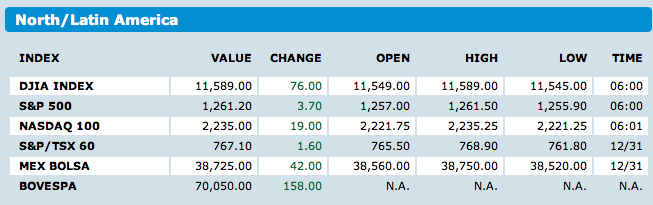

No surprise here: The markets begin 2011 on a high note, with futures forecasting strong gains for the first day of trading.

Why this should be no surprise: Fund managers who wanted the losers off of their books are sitting with a bit of cash, and it gets put to work the first opportunity.

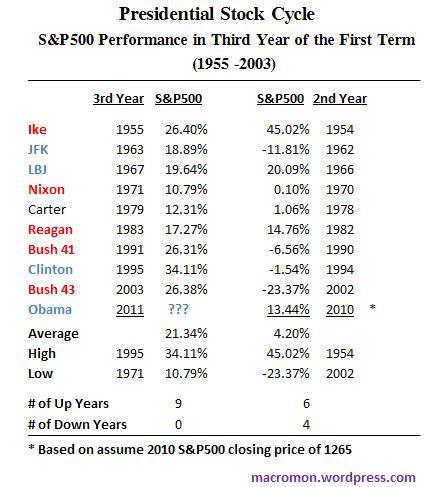

The Positives: Looking forward into this year, I see no reason why the rally should not continue into the first quarter of 2011. Markets are over bought, but can remain that way — persistently overbought — for quite some time. For understandable reasons, the public has been MIA since the March lows, and may get taunted in if the markets keep rising. Profits are strong, the economy is improving albeit grudgingly, and the 3rd year of a the Presidential cycle tends to put a powerful tailwind behind equities.Companies are sitting on tons of cash, and we should see increased M&A activity and IPOs. I also expect to see additional CapEx spending and even some more hiring along the way.

The Positives: Looking forward into this year, I see no reason why the rally should not continue into the first quarter of 2011. Markets are over bought, but can remain that way — persistently overbought — for quite some time. For understandable reasons, the public has been MIA since the March lows, and may get taunted in if the markets keep rising. Profits are strong, the economy is improving albeit grudgingly, and the 3rd year of a the Presidential cycle tends to put a powerful tailwind behind equities.Companies are sitting on tons of cash, and we should see increased M&A activity and IPOs. I also expect to see additional CapEx spending and even some more hiring along the way.

The Risk Factors: Broad consensus for strong gains always makes me nervous, and that is what we have at present. Sentiment is frothy. Government policies have been key drivers of gains, and everyone now knows that zero percent Fed fund rates are unsustainable. Organic growth is required for a self-sustaining recovery, and there is little of that to be found. Underemployment is a significant headwind, as is the sorry state residential real estate. Banks remain in mediocre financial condition, still under-capitalized and over-leveraged; the bailouts papered over the structural issues, and moral hazard all but guarantees a crisis in the next decade. States and cities are in a financially precarious position, and the GOP may very well force a shut down of government in Q2 when it comes time to raise the debt ceiling.

Summation Overall: I expect the rally to continue in Q1, at a more modest pace than the 6% monthly gains we saw close out 2010. But risk factors will accumulate as the year goes on.

History teaches us that when markets collapse 50% or more, they have strong snapback rallies that typically last 12-30 months, with the median around 17 months. That ends with a 25% correction, which we have yet to see as we begin the 23rd month following the March 2009 lows . . .

What's been said:

Discussions found on the web: