Of the many issues that arise via the banking bailouts we have seen, perhaps the most pernicious is how corrosive the process becomes. It corrupts even the most well intended parties.

The latest example is the stress tests, which run the risk of being window dressing. As noted last week, the Stress Tests themselves weren’t very stressful. And, now that some of the results are coming in, the cure for inadequate capital is not more capital, but an accounting trick — converting preferred stock to common. As Paul Kasriel of Northern Trust describeed it, this amounts to nothing more than Accounting Alchemy — the finacial equivalent of lead into gold.

Thus, we see the major test for the sector was inadequate to cleanly identify potential weakness. And even by that soft standard, the cure is inadequate.

US banks are suffering a solvency problem, and what they need is more capital, not an accounting sleight of hand. Yet that is precisely what they are getting — the same clever financial engineering that led to the crisis in the first place. All Treasury needs is more leverage and a few derivatives and the transformation into the financial Borg will be complete.

From Bloomberg:

“At least six of the 19 largest U.S. banks require additional capital, according to preliminary results of government stress tests, people briefed on the matter said.

While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, the people said. The Federal Reserve is now hearing appeals from banks, including Citigroup Inc. and Bank of America Corp., that regulators have determined need more of a cushion against losses, they added.

By pushing conversions, rather than federal assistance, the government would allow banks to shore themselves up without the political taint that has soured both Wall Street and Congress on the bailouts. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.”

All this goes to show is that receivership was the correct approach to this in the first place. Instead, we get “Gentleman B” stress tests and nonsense accounting gimmicks. The Treasury and Federal Reserve can no longer be considered honest brokers of the process. They too have been corrupted by the ugly process of rationalizing insolvent banks ongoing existence . . .

>

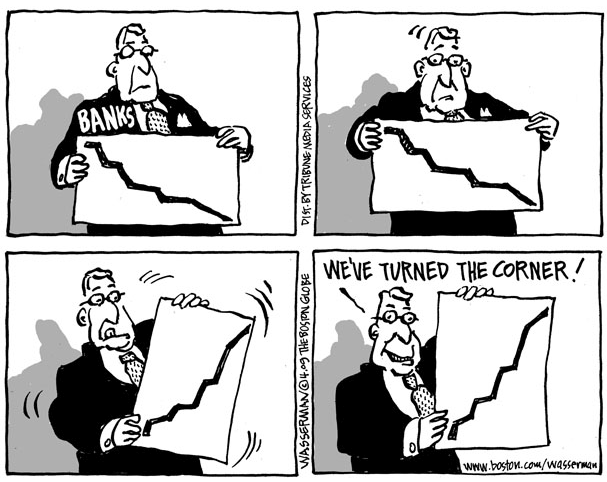

Turning the Corner?

via Dan Wasserman

>

Previously:

Stress Test: Not Very Stressful (April 24th, 2009)

http://www.ritholtz.com/blog/2009/04/stress-test-white-paper/

Sources:

Fed Is Said to Seek Capital for at Least Six Banks

Robert Schmidt and Rebecca Christie

Bloomberg, April 29 2009

http://www.bloomberg.com/apps/news?pid=20601087&sid=aiz06xRmmeOQ&

Preferred Equity into Common Equity – Accounting Alchemy?

Paul Kasriel

Northern Trust, April 27, 2009

http://web-xp2a-pws.ntrs.com:80/content//media/attachment/data/econ_research/0904/document/ec042709.pdf

See Also

Time for Bank Creditors to Share the Pain?

DAVID LEONHARDT

NYT, April 28, 2009

http://www.nytimes.com/2009/04/29/business/economy/29leonhardt.html

What's been said:

Discussions found on the web: