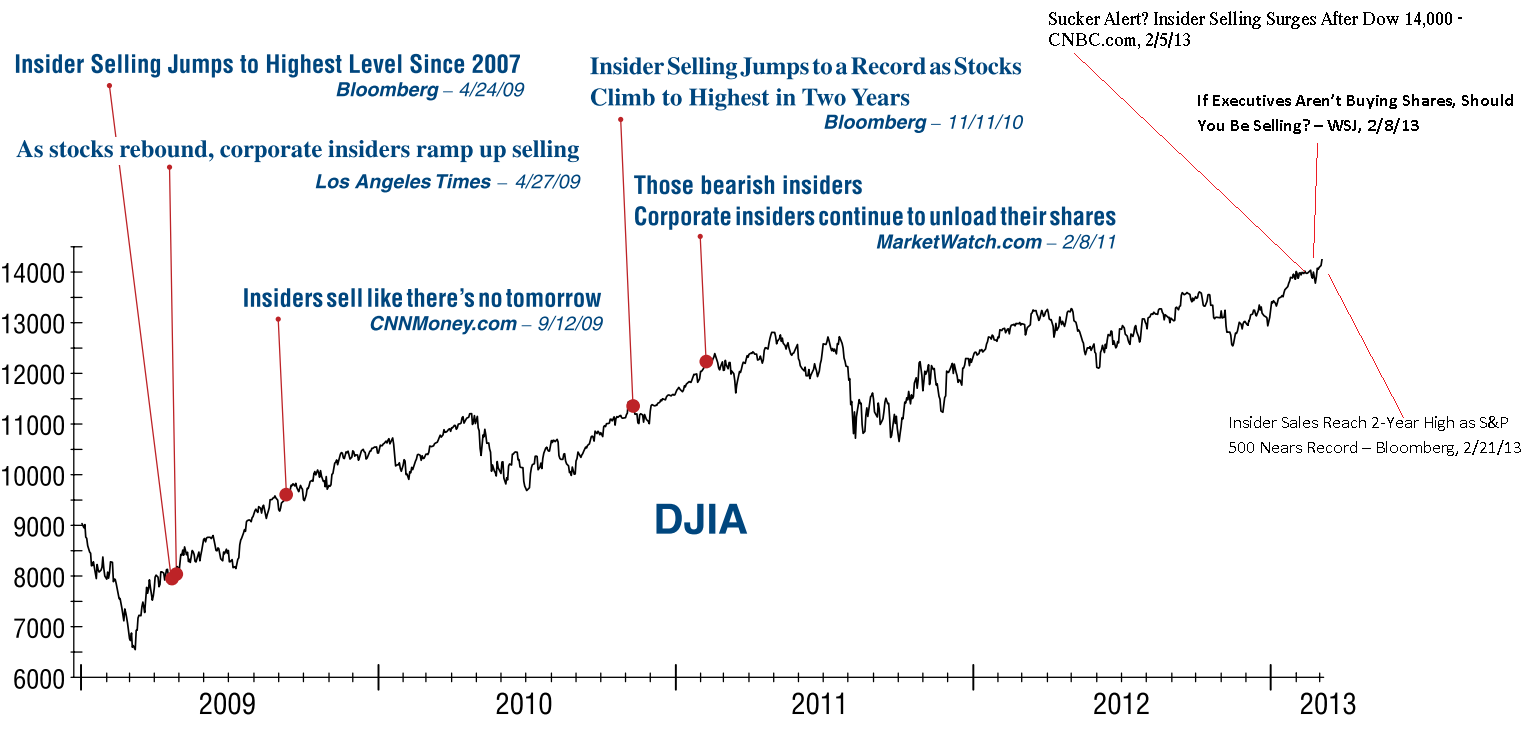

Source: Investech Research

The chart above comes from my favorite market historian, Jim Stack of Investech. Jim notes that Insider Sells have never been a reliable signal — it typically means the market has just rallied a bit and the insiders are looking to lock in some free money (also known as stock option cash outs).

Here is some more history of Insider Buys & Sells from Stack:

• In late 1982, as the DJIA approached 1050 –a level that had proven a barrier for 17 years– Insider Selling reached its highest (supposedly most bearish) extreme in almost a decade.

• Ironically, by the summer of 1987 corporate insiders had turned into aggressive buyers of their own stock. In fact, Insider Buying reached a record (supposedly

most bullish) level in October 1987… just one week before the 1987 Crash.• In 1991 Insider Selling spiked as the stock market roared out of the 1990 recession and corporate earnings languished. Everyone was convinced that stocks had disconnected from reality and the insiders were right. Wrong again!That was only the first year

of a 9-year bull market run that would produce the longest period without a 10% correction.• By May 1999 Insider Buying hit an 8-year high as corporate insiders had again become avid fans of their own stock – at the worst possible time… right before the peak of the dot-com bubble.

In other words, corporate insiders are just as dumb as the rest of you Humans!

(I mean other than that whole transferring wealth from corporate owners to themselves and convincing the eejit shareholder owners its actually good for them! Hahaha that’s hilarious!)

What's been said:

Discussions found on the web: