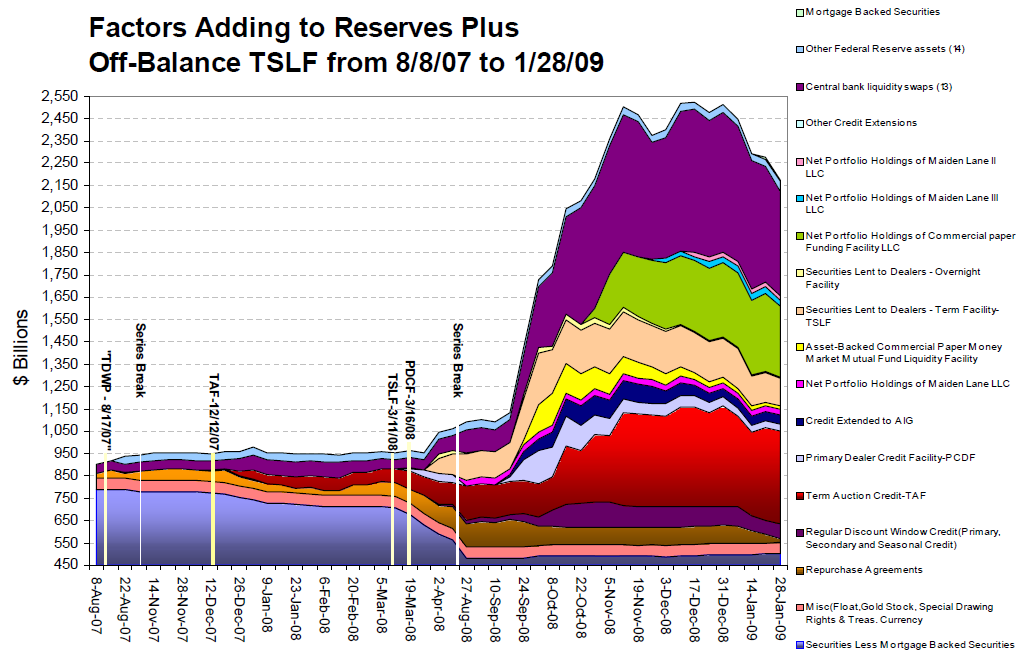

Yesterday, we looked at ECB and BoE balance sheets. Let’s update the chart for the Fed’s books:

>

via David Kotok, Cumberland Advisors

>

Previously:

Reserves and Off Balance Sheet Securities Lending (June 27th, 2008)

http://www.ritholtz.com/blog/2008/06/reserves-and-off-balance-sheet-securities-lending/

ECB, BoE Assets (February 19th, 2009)

http://www.ritholtz.com/blog/2009/02/ecb-boe-assets/

What's been said:

Discussions found on the web: