I mentioned this morning that Jeff Hirsch is the anti-Prechter — forecasting a wild $38K Dow in 2025. (Discussed this AM here, with Jeff’s full piece here)

Jeff and I are in the same secular bear market camp; However, he argues that the current secular Bear market will end ~18 years after the last secular Bull market ended in March 2,000. I cannot place the end of the Bear that precisely, but I figure its coming sometime this decade.

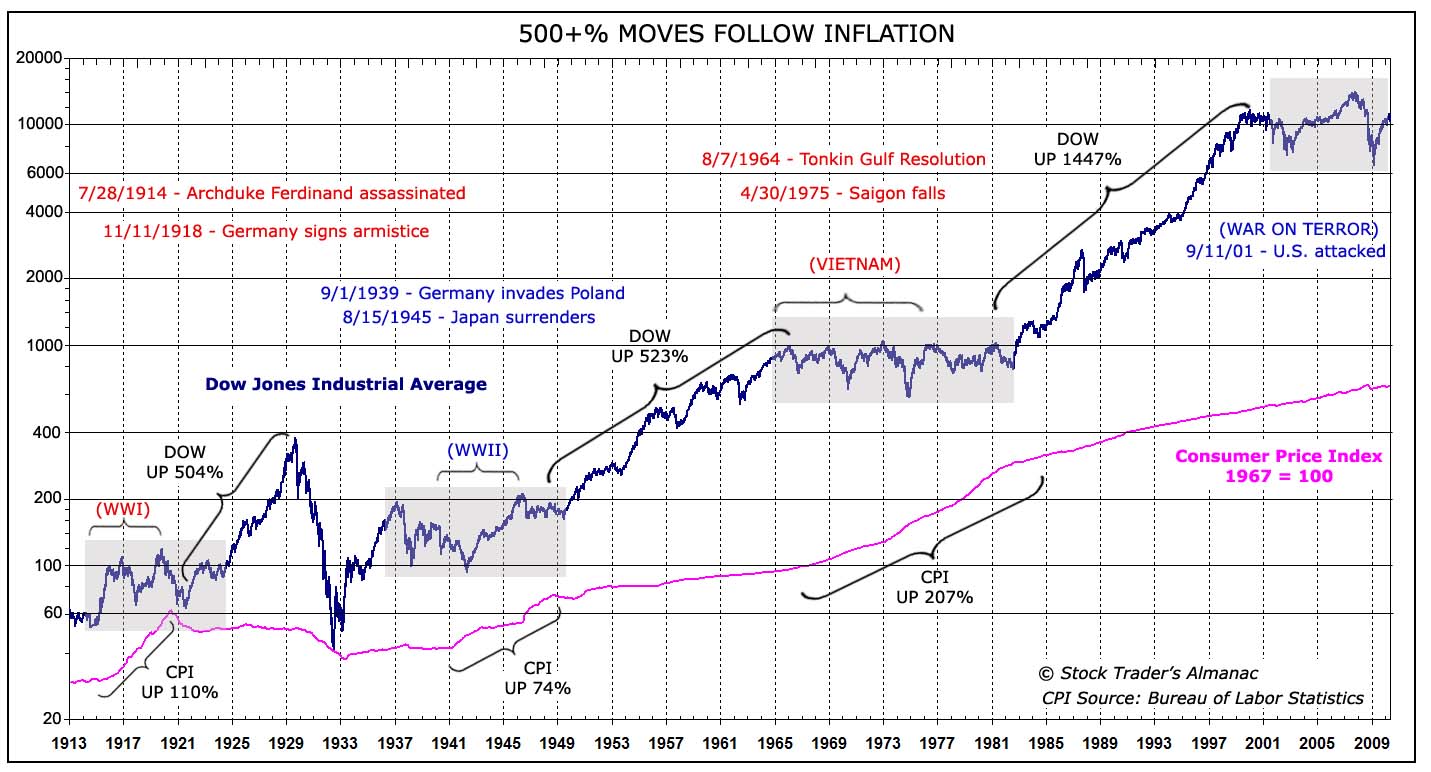

Ironically, the route Jeff takes to get to $38k uses an approach similar to Prechter’s: Long historic cycles that impact group psychology, with regular wars that lead to massive government interventions and big inflation (so far so good). As the chart below shows, major global wars were followed in the 20th century by high inflation and 500% market moves over the following decades. Note huge 1447% Dow move from 1982 – 2000 — the theory being it was caused by an outsized 207% CPI inflation.

>

War followed by Inflation, Peace, Secular Bull Market Gains

click for ginormous graphic

chart courtesy of Stock Trader’s Almanac

>

One caveat: The 3 year Korean War (1950-53), with ~37,000 US dead, is omitted from this chart. I’d like to know why (other than convenience sake) that this was not considered a military conflict on par with WWI or Viet Nam.

What's been said:

Discussions found on the web: