I have been arguing that $100B is rather rich for Facebook. Perusing the S1, and discussing this with Bloomberg’s Dave Wilson has further confirmed this.

Why? It has to do with what they consider a daily or monthly “user.” Indeed, this is extremely significant, because the excitement about Facebook’s reach and user base is driving valuations to levels that may be setting the company up for investor disappointment.

Consider the 843 million monthly users and the 450 million daily users. Those sound like enormous numbers — but what do they really mean?

As it turns out, there is far less to being counted as a FB user than meets the eye. If you click on a Like button any given day, you are counted by Facebook as an active user that day.

From the S-1:

Daily Active Users (DAUs). We define a daily active user as a registered Facebook user who logged in and visited Facebook through our website or a mobile device, or took an action to share content or activity with his or her Facebook friends or connections via a third-party website that is integrated with Facebook, on a given day. We view DAUs, and DAUs as a percentage of MAUs, as measures of user engagement. (emphasis added)

All of those people clicking all of those “Like” buttons are counted as active that day, EVEN IF THEY NEVER GO TO FACEBOOK.COM.

Think of what this means in terms of monetizing their “daily users.” If they click a like button but do not go to Facebook that day, they cannot be marketed to, they do not see any advertising, they cannot be sold any goods or services. All they did was take advantage of FB’s extensive infrastructure to tell their FB friends (who may or may not see what they did) that they liked something online. Period.

This helps to explain why Facebook’s annual revenue per user is so low:

Facebook – $5.02

Google $30

Netflix – $148.20

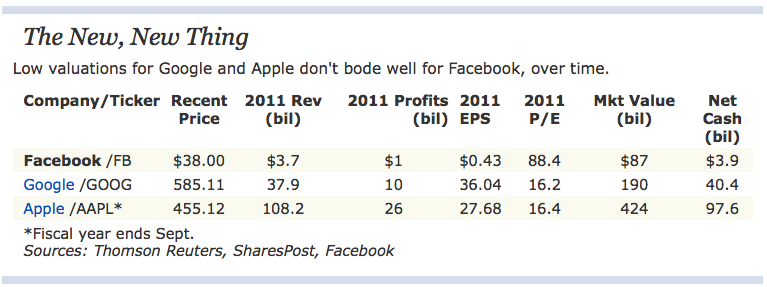

It also helps to explain why Facebook’s valuation may be so greatly exaggerated. Retired Neuberger Berman value investor and present CNBC commentator Gary Kaminsky observed that at similar multiples as Facebook, Google would be trading at $850 and Apple trading at $1250.

The question for investors: Can Facebook monetize their users at a rate 5-10X greater than what they are currently doing? If they can, their valuations are far more reasonable. If they cannot, then this is a very very expensive company.

Source: Barron’s

What's been said:

Discussions found on the web: