Over the past few weeks, we’ve been debating the state of the economic recovery. The posts that have emphasized the shift in data towards the positive have generated a lot of pushback.

This is something that I want to discuss in general terms — I want readers to not only understand my perspective, but to grasp what typically occurs heading into recessions and recoveries, into new bull and bear markets. (Note I am speaking generally, and not referring tot he details of this cycle).

Over the next week, I will put together a broad overview of the positives and negatives of the economy, looking at the risks and opportunities presented. For now, let’s discuss the sentiment that typically accompanies oscillating phenomena, such as markets or the economic cycle.

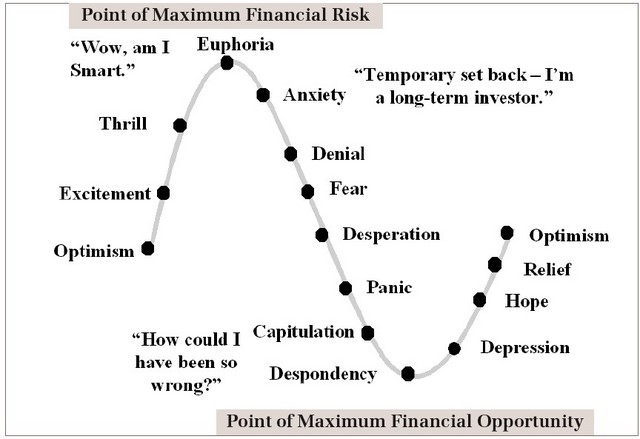

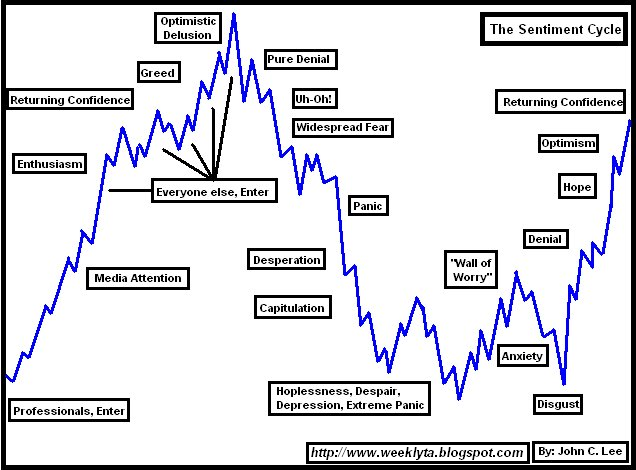

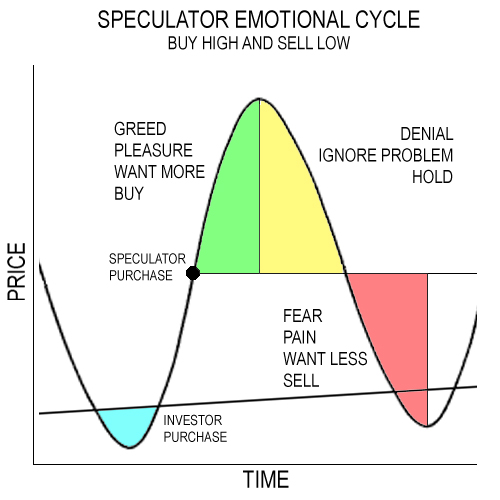

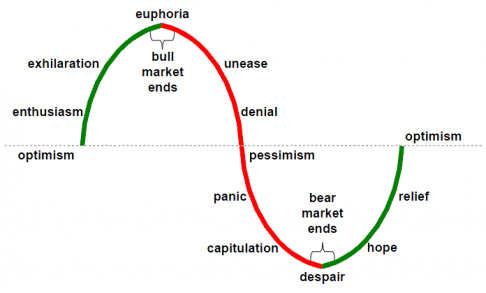

Today, I want to look at the big overview. Historically, the sentiment that occurs at inflection points are extremes. The are the result of the prior few years of economic/market activity. They lag the cycle — often quite significantly.

Consider:

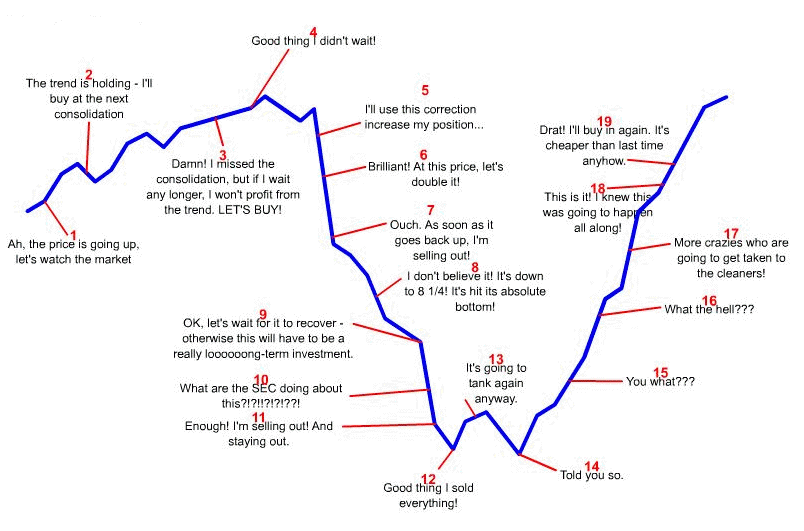

• Humans have an unfortunate tendency of to overemphasize our most recent experiences. We draw from what has just happened, rather than deduce based on what is occurring right now.

• Following that idea, the analyst community is typically too bullish at tops, too bearish at bottoms. They extrapolate from the most recent data to infinity or zero. Hence, they miss the inflection points.

• Sentiment is a justification of recent actions. Very often, equity buyers describe themselves as bullish after their purchase. The comments they make can are often an attempt to reassure themselves.

• Changing viewpoints is a gradual process. Flipping from bullish to bearish and vice versa is difficult. We remember what most recently rewarded us, and internalize that. After a period of economic expansion, we are slow to grasp the change for the worse. At the tail end of an ugly recession, we find it hard to imagine an imminent improvement.

• Investors develop the equivalent of Muscle memory. During a bull market, every dip that was bought made us money. When the cycle changes, we are slow to perceive it. Bulls become out of phase with what is taking place, buying on the way down in a bear market.

• The reverse takes place after a long Bear market. Selling rallies made us money, preserved capital during the downturn. When the sell off ends and a new bull cycle begins, the bears have a similar hard time getting back into sync with the market. Since it was so rewarding to sell into prior rallies, it becomes difficult to flip towards the positive perspective.

• Excuse making rationalizing the missed turn becomes endemic. We get conspiracy theories (the Fed is buying SPX minis!), complaints about the artifice of the market, Fed bashing, etc. They all have their roots in the missed turn. I even suspect some of the Goldman bashing (deserved tho it may be) is also partly rooted in this issue.

Consider this chart, which I first showed back in 2005 — but its worth reviewing again:

>

>

If you like these sorts of things, there are more psychology visualizations after the jump . . .

>

>

>

>

>

>

>

>

>

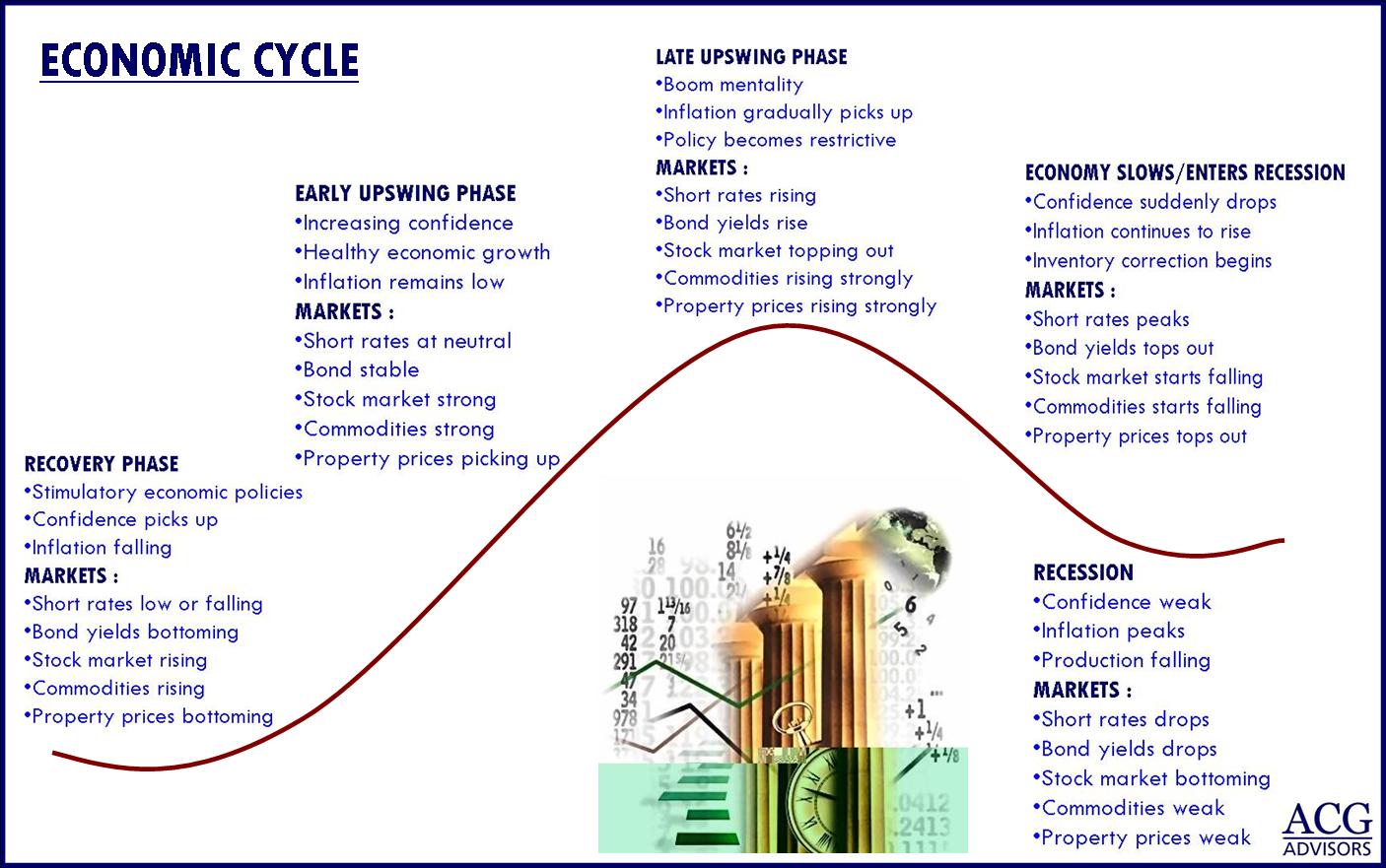

![Economic Cycle_thumb[6]](http://www.ritholtz.com/blog/wp-content/uploads/2010/04/Economic-Cycle_thumb6.gif)

What's been said:

Discussions found on the web: