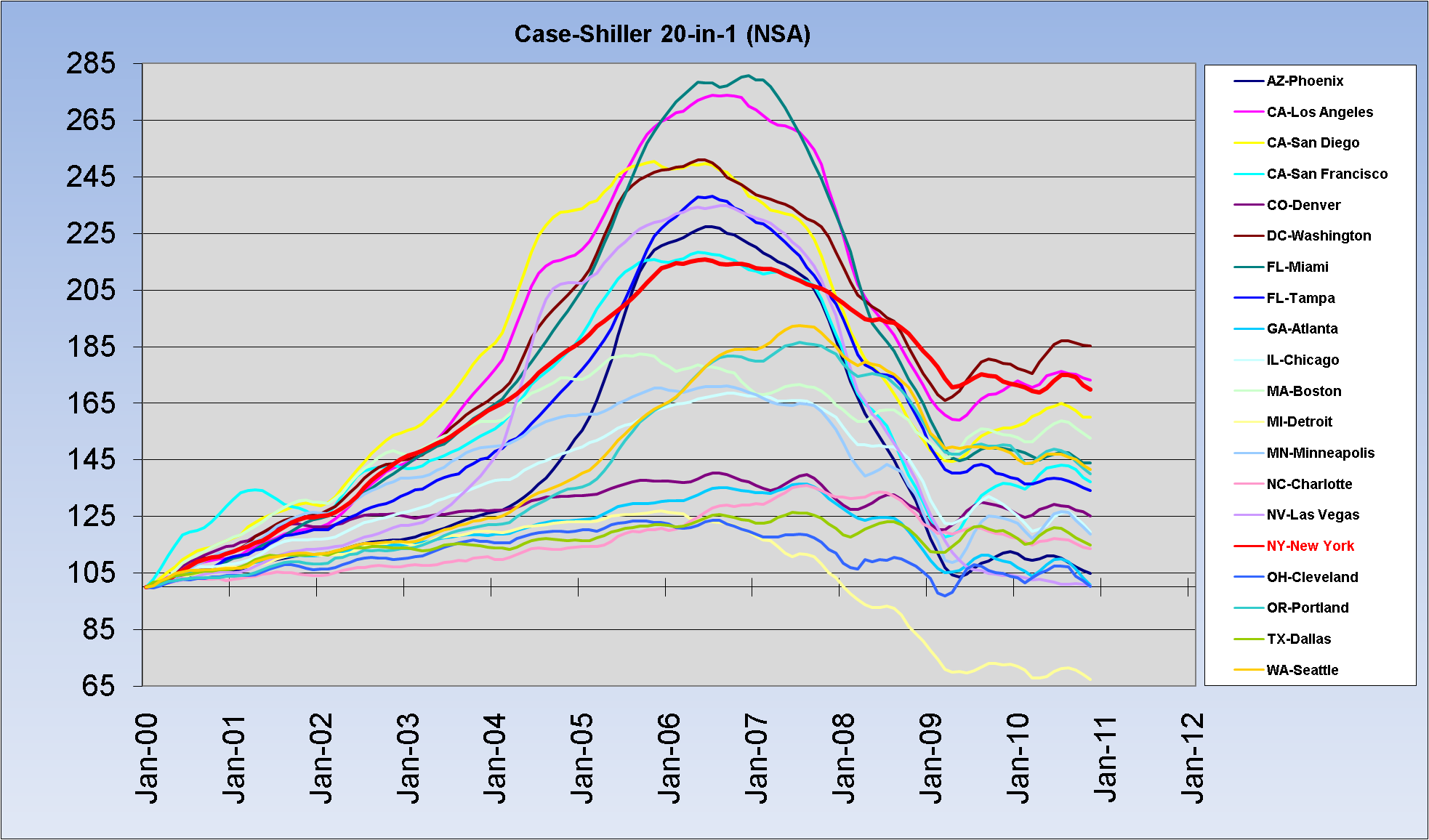

Invictus adds: One area — San Diego — eked out a miniscule month-over-month NSA gain, and was the only area that prevented all 20 from declining on a month-over-month basis. And yes, I will be pissed if Detroit eventually breaks below 65 and forces me to recalibrate my y-axis.

>

>

>

>

>

Source:

U.S. Home Prices Keep Weakening as Eight Cities Reach New Lows

S&P, January 25, 2011

http://bit.ly/erp5m0

What's been said:

Discussions found on the web: