I was pleasantly surprised this morning when I woke up to find the first review of Bailout Nation was written, by Eddy Elfenbein of Crossing Wall Street.

I was pleasantly surprised this morning when I woke up to find the first review of Bailout Nation was written, by Eddy Elfenbein of Crossing Wall Street.

It is very long and thoughtful and I am thrilled with it.

Excerpt:

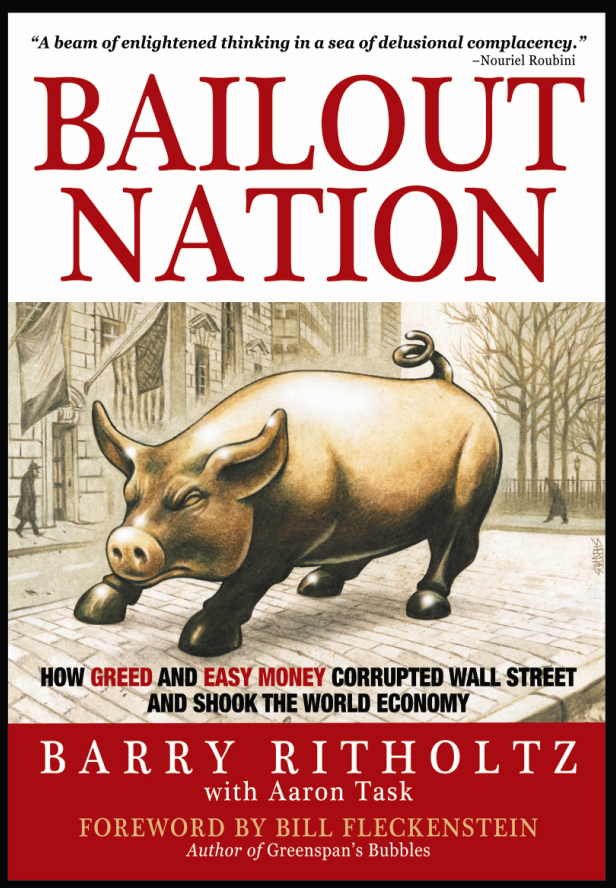

In Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy, Barry Ritholtz takes on that question with gusto and the result is a wonderfully engaging book. Bailout Nation describes not only what happened and what went wrong, but also why. Don’t worry, you don’t need an advanced degree in economics to follow the story. Bailout Nation manages to be both comprehensive and easy to read.

Ritholtz is already known to countless investors through his invaluable blog, The Big Picture. (Full disclose: He’s been a supporter of CWS from its earliest days.) I have to confess to having some initial reservations about Ritholtz’s book. What makes him a great blogger, I feared, might not transfer well to a 300-page sustained argument. Let’s just say that Ritholtz isn’t exactly a “shades of gray” kind of guy. When a rapier is needed, Ritholtz is fully willing to use a cluster bomb. If you don’t think it’s possible to get a true sense of moral outrage over, say, the latest BLS report, well…you haven’t read The Big Picture.

Fortunately, my fears were unfounded. Ritholtz does very well in book form. His editor, Aaron Task, served him well; the prose is compact and well-organized, though I’m fairly certain of the sentences where Ritholtz shook off all editorial changes. Where Ritholtz truly shines is in drawing connections between seemingly dispirit events; the fall of Bear Stearns, oleaginous mortgage brokers, the repeal of Glass-Steagall, the growth of credit default swaps, even the effects of reforming the Consumer Price Index, all play a role in this complex mess of unintended consequences, vicious cycles, ideological blindness and abject stupidity.

I can’t remember that last time I had so much fun reading about the Apocalypse

The whole review is here.

>

Source:

The Strange Death of American Capitalism

Book Review of Bailout Nation by Barry Ritholtz

Eddy Elfenbein,

Crossing Wall Street, May 17, 2009

http://www.crossingwallstreet.com/archives/2009/05/the_strange_dea_1.html

What's been said:

Discussions found on the web: