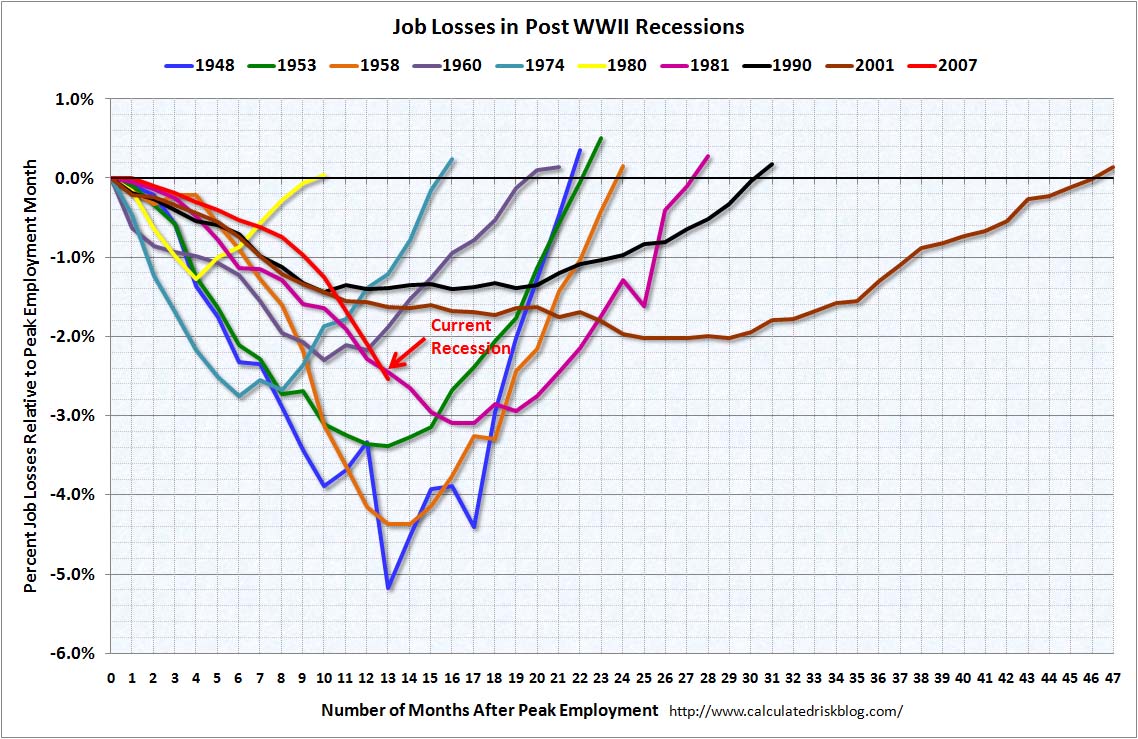

Our earlier discussion about “Job Losses in Post WWII Recessions” raised a few questions about the extent and depth of the job loss in recessions relative to population and labor pool.

He is a completely different way to visualize this: How long it took each recession to recover to the prior jobs peak.

>

Post WWII Recession Job Recoveries (Months)

Are recessions taking longer to recover from? It certainly appears that way, at leatsd for the past 3 recessions. Each took longer to return to pre-recession employment levels than the prior contraction.

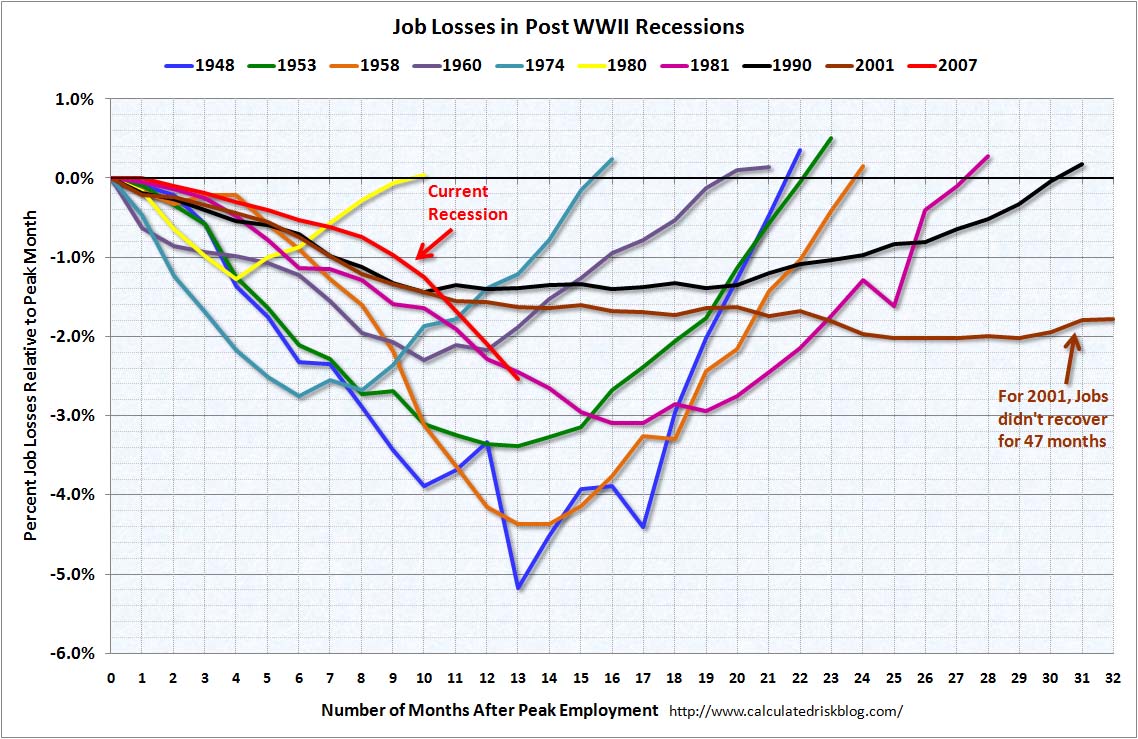

This version normalizes for the 2001 Outlier:

Thanks to Bill of Calculated Risk for whipping these us for us . . .

What's been said:

Discussions found on the web: