Let’s imagine the following scenario: You have a Jumbo mortgage with Bank of America. You are a good customer, do your banking with BofA, and you have never missed a payment. In fact, you always send your mortgage in on time.

But this fraudclosure mess has you curious. You wonder who actually holds your note, how many times its been sold, what MERS involvement is.

With your curiosity piqued, you decide to ask Bank of America where your actual mortgage note is, and who is holding it.

That is what long time BP reader SM did. He writes in to note what happened:

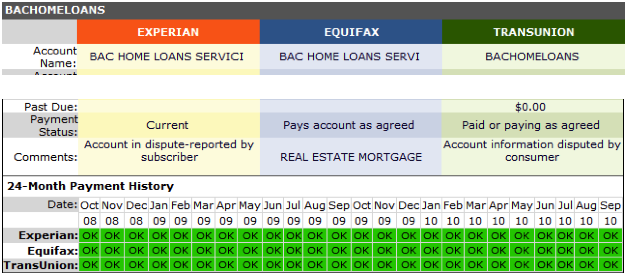

“FYI Just to let you know I ended up doing Where’s the Note and it resulted in this for me, see the 2 reported disputes in the attached screenshots below for my Jumbo 1st mortgage. 40 point hit on my scores. I will be speaking with an attorney soon. We need to get a warning out (SEIU has not responded).”

That is astonishing —

SM included a snapshot of his Credit report (Nice payment history!):

>

BAC reporting to Experian and Trans union

>

Looks like a job for Elizabeth Warren . . .

What's been said:

Discussions found on the web: