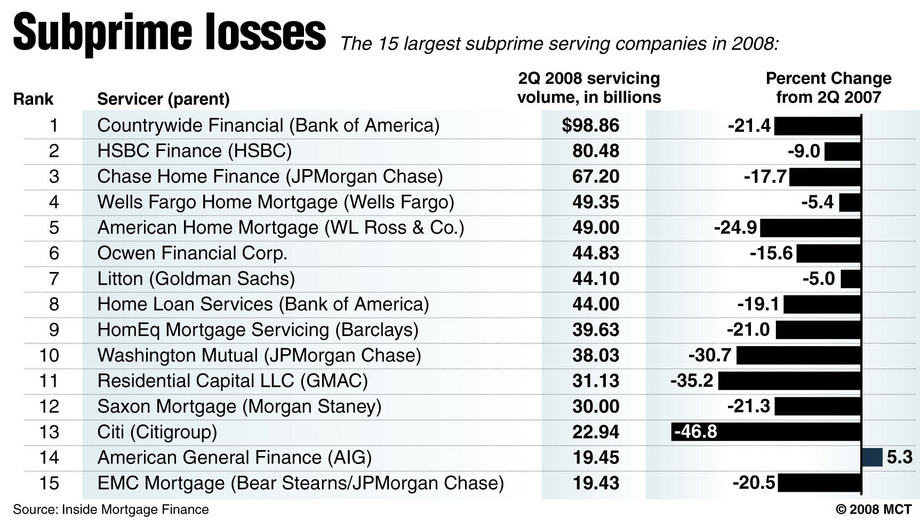

Here is a blast from October 2008 past: This chart as to who were the underwriters of the subprime loans.

Federal Reserve Board data show that:

-More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

-Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

-Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that’s being lambasted by conservative critics.

Here is the table of underwriters:

>

hat tip Econbrowser

Source:

Private sector loans, not Fannie or Freddie, triggered crisis

David Goldstein and Kevin G. Hall

McClatchy Newspapers, October 12 2008

http://www.mcclatchydc.com/2008/10/12/53802/private-sector-loans-not-fannie.html

What's been said:

Discussions found on the web: