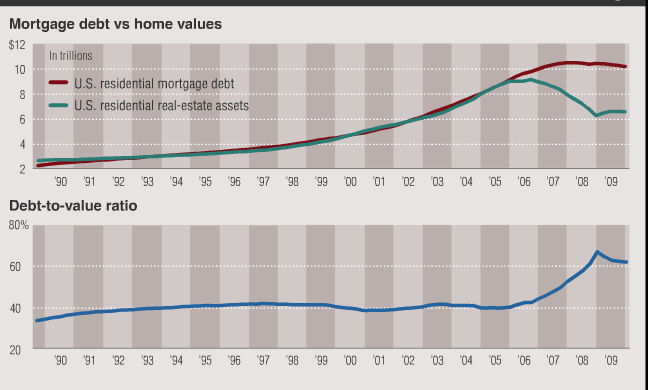

Last week, we looked at London based hedge fund RAB Capital Chief Strategist Dhaval Joshi’s The $4 Trillion Dollar Question.

It turns out that is now a Bloomberg Chart of Day!

>

>

Source:

U.S. Housing Bubble Leaves $4 Trillion Hangover: Chart of Day

David Wilson

Bloomberg, July 16 2010

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aE_Yf1qMj5NQ

What's been said:

Discussions found on the web: