On Monday, we looked at the impact of the Exhaustion Rate on Continuing Unemployment Claims (See Continuing Claims “Exhaustion Rate” and Exhausted Claims part II). Those charts and tables made it clear that Continuing Unemployment Claims were dropping not due to folks getting jobs, but simply using up all of their benefits.

Wednesday, we learned of a) record credit card chargeoffs and Increasing minimum Credit Cards payments from 2% to 5% at Chase.

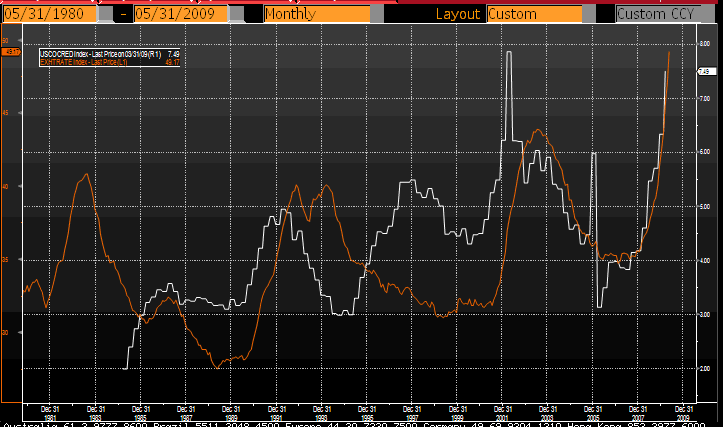

Now, lets see what happens if we can put those two together:

>

Unemployment Exhaustion Rates and Credit Card Charge Offs

>

I suspect we can do the same studies with Unemployment Rates also . . .

>

Hat tip Shawn!

What's been said:

Discussions found on the web: