Over the past few months, I have noted our current bullish posture, along with the reasons for it.

Earlier this week, I noted the disconnect between the economy/markets, and in that post, I promised to further explain my views.

Well, today is the day. I am going to UBS this afternoon to discuss this in more detail, but the key factors that have been contributing to, and may continue adding to, the ongoing rally.

>

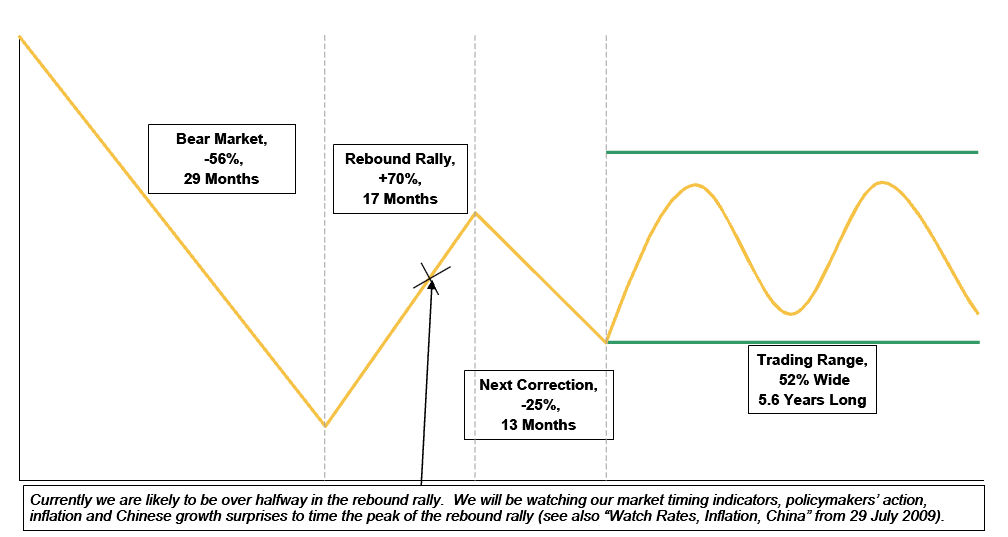

1) Historical Secular Bear Markets: As discussed in August, secular bear markets tend to get massively oversold, then see a huge bounce. The chart below shows a composite of 29 Secular bear markets:

Typical Secular Bear Market and Its Aftermath

>

2) Hated Rally: I have noted previously that this is the most hated rally in Wall Street history. Many people — both pros and individuals — all have reasons as to why it must end badly: PPT, hyper-inflation, bad economy, etc.

Most bull moves do not end when they are hated, they come to a halt and reverse when they become over-owned and over-loved.

We are not there yet.

>

3) Dollar Selloff: Yet another factor is the weak dollar, mentioned earlier in our Gold discussion. The relationship has been pretty explicit lately. See the FT’s Dollar-adjusted S&P 500.

>

4) Typical Recession vs Panic Selloff: From October 2007, when the Dow hit ~14,200, to about September 2008 when it slid to 11,500, we had what looked to me like a standard recession: About 8-10 months long, down about 20%.

That is fairly ordinary length and depth of typical market reactions to recessions.

The next 5000 points of freefall was a panic reaction to an expected end of the economic world. Recall that the widespread belief was that the system was fatally broken, and we were all going to hell. Indeed, the SPX did get down to 666 level.

What we have been experiencing since that low has NOT been an anticipation of earnings improvements, or a V shaped recovery. To be blunt, it is little more than mean reversion, as the aberrational credit panic sell off gets unwound.

We are now returning towards a more typical recessionary sell off. That’s when things make get alot more difficult . . .

Typical Recession Bear Market

After 7 months of Hell Purgatory feels pretty good.

What's been said:

Discussions found on the web: